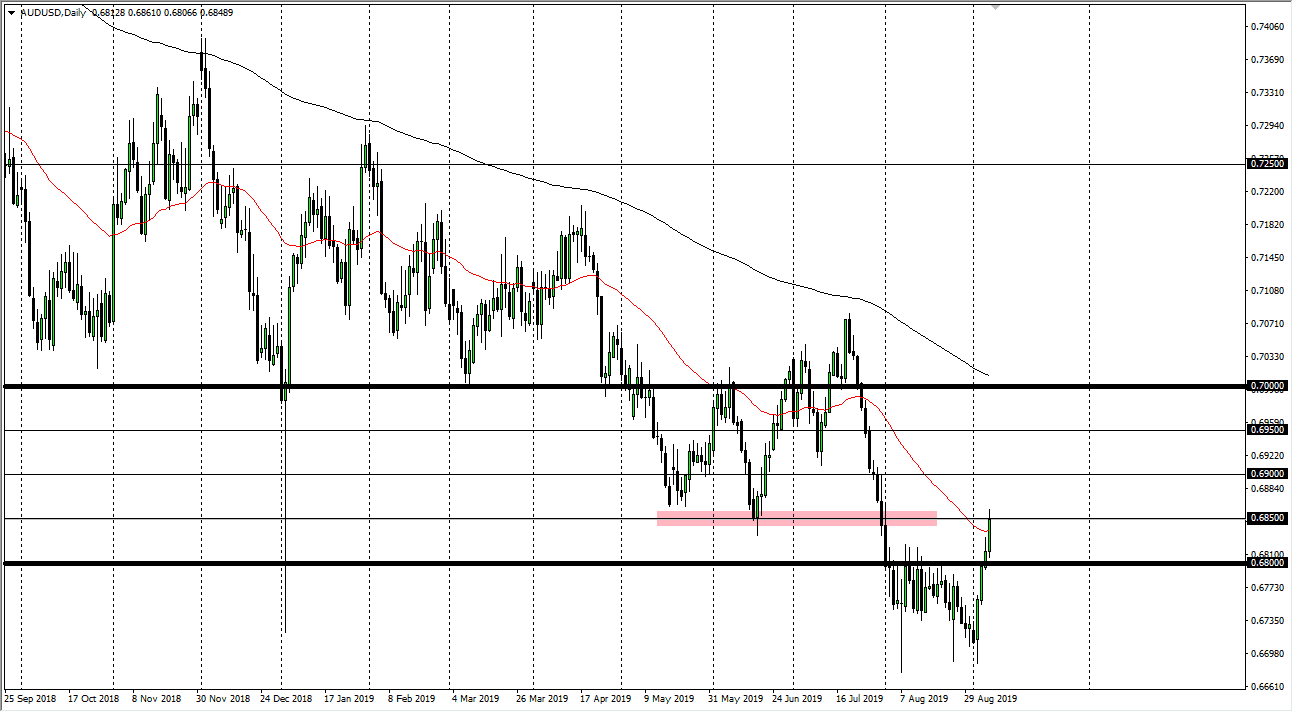

The Australian dollar has rallied quite significantly during the trading session again on Friday, slicing through the 50 day EMA. By doing so, the market then reached towards the 0.6850 level. That is an area that previously had been massive support, and it should now offer significant resistance. This being the case it’s likely that we could see a bit of a pullback from here. Keep in mind that the Australian dollar is getting a major boost from the US/China trade talk relations getting a little bit better, and if that’s going to be a case, it’s likely that we are only one headline away from turning things around.

The Australian dollar continues to be highly sensitive to the trade talks, and we have seen more than once massive amounts of hope come into the market only to turn around. At the very least, you can see that we have gone parabolic over the last week or so, so I think a pullback is likely to happen. To the upside, the 0.70 level is the absolute “top” of the market right now, as it also features not only resistance but the 200 day EMA just above it. We could go as high as that level without much changing. At this point in time it’s likely that we will continue to see this move simply based upon the occasional Tweet or headline out of Beijing.

Give this market some time, and it will show you when it’s running out of steam. We will get a little bit more help to the downside from either Donald Trump or the Chinese government, as they clearly can’t get the situation together. That being said though, if we were to break above the 200 day EMA, then it could signify a longer-term trade to the upside, and it in fact could be the beginning of a longer-term uptrend. All things being equal though it’s likely that the 50 pip levels will continue to cause issues, as it has in the past. Overall, I think it’s only a matter time before the sellers get involved and push this market back down. Simply be patient and wait for the roll over. Right now I think you are probably best to sit on the sideline and wait for the tide to turn back in favor of the longer-term trend.