The Australian dollar initially tried to rally during the trading session on Friday, but then pulled back from the 0.68 level to fall pretty significantly. With that being the case it’s likely that we will see the market drop down towards the lows again, which is just below the 0.67 handle. This makes quite a bit of sense as the US/China trade relations have not gotten any better, and although there were low-level talks over the course of the week, it wasn’t as if something had fundamentally changed.

The Australian dollar continues to be a proxy for China, so as long as there are issues between the Americans in China, there will continue to be a major weight around the neck of the Aussie dollar as Australia’s a major contributor to the Chinese economy in the form of raw materials. Beyond all of that, the Reserve Bank of Australia looks very likely to continue cutting as other banks have, and this is now being priced into the currency.

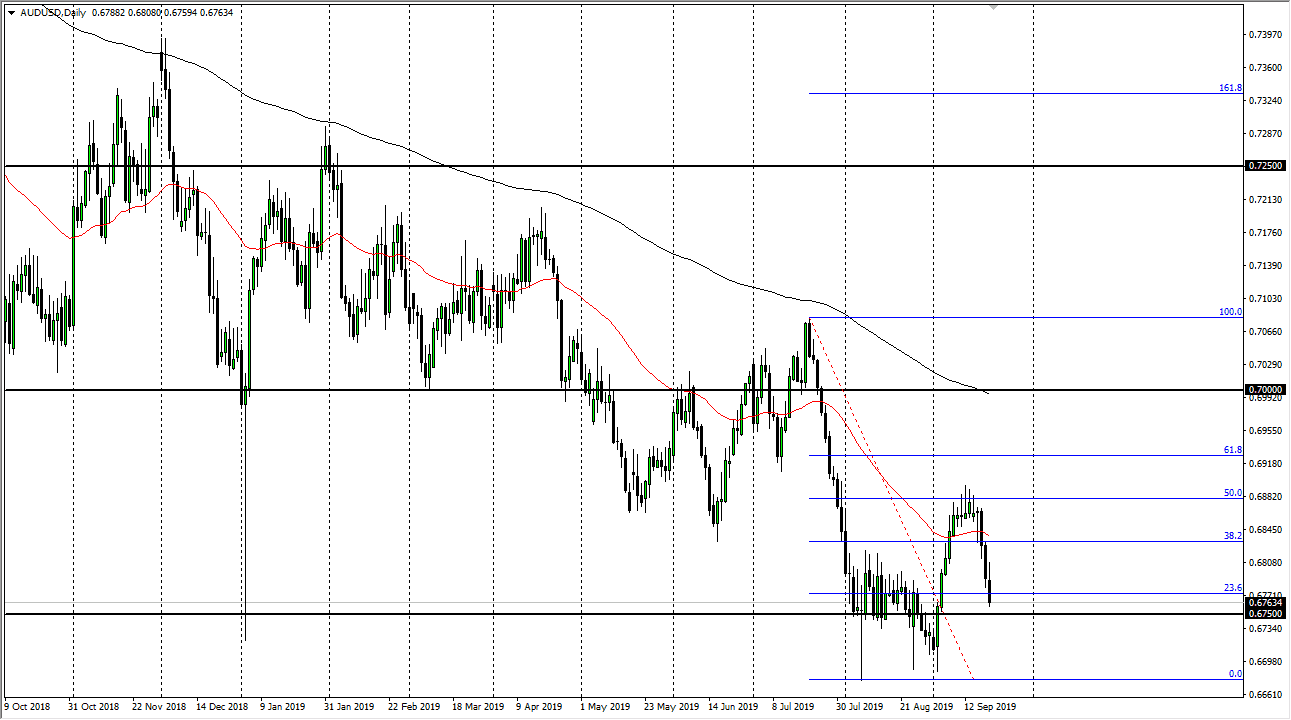

The fact that we formed so many shooting stars near the 50% Fibonacci retracement level was your first clue that the market was in fact running into trouble. What’s even more interesting is the fact that the Australian dollar even fell after the Federal Reserve cut interest rates, which is a bit counterintuitive as one would expect the US dollar to lose some value. The fact that only made things more bearish for the Aussie dollar tells you just how dire the situation could be.

Looking at the chart, if we were to break down below the lows, the 0.65 level on a historical chart shows a significant amount of interest. Another proxy that you can use for this market is the copper market, which looks very weak. All things being equal I believe that the market will continue to offer selling opportunities on rallies, but it’s more of a short-term trade as we are so overextended to the downside from a longer-term perspective. That doesn’t mean that we can’t go lower, and I think we will. However, the noise will be deafening at times, but I still have only a negative bias when it comes to this pair and have no interest in trying to fight the longer-term trend as it is so firmly ensconced in this market and has been so reinforced over the last several months.