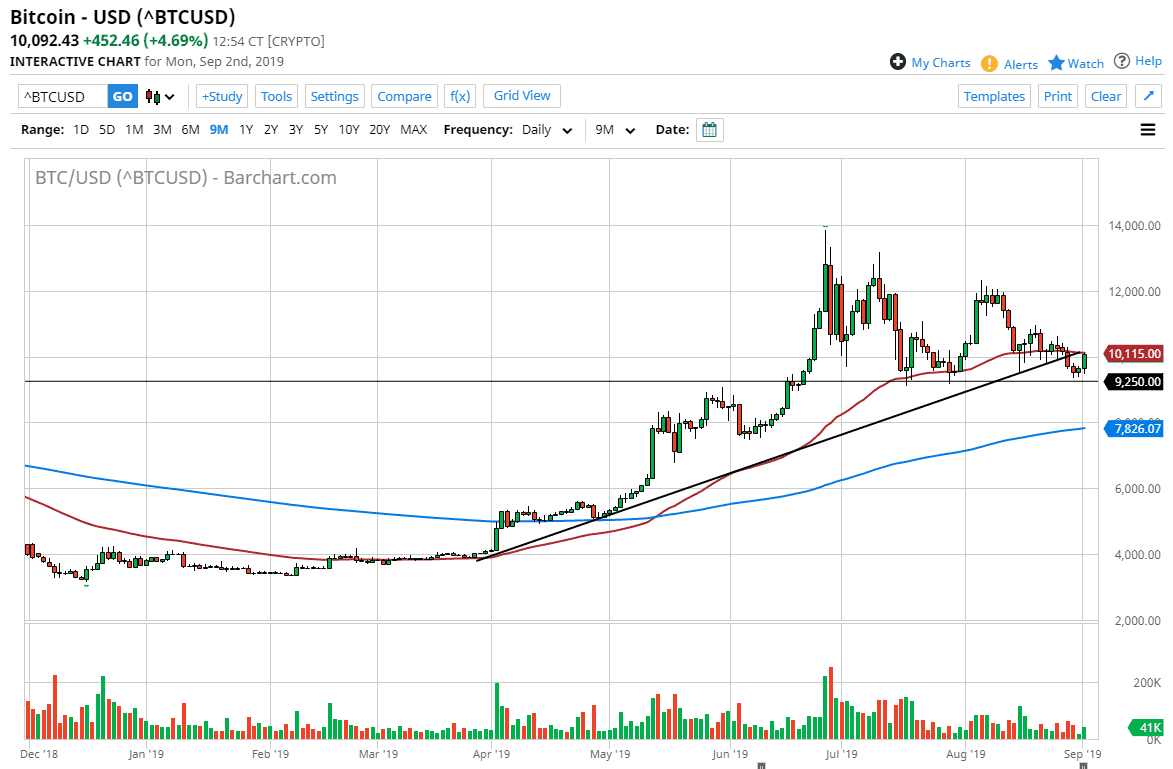

Bitcoin markets rallied quite nicely during Labor Day on Monday, as we have found a significant amount of support at the $9250 level. This is a horizontal support level that needed to hold as we had recently broken through a major uptrend line. That being the case, it’s likely that we continue to see an attempt to push Bitcoin higher. Beyond that, you should also think about all of the reasons that we got here in the first place.

You can go on about the world needs crypto, or perhaps about how it’s a better payment system. All of that is not necessarily something that can be quantified easily. However, one thing that is obvious is that central banks around the world are going to continue to loosen monetary policy, and it’s very likely that fiat currencies will continue to get hammered. Money has flowed into Bitcoin for that main reason, but there’s also some other political based reasons that have attracted a lot of money into the Bitcoin markets as well. All one has to do is think about places like Hong Kong, Venezuela, China, or quite a few places in the Middle East. By circumventing capital controls via the Bitcoin market, people can protect their wealth and get their money out of the country. That’s one of the main appeals of Bitcoin and it has been used quite significantly over the last several months.

We recently has broken through a significant trend line, but now have turned around to reach towards the bottom of that trend line. Beyond that, we also have the 50 day EMA crossing that area and that of course will attract quite a bit of attention. If we can break above both of those levels, which is roughly the $10,250 level, then I think we will continue to reach towards the $12,000 level above. At this point, I think short-term pullbacks will continue to offer plenty of buying opportunities as long as we can stay above the $9250 level. The alternate scenario is that we break down through there, and then go looking towards the $8000 level underneath. That level features the 200 day EMA which of course would attract a lot of attention. Simply put, I think we are in a roughly $1000 range short-term that once we get broken out above, we will make a significant move in one direction or the other. Currently, it looks as if the buyers are trying to make their stand.