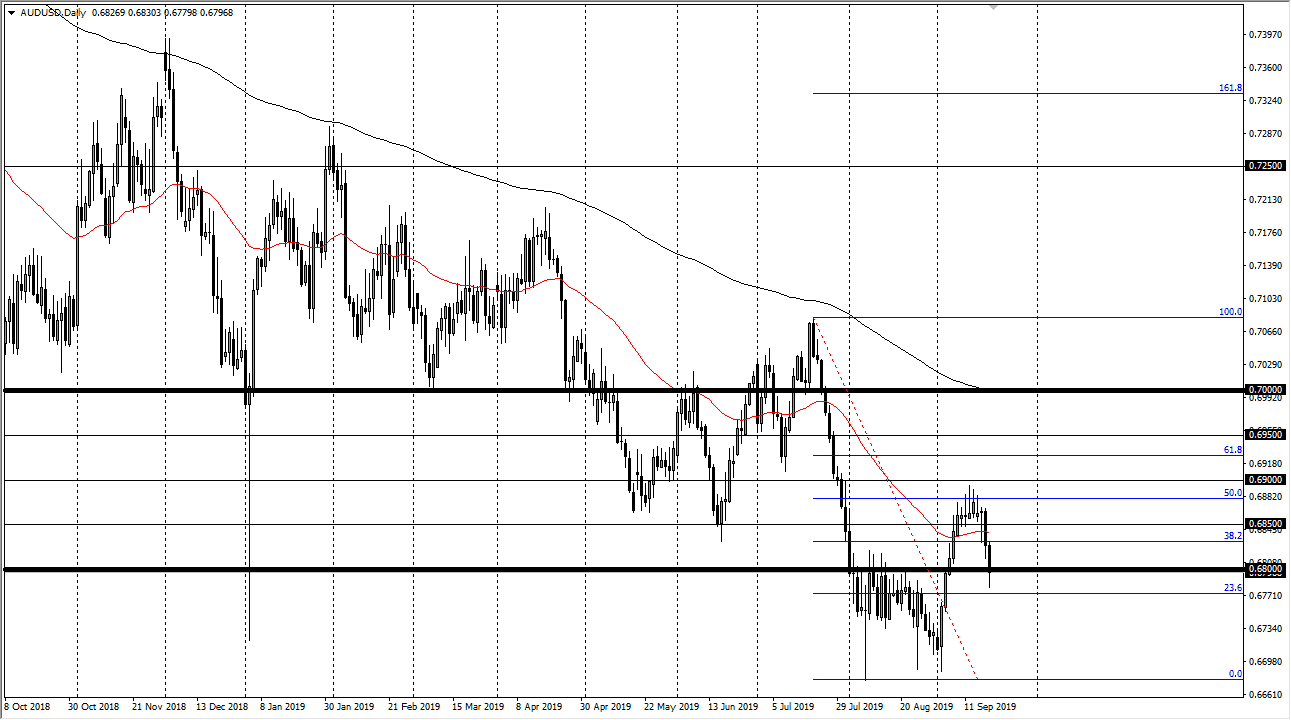

The Australian dollar fell rather hard during the trading session on Thursday, slamming into the 0.68 level as we had a little bit of a “risk off” scenario. Beyond that, the market had been struggling at the 50% Fibonacci retracement level above anyway, so therefore it makes sense that we eventually try to continue the longer-term trend. We had gotten a bit parabolic, so when you mix a parabolic move with exhaustion, this is the example you get. We are now well below the 50 day EMA which of course is a negative turn of events.

However, there is a lot of order flow below the 0.68 handle, so don’t expect a move below here to be easy. In fact, I think the market will be trying to find a bit of a bottom in this area considering that the move was so parabolic but all things being equal if the Fibonacci study holds, then the market should in fact go looking towards the 0.0% Fibonacci retracement move, which is closer to the 0.6680 handle. That doesn’t mean that it would be an easy move, I think it would be more of a grind at this point but obviously the Australian dollar is going to be very sensitive to the Chinese economy and economic numbers which hasn’t exactly been a standout. With weaker than usual numbers coming out of the mainland, it makes sense that the Aussie has taken it on the chin a bit.

Some people use the Australian dollar as a bit of a proxy for the gold market, but that correlation seems to have broken down while this trade war continues, so I would not use that as any type of indicator going forward. In fact, not only is the Chinese economy starting to slow down, but we are now starting to see a lot of ripples in the Australian economy as there is a housing bubble and growth numbers haven’t exactly been strong. The Reserve Bank of Australia is likely to cut rates in the future, and now the market is trying to praise that end. The only thing keeping this market from breaking down significantly at this point is probably the fact that the Federal Reserve is also likely to cut rates going forward as well. However, it should be noted that even though the Federal Reserve cut interest rates during the previous session, the Australian dollar still lost value against it.