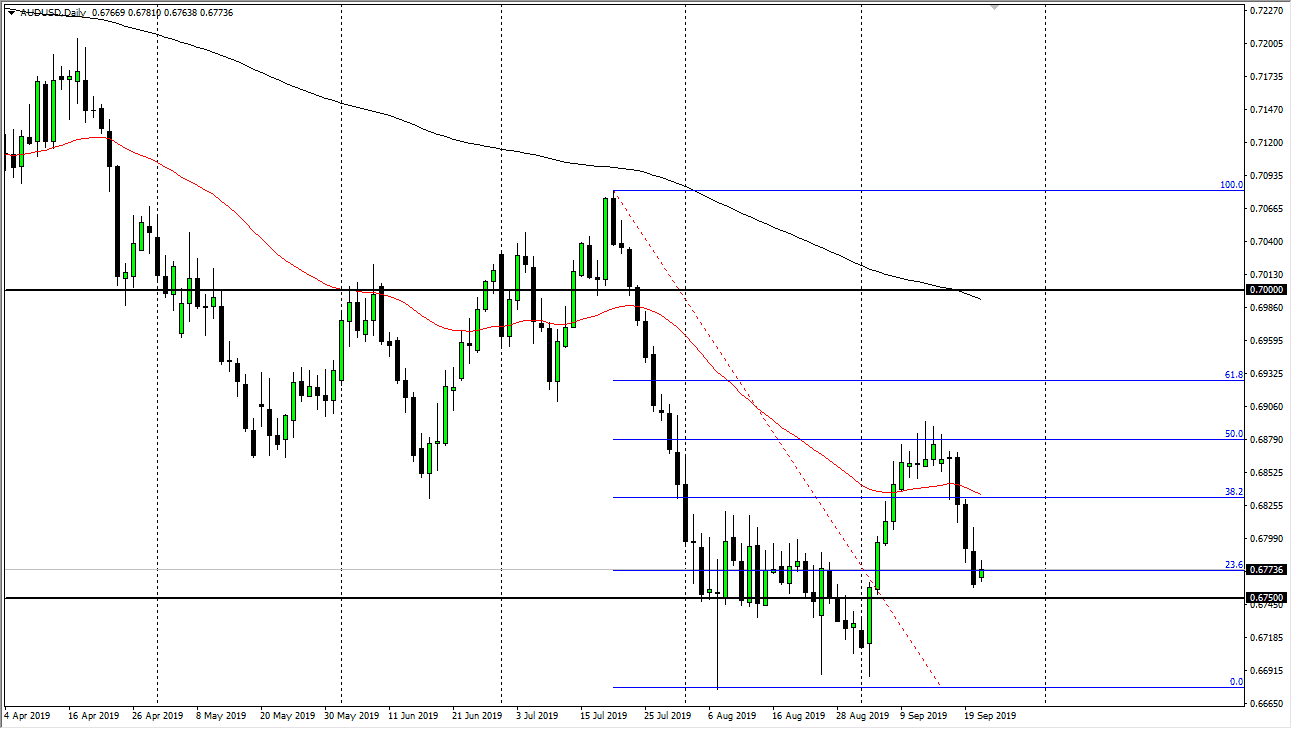

The Australian dollar gapped higher to kick off the trading session on Monday, but as we continue to go back and forth just above a major support level in the form of the 0.6750 level. At this point, it’s likely that the market will continue to bounce around in this area, as the Australian dollar is so highly sensitive to global growth, and of course risk appetite. The risk appetite scenario around the world is a bit mixed at best, so ultimately it’s only a matter time before the Australian dollar breaks down.

The rallies at this point continue to show opportunity for selling, as the 50% Fibonacci retracement level has been so restrictive recently. If we reach towards the 0.69 handle, it’s very likely that the sellers will return. To the downside, if we clear the 0.6750 level it’s likely that we go down to the bottom again, closer to the 0.67 handle. This is a market that will continue to move right along with the headlines coming out of the US/China situation, so keep in mind that it can move very suddenly. All things being equal, the Australian dollar is highly sensitive to what goes on with the Chinese economy, and at this point it’s likely that the poor economic numbers in the mainland continue to weigh upon the Aussie itself.

Beyond all of that, there is a significant problem with the Australian housing sector, and therefore we could see this currency unwind further. The Reserve Bank of Australia should also be on course to start cutting rates and that of course will weigh upon the currency as well. Furthermore, the United States dollar continues to pick up value due to the fact that there is a lot of money coming into the bond market, and therefore it shows signs of being the currency that most traders favor currently. At this point I continue to sell short-term rallies, but I’m not looking for a huge moves. Even if we were to break down below the lows, it’s likely that the market continues to grind to the downside, perhaps reaching towards the 0.65 handle. The market had been rather parabolic but has also given back most of those gains as we had perhaps gotten ahead of ourselves. All things being equal, this is a market that should continue to attract a lot of downward pressure.