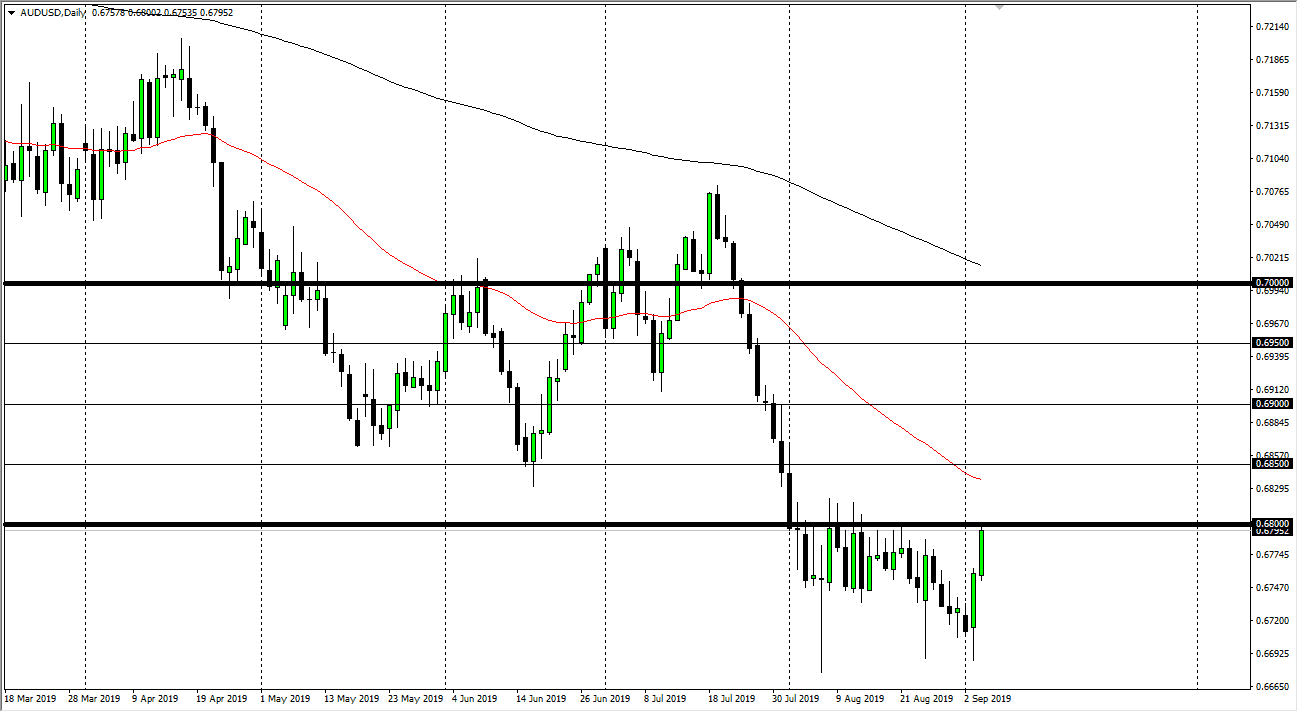

The Australian dollar has rallied quite nicely during the trading session on Wednesday, slamming into the 0.68 level, an area that should continue to offer plenty of resistance based upon recent action. The fact that we have gone straight up in the air and slammed in that level will more than likely make it easier to push back as we will probably run out of momentum. Add to the fact that the US/China trade talks aren't going any better, and then you have a perfect recipe for weaker Aussie overall.

Granted, the RBA may not had been as dovish as people expected, but at the end of the day it doesn’t really matter because sooner or later people will start focusing on China again. Once they do that, the Aussie gets punished. The market seems to have a significant amount of resistance near the 0.6833 level, the 50 day EMA racing towards that level does little to dissuade me from thinking that it will hold. With that being said, it’s likely that we will continue to see a lot of volatility in the markets over the next couple of days, especially considering that Friday is the jobs figure. Keep in mind that it is only a matter of getting the right Tweet out there to send this market plummeting as well, and therefore it’s going to be very difficult to trade the Australian dollar.

The US dollar has been falling during most of the trading session on Wednesday so that’s probably part of the problem as well, but this is a downtrend and nothing has changed, despite the fact that the last two days have been very strong. To the downside, I would expect that the market could go looking towards the 0.67 handle again, but in the meantime I think we’re just simply going sideways grinding back and forth. All things been equal though, if we did break above the 50 day EMA which is pictured in red on the chart, one would have to start thinking about where we could go from there. The next major resistance barrier is the 0.69 level, followed very closely by the 0.70 level. It’s hard to imagine a scenario where that happens without at least some good news coming out of the US/China trade talks, which is something that isn’t very likely to happen in the short term.