Bitcoin markets rallied a bit during the trading session on Thursday as the ECB has cut interest rates and added liquidity to the market yet again. As central banks continue to do with they know how to do, cut interest rates and try to devalue currency, this fits very well into the argument for owning crypto, and most specifically Bitcoin.

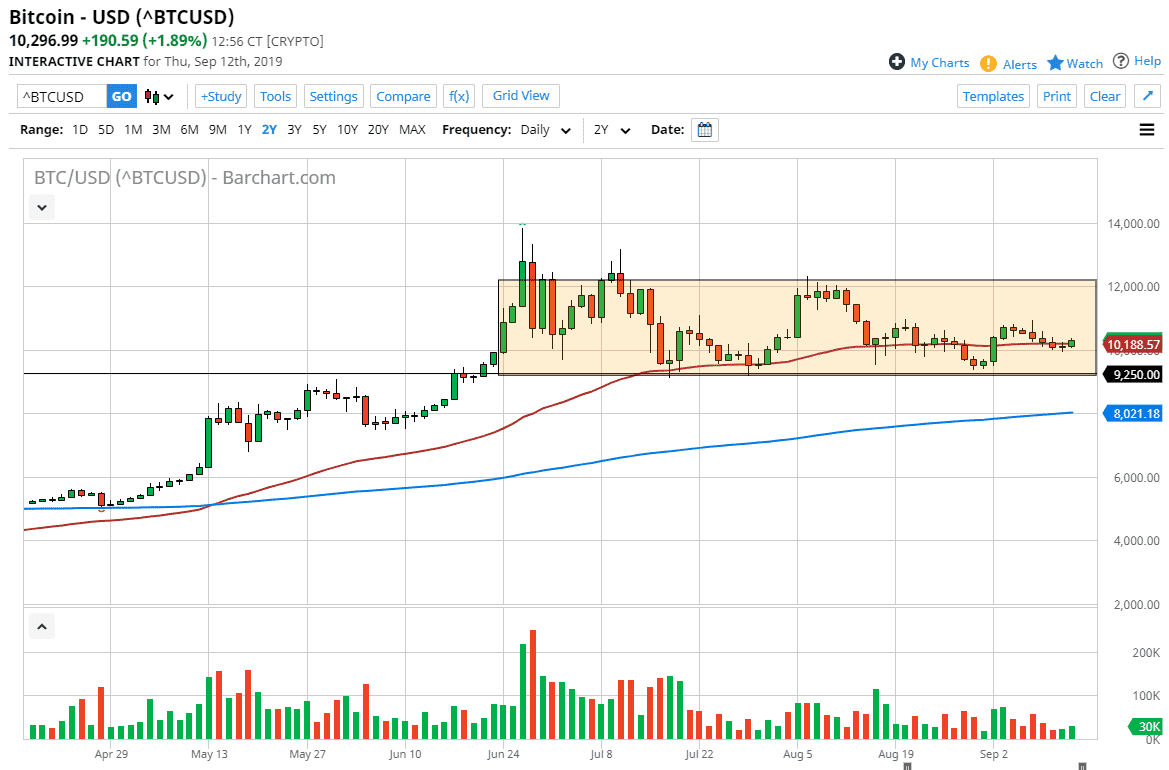

We did slice through the 50 day EMA which of course is a good sign, but it’s also very flat so at this point it’s very likely that the biggest thing that we are looking at is the overall consolidation that we have been in. After all, the market has bounced around between the $12,000 level above and the $9250 level underneath. Because of that, it’s very likely that we should continue to find buyers even if we do drop from here, and I think what we are looking at is a scenario where we are trying to digest the massive gains that we had seen until the last couple of months. The market had gotten a bit parabolic so it makes sense that we continue to see a lot of interest.

Bitcoin also has the 200 day EMA just above the $8000 level so I think that is essentially where we would define the trend. As long as we are above there then I don’t see any need to think about shorting. I think short-term pullbacks could be a nice buying opportunity, as we try to reach towards the $12,000 level, possibly even the highs at the $14,000 level.

The Federal Reserve has an interest rate decision next week, which is widely expected to be a cut. The question now is whether or not they will cut interest rates enough to have people running from the greenback as well? I don’t know if that’s the case but certainly foreign, i.e. non-American traders, will still form a positive flow of capital into the Crypto markets as other currencies around the world are being devalued. However, if the US dollar gets hammered then it will only exacerbate this chart to the upside. I do believe that we go towards the highs again, but the impulsive move to the upside is already over. At this point, every time we pull back is very likely that value hunters will come back into the marketplace to take advantage of opportunities.