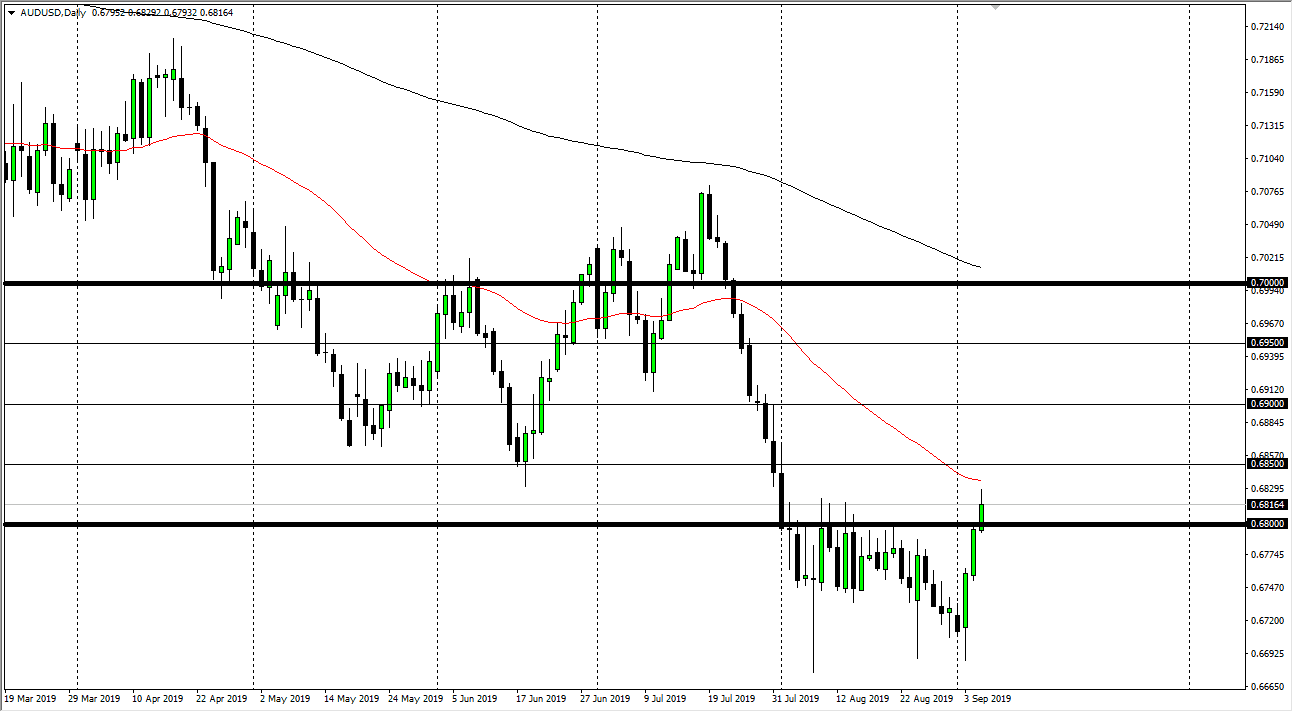

The Australian dollar rallied a bit during the trading session on Thursday, reaching towards the 50 day EMA which is rapidly reaching towards the market itself. With that being the case it’s likely that we will continue to roll over at the first signs of US dollar strength. Remember, the Australian dollar has gotten a bit of a rally due to not only the RBA being a little less dovish than thought, but at the same time we got confirmation that the Americans and the Chinese were meeting in October again. Because of this, the Australian dollar got a bit of a boost due to the fact that it is so highly levered to the Chinese economy.

Ultimately, it’s very likely that we will be disappointed though, so I anticipate that there will be a selling opportunity soon. The 50 day EMA of course causes a bit of technical resistance, and if we can break down below the 0.68 handle again, I think we will pull back towards the bottom of the range. With all of that being said, if we break above the 50 day EMA it’s likely that we could then go to the 0.69 level, perhaps even the 0.70 level after that. It’s not until we break above the 0.70 level that I would be suddenly bullish for a longer-term move. All things been equal though it’s very likely that the US/China trade talks will either produce nothing, or nothing but more frustration. Once that happens, the Australian dollar would get whacked.

Expect volatility, and with the jobs number coming out on Friday it’s very likely that somewhere around 830 in the morning New York time we will see quite a bit of chop. The weekly close will be crucial, so it’s probably easier to sit on the sidelines and wait for the market to shake itself out and show its next obvious move. Remember, even though we have seen quite a bit of a large pop higher, the reality is that we are still very much in a downtrend, and that has not changed quite yet. With that being the case, I do favor shorting this market if I get the right set up but right now I think it’s probably best to stand on the sidelines and let it shake itself out over the next 24 hours or so.