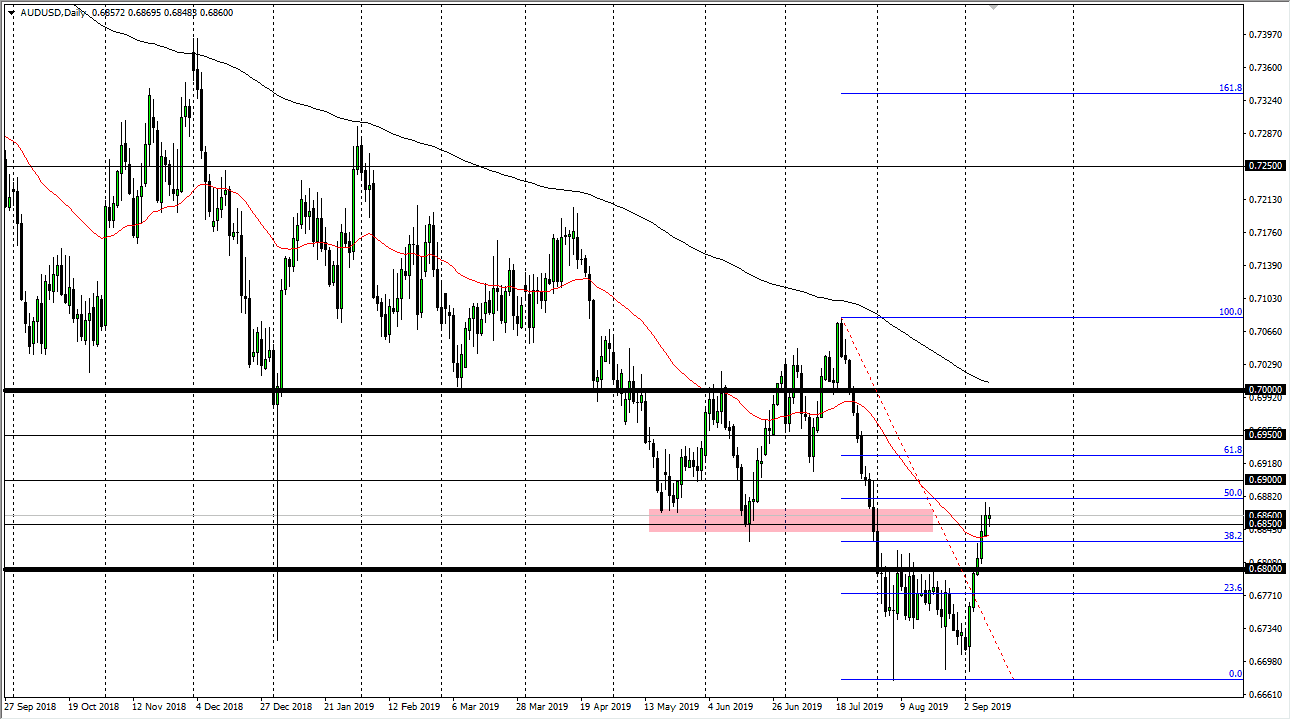

The Australian dollar went back and forth during the trading session on Tuesday, slicing around the 0.6850 level. By forming this very neutral candle stick, it’s likely that it is showing that the Australian dollar is a bit overdone at this point. In fact, the 50% Fibonacci retracement level is just above and that could cause a bit of resistance. That being said, I like the idea of selling if we can break down below the 0.6050 level, perhaps even the 50 day EMA. Remember, even though the United States and China are talking again, the reality is that we are light years away from some type of agreement. This is simply short-term traders trying to take advantage of the market momentum, and as soon as it’s obvious that nothing will come out of these meetings, the Australian dollar will roll over.

Keep in mind that Australia is highly levered to the Chinese markets, and perhaps even more importantly the Chinese export market. With that, the Australian supply a lot of the raw commodities that the Chinese use, so that is why the two economies are so highly intertwined. It’s not overly out of line to consider Australia to be the “general store” for Chinese manufacturing.

If we do break above the 0.69 level, we could then go looking towards the 0.70 level after that, which is currently about where the 200 day EMA sits. At this point, I think that the market will continue to face the downside more than anything else, and one thing that should be noted is that although this has been a very impressive rally, it’s also been a very parabolic one. That can’t go on forever so the very least I think we will probably have a pullback towards the 0.68 handle. Because of this, I remain bearish but also a bit patient. Signs of exhaustion or break down below the 0.6850 level have me looking for opportunities. The 50 day EMA could offer minor support, but if we break through there then I think it’s all but said and done that we are going lower.

Unless we get some type a US/China trade settlement, I don’t know how the Australian dollar rallies for the longer-term. Granted, it had been extraordinarily oversold, but at this point we are starting to get extraordinarily overbought. In fact, if you just look at the last couple of months in the Australian dollar market, it’s a perfect proxy for just how the overall markets have behaved.