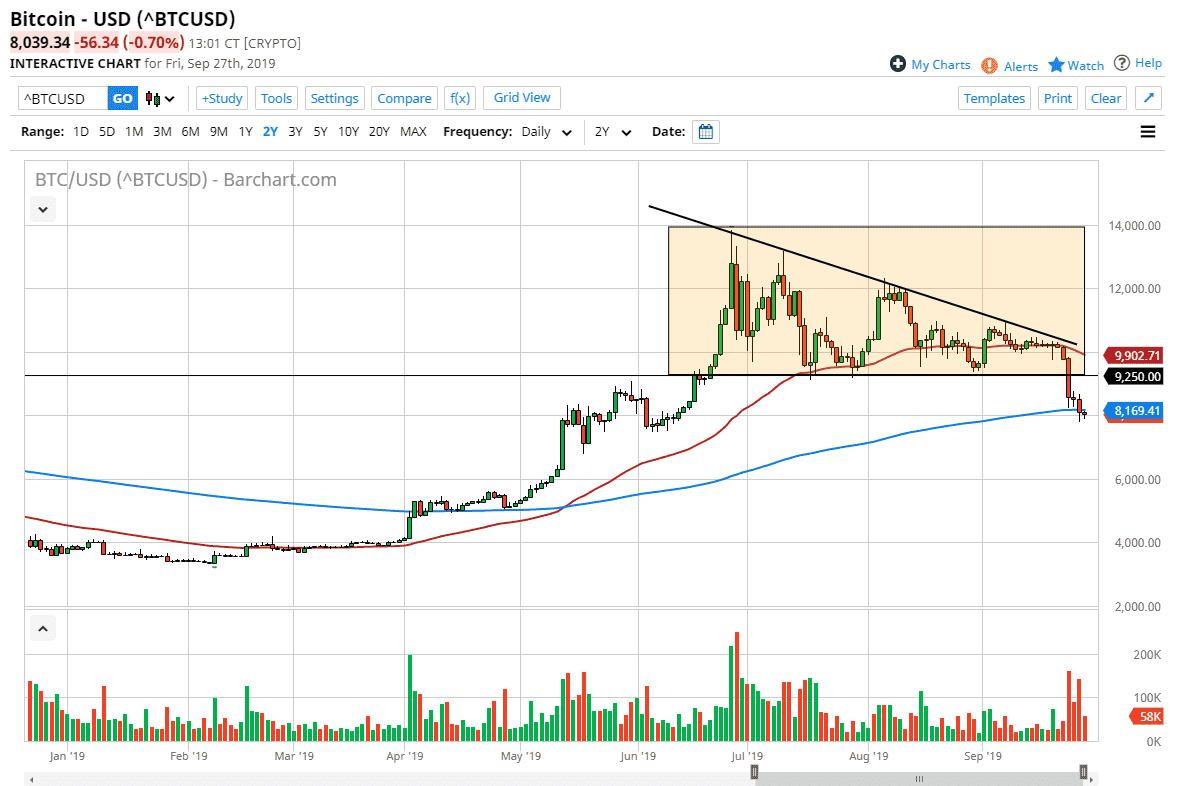

Bitcoin likely to make a serious decision soon.

Bitcoin markets were slightly negative during the trading session on Friday, as we are just below the 200 day EMA. The $8000 level underneath is massive support, so as we are sitting right there it makes quite a bit of sense that the market will have to make some type of decision in this area. That being said, we have made a pretty significant move based upon technical analysis as lately, so overall it looks very likely to be a scenario that could lead to much bigger moves.

Looking at the recent action, we have broken through the bottom of a descending triangle and reached down towards the 200 day EMA. When you look at the descending triangle, it suggests that we could go down to just below the $5000 handle. At this point, the market still obviously hasn’t reached there but I think it will give enough time. At this point, the market needs to save itself or we are going to be in a major downtrend before you know it. This most recent breakdown has of course offered not only negative action, but increased volume as well.

The bottom of the descending triangle should offer resistance, at roughly the $9250 level. That area should essentially be the “ceiling” in the marketplace as it was previously the “floor.” Again, the measured move suggests that we could go just below the $5000 level, which leaves plenty of room for short sellers to get involved. The next couple of days will be crucial for Bitcoin, as a break down below the lows from the Thursday session would unwind this trait even further and send the market straight down. However, if we were to rally from here it’s likely that the $9250 level would be an area where sellers will look to defend their downtrend.

What has been a bit interesting about Bitcoin is the fact that it has lost value in an environment that certainly is “risk off.” Beyond that, central banks around the world continue to ease monetary policy, and therefore it’s likely that non-fiat currencies should do better. However, they aren’t. In this scenario, and the fact that it isn’t working out, tells me a lot about Bitcoin. It tells me that demand has dropped and it’s very likely that much of the rally was trying to get money out of China. The capital outflows from the mainland seems to have abated.