The Bitcoin market has done nothing again during the trading session on Wednesday, which is very interesting considering that the Federal Reserve cut interest rates by 25 bps but has done nothing but confuse the market as it is very difficult to imagine a scenario where there is clear cut guidance as to where the Federal Reserve goes next. Keep in mind that Bitcoin is highly sensitive to the US dollar, which is all over the place right now. That being said, there is the possibility that this will be thought of as a “hawkish cut”, meaning that the Federal Reserve did cut rates but doesn’t sound likely to do so going forward. If that’s the case, then it’s likely that the US dollar could pick up a little bit of value, and it’s likely that Bitcoin will suffer at the hands of a stronger greenback.

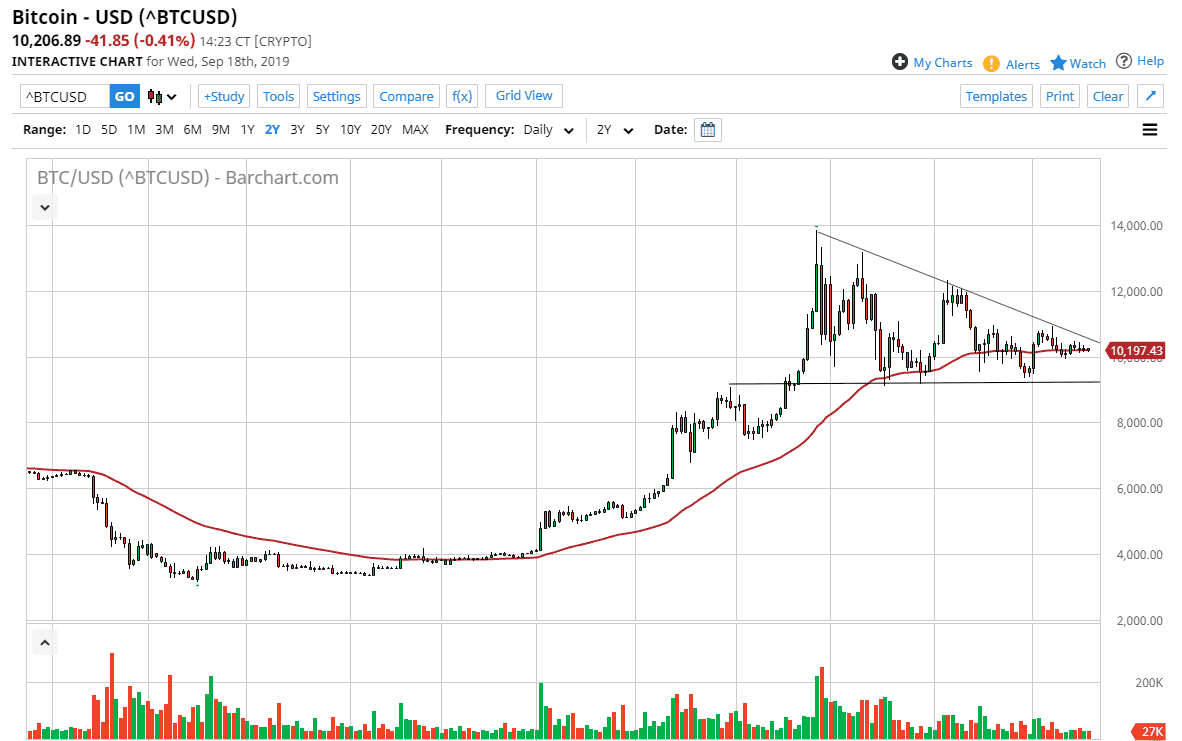

However, if we were to break above the downtrend line that makes up part of the descending triangle, that could send this market towards the $12,000 level, possibly even the $14,000 level. Alternately, if we were to break down below the $9250 level which is the bottom of the ascending triangle, it could open up the door down towards the $5000 region. That being said, we are about to make a significant move in Bitcoin and it’s difficult to imagine a scenario where we don’t get some type of move.

However, if we were not to make an impulsive move one way or the other, then I suspect the bitcoin might go into the phase that it was in previously near the $6000 level where it was essentially “dead money.” It’s a bit surprising to me that we did have some type of reaction during the Federal Reserve meeting, as the US dollar has a massive influence on what happens here, as it is of course the BTC/USD pair. All things being equal, we need to make a decision sometime soon, and I’m afraid if we don’t get that, a lot of traders will be holding the bag simply waiting for some type of action. Ultimately, the technical pattern does look rather bad so pay attention to the greenback in the currency market so it gives us a bit of a “heads up” as to where this could go.