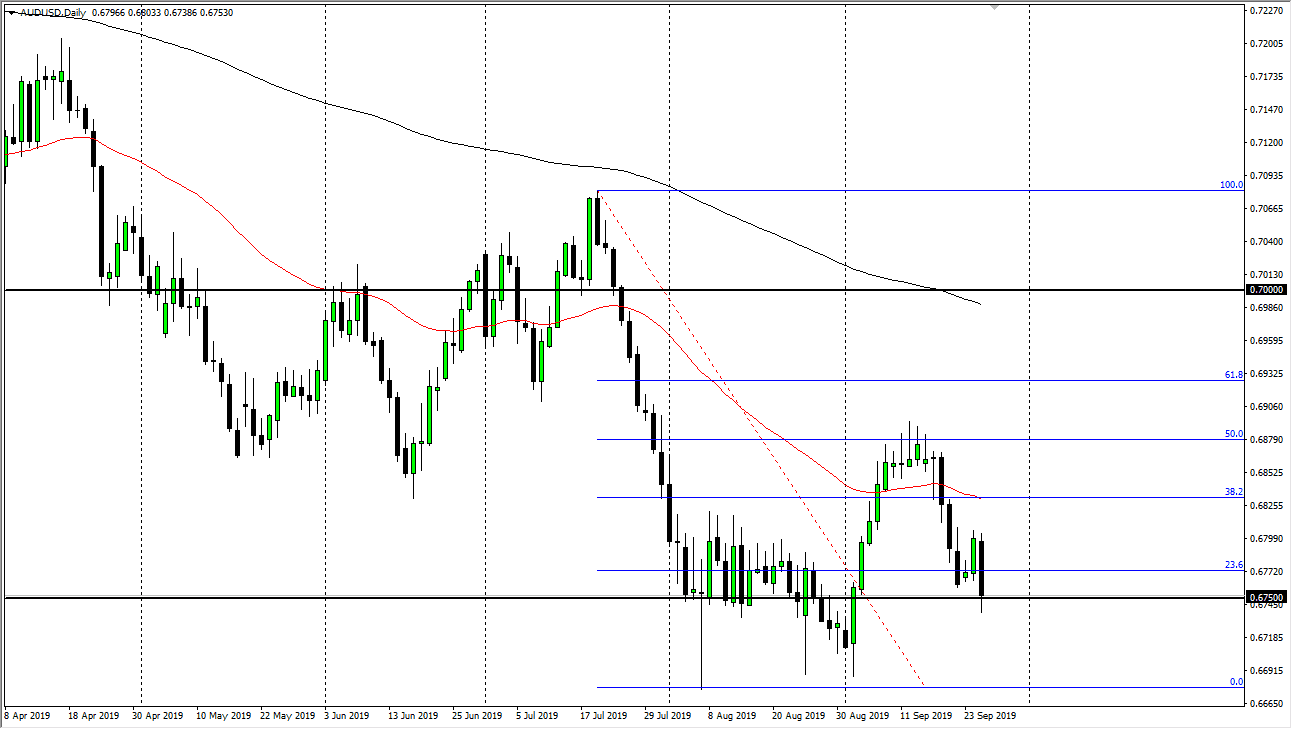

The Australian dollar has broken down significantly during the trading session on Wednesday, reaching below the 0.6750 level before bouncing slightly. However, there is a lot of noise underneath so although I do think that we could continue to go lower, the reality is there is a lot of noise underneath so I think the downside is probably somewhat limited in the current environment as the Australian dollar has been so beaten up.

This is going to continue to be a very difficult market to trade for anything more than a quick scout, because it is so highly sensitive to the US/China trade situation, as the Aussie economy is so highly sensitive to how the mainland as performing. The better the Chinese economy does, the more likely it is Australia will be needed to send hard commodities to China in order to help with manufacturing and of course construction.

The candle stick for the trading session on Wednesday has been rather negative looking, but again I think it has a lot of work to do if we are going to break down. That being said, if we do bounce from here I think that the red 50 day EMA is going to cause some issues, just as the 50% Fibonacci retracement level at the 0.69 level has recently. Both of those levels, and the area between the two of them, could show a significant amount of selling pressure and resistance. A significant exhaustive candle in that area could have me selling again but I think at this point the Australian dollar is going to be very difficult to touch, at least against the US dollar as the market has so much in the way of choppiness just below. If we were to break above that 50% Fibonacci retracement level though, it’s likely that we will run into trouble at the 200 day EMA which is painted in black as well. In other words, I think the easiest way to trade this market is to simply fade signs of exhaustion after short-term rallies. I have traded the Australian dollar so little over the last several months that I have had to essentially “pick my spots” as the market has been so tight over the last couple of handles, as the market has no real direction at this point, going higher suddenly, followed by sudden pullbacks.