The Bitcoin market has tried to rally again during the trading session on Tuesday but has also failed again. At this point, it’s very likely that this market continues to drift a little bit lower but at the end of the day it is still a market that has been very bullish. We have been dancing around the 50 day EMA for the last several days, which is a longer-term support level, but isn’t the be-all and end-all of support.

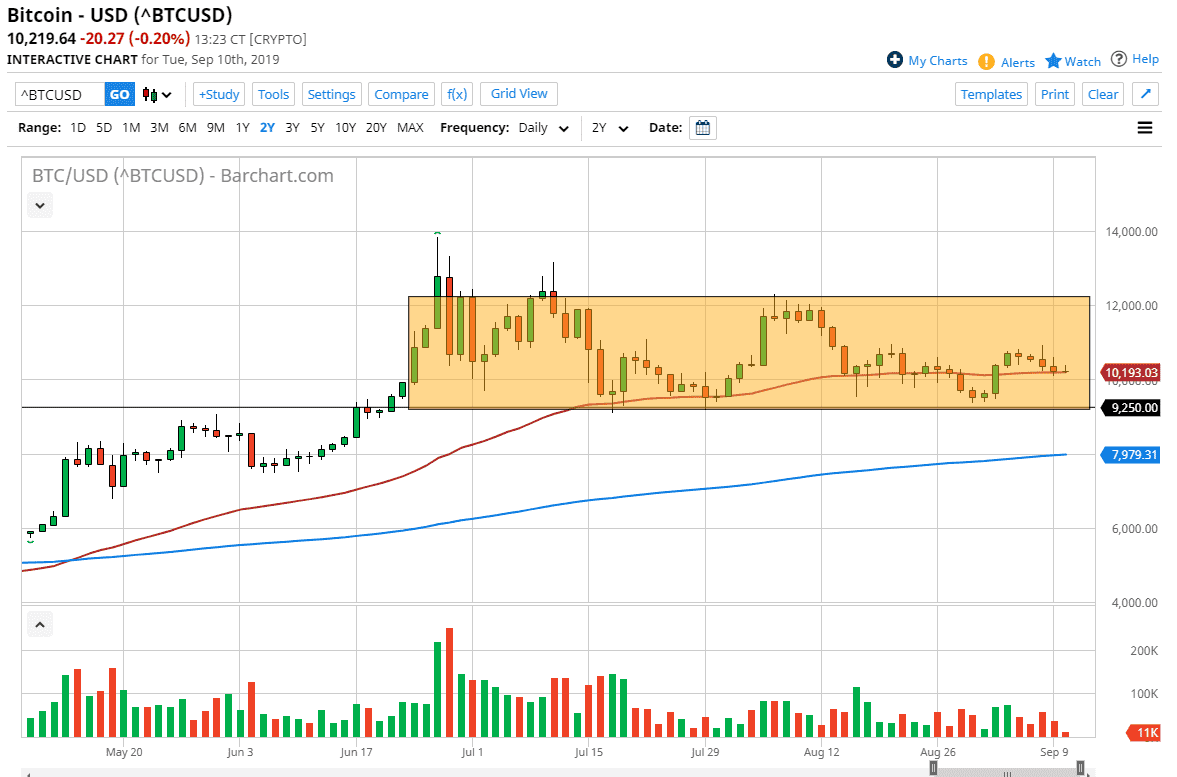

With that being said, we are still within a consolidation rectangle, that extends down to the $9250 level underneath. That level has handled selling pressure several times in the past, so the very likely that it should contain the selling pressure again, unless something fundamentally changes. Currently, traders are still looking at Bitcoin as a way to get money out of the fiat currency world. This is a market that continues to see a lot of noise but at the end of the day a grind sideways over the course of the last couple of months makes sense after the impulsive move higher that we had seen.

Even if we do break down below the $9250 level, I’m fairly certain that the 200 day EMA which is closer to the $8000 level should offer a bit of support as well. If we did break down below there, then you have to question the entire trend. All things being equal though, this is a market that is very sideways, but I think at this point it’s likely that we will continue to see interest in Bitcoin as it is not only a way to get away from fiat currency, but it is also a way to get away from Central Bank monetary policy. After all, that’s one of the biggest appeals of crypto, and of course Bitcoin is the biggest market. Central banks around the world are still on cue to start cutting monetary policy back to more of an easy stance. This week it’ll be the ECB, but in a couple of weeks it’ll be the Federal Reserve. Ultimately, Bitcoin is rallying for the exact same reason precious metals have been rallying, it’s a way to get away from Central Bank disruptions and distortions in the market. If we can break above the last couple of days, that would be an extraordinarily strong sign as it would be slicing through the top of a couple of shooting stars.