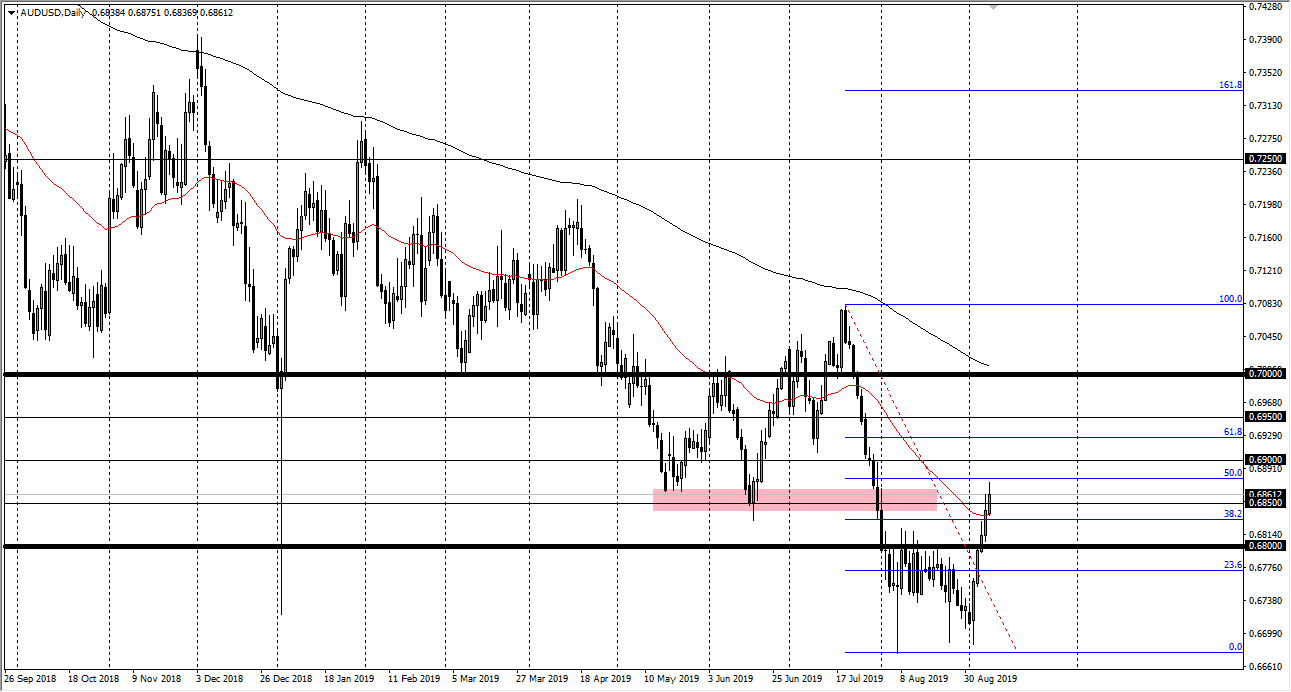

The Australian dollar has look very good for the last five sessions, but the one thing that continues to be an issue is that the market can’t go in one direction forever. During the trading session on Monday, we pulled back from the 50% Fibonacci retracement level, and that is something worth noting. Beyond that, we also have the 0.69 level above that could cause some issues, so keep that in mind as well.

I like the idea of shorting this market at the first signs of serious trouble, but unfortunately we don’t have that yet. Keep in mind that the Australian housing market is starting to see serious problems, and of course by extension the Australian economy could be entering a recession. Australia is unfortunately highly levered to the Chinese economy, which has shown a lot of cracks as of late also.

Think of it this way: if the Chinese economic numbers have been somewhat poor, imagine what the real numbers must be like. The Chinese government is known to fudge numbers, and therefore I think that most traders are starting to look at these numbers with real skepticism. With those huge amounts of debt in China that are based in US dollars, there are a lot of problems just waiting to come into the fold. All that being said I think what we are looking at is the simple short covering rally that probably was needed for some time. I do think that that’s all it will be, and I think it’s only a matter of time before some type of negativity comes back into play that we can take advantage of.

The US dollar continues to attract a lot of money every time there is trouble, and let’s be honest here, there’s plenty of trouble. I like the idea of waiting for some type of exhaustive candle to take advantage of, and then start shorting as I think we will go heading back towards the bottom. In fact, it’s very likely that we will see this market roll over sooner rather than later, because we can’t continue this type of momentum, and eventually all things find gravity. If we do break higher, then the 0.70 level should be massive resistance as well. At this point I think that the 0.70 level being broken would be a change in the trend, but I don’t see how that happens.