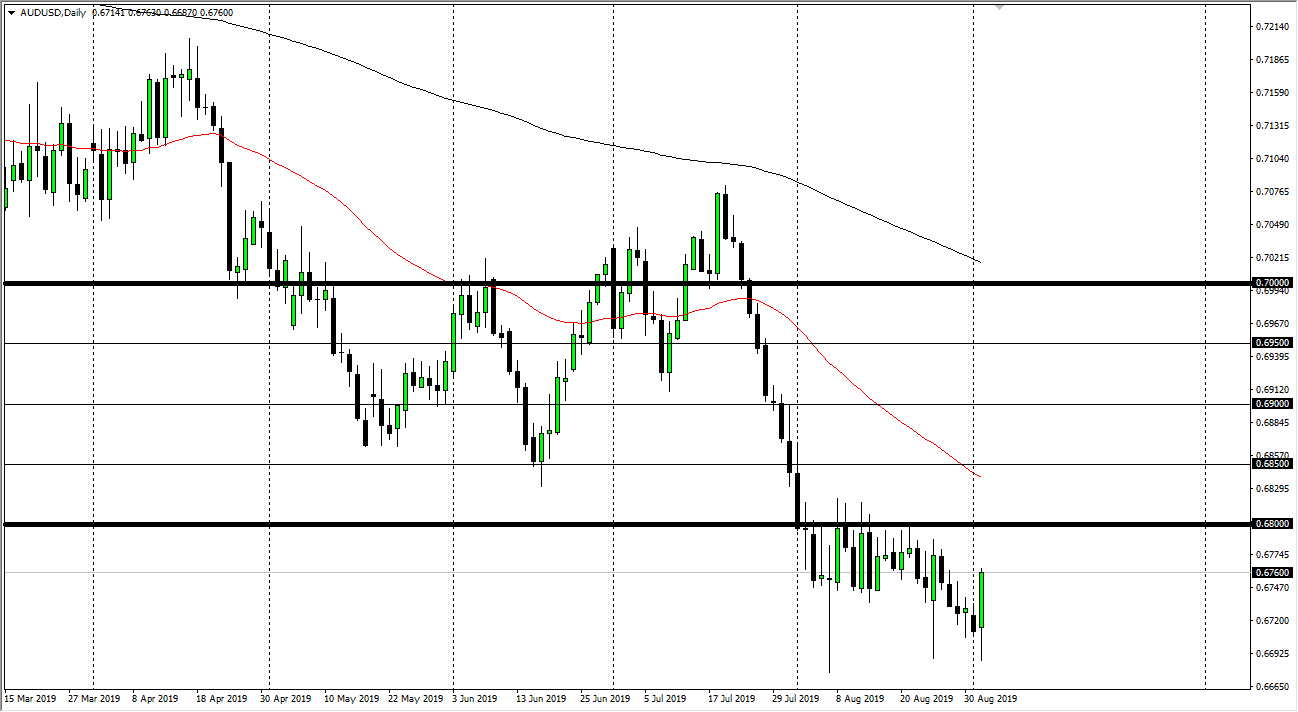

The Australian dollar is heading towards a significant amount of resistance just above, especially near the 0.68 handle, as it is an area that has caused quite a bit of selling in the past. We have seen a nice turnaround during the trading session, but we are still in a very negative downtrend, so I think it’s only a matter time before the sellers come in and push this market right back down. Beyond that, the Australian dollar is too highly levered to the Chinese economy do think that it will take off to the upside for a significant move.

Looking at the chart, the 50 day EMA is sitting just above the recent resistance, so it’s very likely that the 50 day EMA comes into play for resistance and therefore I think it’s only a matter of time before we start shorting. I have no interest in buying this market and given enough time I think that we reached towards the lows again. All things being equal, a move above the 50 day EMA would in fact be rather bullish, but overall it seems to be very unlikely to happen as the US/China situation continues to get much worse.

Beyond that, there is a lot of concern when it comes to the global growth situation, as we continue to see economy slows down. With that being the case I think it’s only a matter time before we take advantage of US dollar strength, and although we have seen a complete turnaround during the day, there will continue to be a lot of concern when it comes to Asian trading, and it will be interesting to see if we can hold any gains closer to the 0.68 handle. There’s nothing out there to suggest that things have changed other than the fact that we’ve had a very bullish day. Keep in mind that the RBA recently had an announcement, so having said that it’s likely that there is still a lot of confusion and therefore it’s likely that we will continue to see the Australian dollar suffer as a result. Beyond that, we also have the Australian housing situation which is tenuous at best. I believe in fading the rallies, and at the first sign of exhaustion near the 0.68 level I will be short of this market.