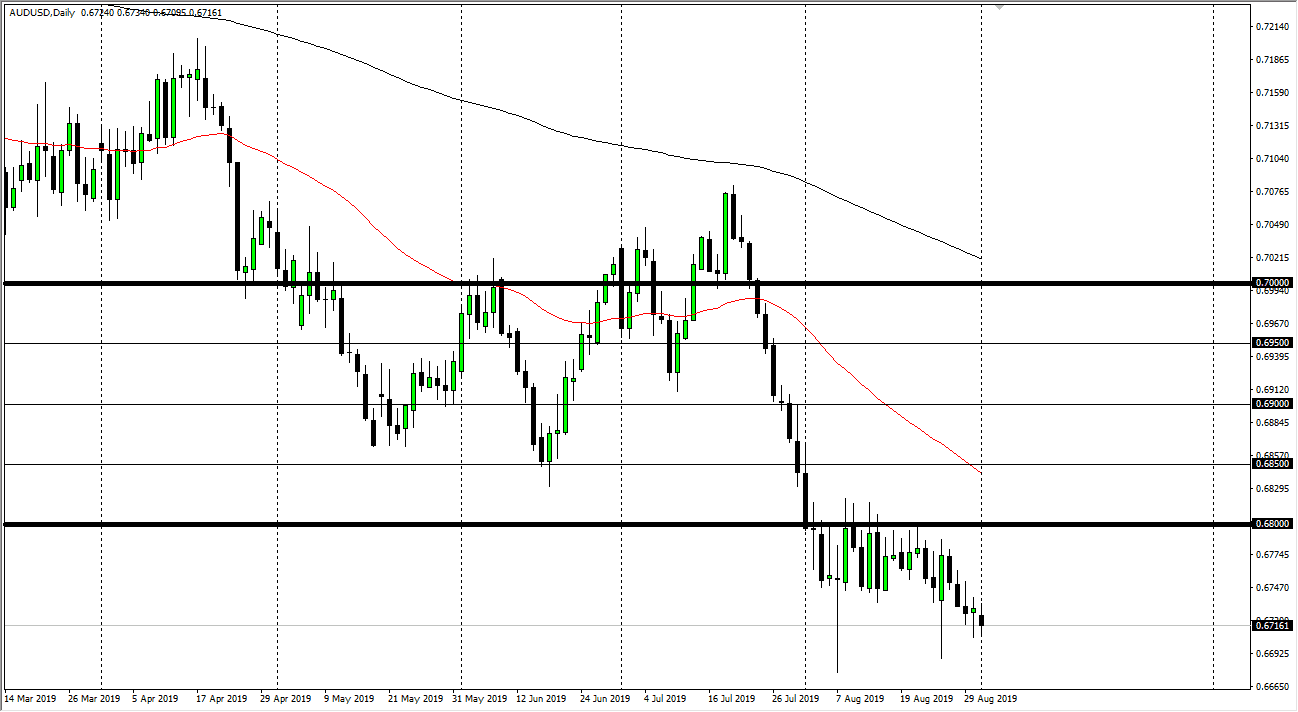

The Australian dollar continues to be very negative overall as risk appetite has gotten hit. By doing so, it looks likely that we will continue to grind below the 0.67 level given enough time. I think short-term rallies will continue to be selling opportunities, with a massive amount of resistance near the 0.68 level. With that being the case I’m looking for rallies to take advantage of and start shorting. After all, the Australian dollar is highly levered to the Chinese economy, and with the US/China tariffs continuing to be a major headline, it’s difficult to imagine a scenario where the Australian dollar will suddenly take off.

Beyond all of that, we also have an interest rate statement coming out of Australia, and that of course has quite a bit of interest drawn by the trading community. I believe the 0.68 level above is massive resistance, extending all the way to the 0.6833 level. At this point, rallies are to be faded and I think we do continue to go much lower. Ultimately, if we did break down below the 0.65 level we could show signs of catastrophe for the Aussie dollar itself.

With the Australian housing bubble out there I think that we will continue to see a lot of weakness here and as central banks around the world continue to look very dovish, it makes quite a bit of sense that the Aussie will be no different than many of the other currencies out there. The US Treasury market continues to attract a lot of attention, and as they offer better rates than many other central banks around the world, it makes sense that the US dollar strengthens.

Ultimately, rallies will continue to be selling opportunities, unless of course the RBA does something shocking and perhaps sounds quite a bit hawkish, but I just don’t see that happening anytime soon. Ultimately, I think that any time we rally you should look at it as an opportunity to take advantage of cheap US dollars. It’s going to be very noisy, so I think you should also be cautious about the size of your position, but most certainly the downside is the only direction that you should be trading at this market, and therefore I don’t have any interest in trying to buy. In fact, it’s not until we clear the 50 day EMA on a daily close that I would consider buying.