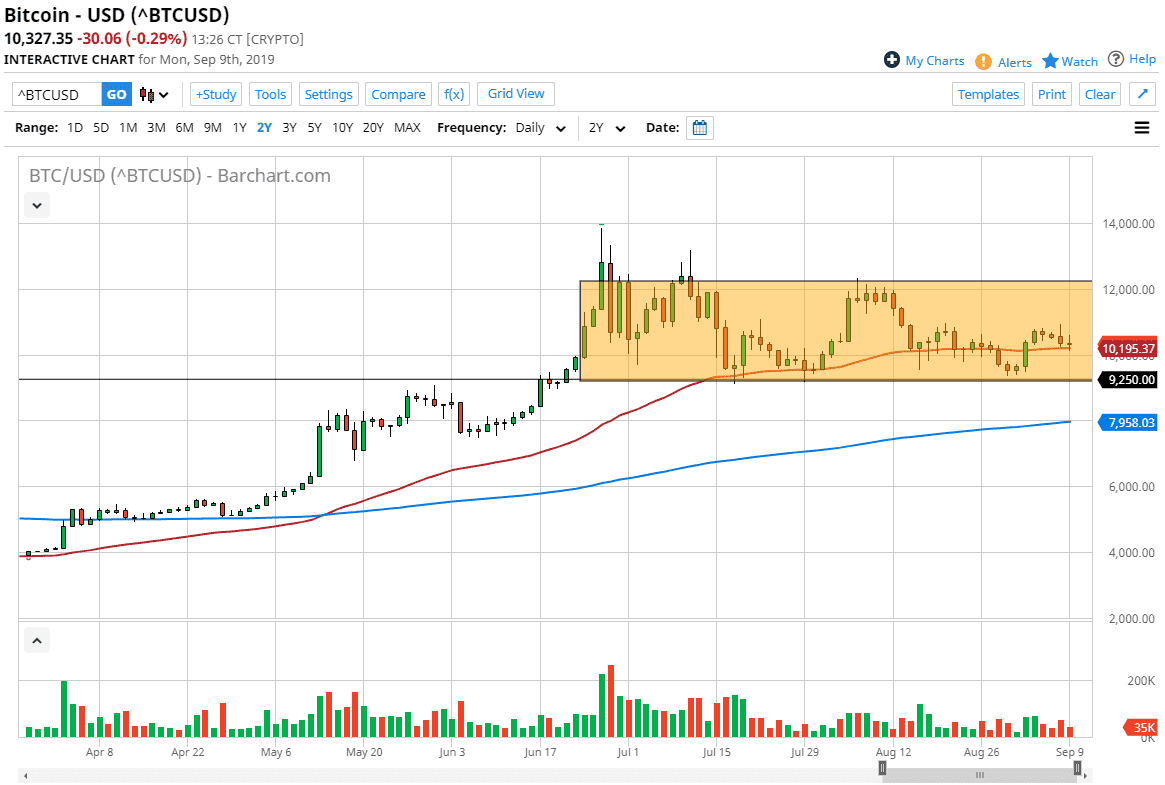

Bitcoin markets tried to rally during the trading session initially on Monday but has rolled over just a little bit to show signs of exhaustion. At this point, it’s very likely that we will continue to see a lot of buyers underneath though, as we had been so well supported previously. With that being the case I am still bullish, but I also recognize that the Bitcoin market has slowed down quite a bit.

The move higher was so drastic that I think it needed to consolidate and I do believe that’s what we been doing over the last couple of months, simply killing time after that massive move. Ultimately, this is a market that should continue to go higher over the longer-term because the fundamental reasons that Bitcoin rallied are still there. We still have to worry about capital controls in places like China, Hong Kong, Venezuela, Syria, and a whole host of other nations. These places have massive problems, and wealth transfer is one of the first things that will happen when things go south.

In fact, there has been some research I’ve been privy to lately that has shown a direct correlation with Bitcoin markets rallying right before capital controls are tightened and the Chinese mainland. This will continue to be the case, and therefore it is one of the main reasons why the markets should go higher over the longer-term.

Beyond all of that, central banks around the world continue to ease monetary policy and that has people trying to get away from various forms a fiat currency and that should help Non-fiat markets overall. Gold markets obviously are heavily influenced by central banks, the US dollar, fiat currencies and everything else and it should be noted that gold and Bitcoin have moved in almost lockstep lately. I believe that will continue to be the case because both of the markets continue to move because of the same reasons. Until central banks start to tighten monetary policy, which seems to be light years away, it’s difficult to imagine a scenario where Bitcoin suffers. This isn’t to say that we don’t pull back, and I think we will pull back a little bit from here but the $9250 level should continue to offer support. To the upside, I believe that the $12,000 level would be the massive resistance barrier need to broke for the market to continue to go much higher