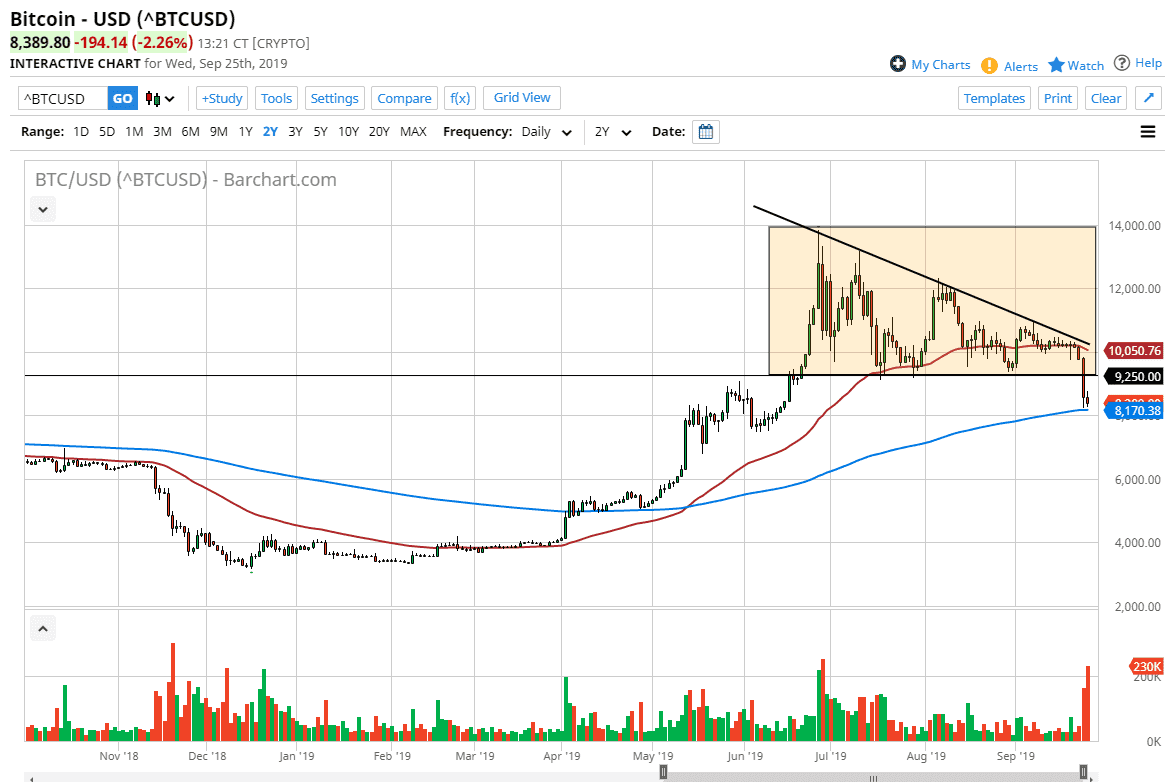

Bitcoin markets broke down a bit during the trading session again on Wednesday, as we continue to see a lot of weakness in the cryptocurrency markets. This is a marketplace that continues to see a lot of volatility, and if you been reading my reports here at Daily Forex, you know that I have been talking about this descending triangle that has just been broken. At this point, it now appears that the $9250 level should be resistance as it was previous support. This is a market that is starting to march back in line with gold again, which is interesting considering that gold sold off so hard during the day as well.

The 200 day EMA is just below and offering support, so at this point it’s very likely that we continue to see a lot of interest paid to this indicator. However, it looks very likely to be broken through, and once it is it opens up the door for the measured move coming out of the descending triangle. This is a market that looks very vulnerable, and will probably go looking towards that measured move which sends Bitcoin down below the $5000 level. That of course is a vicious move just waiting to happen, but we may get a little bit of a short-term bounce from the 200 day EMA towards that $9250 level. If we were to break above there, then the next major resistance barrier will be the 50 day EMA as well.

Now that we have finally made our move, a little bit more confidence can be had when it comes to trading the Bitcoin market as alt coins continue to get absently hammered, which may be part of what’s driving down the Bitcoin market as well. All things being equal, I believe that this market continues to offer plenty of selling opportunities in the short term but I also recognize that we will get a bit of noise and bounces from time to time but this last couple of days has really driven home the idea of the market running out of steam and clearly looking to break apart. Selling Bitcoin is probably the only thing you can do at this point, as the ferocity of the move cannot be understated. As far as buying is concerned, I would need to see that 50 day EMA recaptured with conviction.