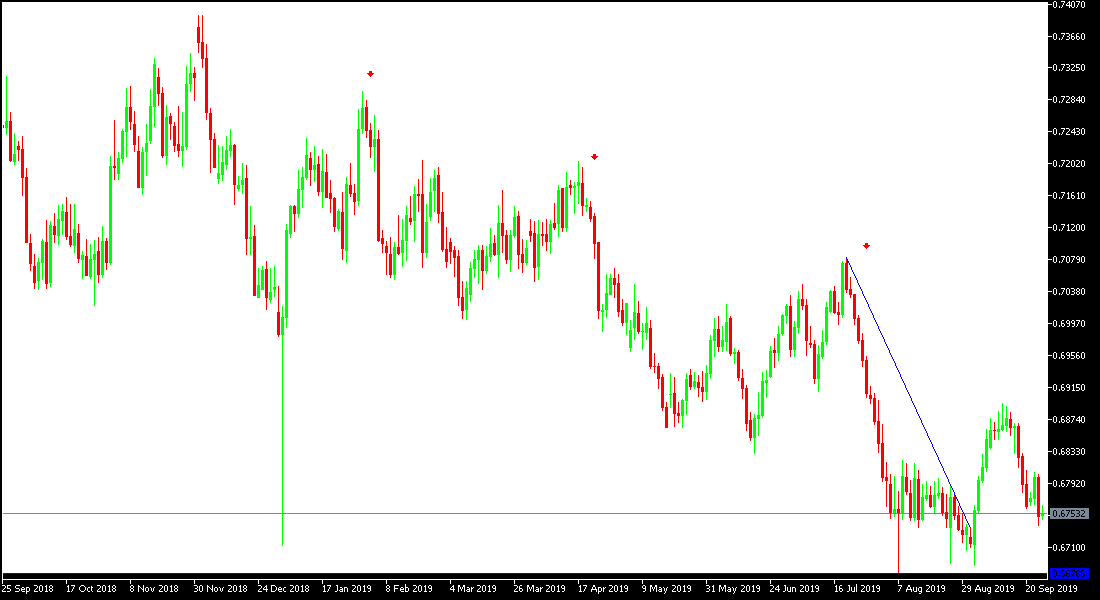

For two consecutive trading sessions, AUD / USD fails to break above the 0.6805 resistance level, and the pair has completed the decline as it retreated to support at 0.6738 before settling around 0.6760 at the time of writing. The Australian dollar weakened despite positive remarks from the US president about a near chance for a trade deal with China. Investors may have focused on political uncertainty in the United States, after Democrats in the House of Representatives launched an official inquiry that could isolate President Donald Trump. Trump again criticized China's trade practices in his speech to the UN General Assembly, adding to pessimism about a possible truce between the world's two largest economies.

"China not only refused to adopt the promised reforms, but also adopted an economic model based on huge market barriers, heavy government subsidies, currency manipulation, product dumping, forced technology transfer, theft of intellectual property and theft of trade secrets," Trump said at the United Nations. "I will not accept a bad deal for the American people."

House Speaker Nancy Pelosi announced a formal investigation to prosecute US President Donald Trump following allegations that he pressured the Ukrainian government to investigate his democratic rival, Joe Biden.

According to the technical analysis of the pair: In the long term, the price of AUD/USD is still in a downtrend channel and the trend will strengthen if the pair moves towards the 0.6700 support and stabilized below it. On the upside, the pair will not have a strong chance of a bullish correction without testing the 0.7000 psychological resistance level. As the Aussie is a risk currency, the persistence of global trade and geopolitical tensions will remain a constant pressure on any attempt by the Aussie to make gains.

The pair's performance is cautiously awaiting the release of US economic growth figures, jobless claims, pending home sales and important remarks by Federal Reserve Governor Jerome Powell. As well as any developments about the trade war between the United States and China.