The Australian dollar has fallen during the trading session after the FOMC statement, and of course interest rate cut. That being said though, the reality is that there are a lot of concerns out there that continue to weigh upon the Australian dollar, not the least of which will be problems in China. The Chinese are suffering at the hands of the trade war, and recent economic figures coming out of China have been miserable to say the least.

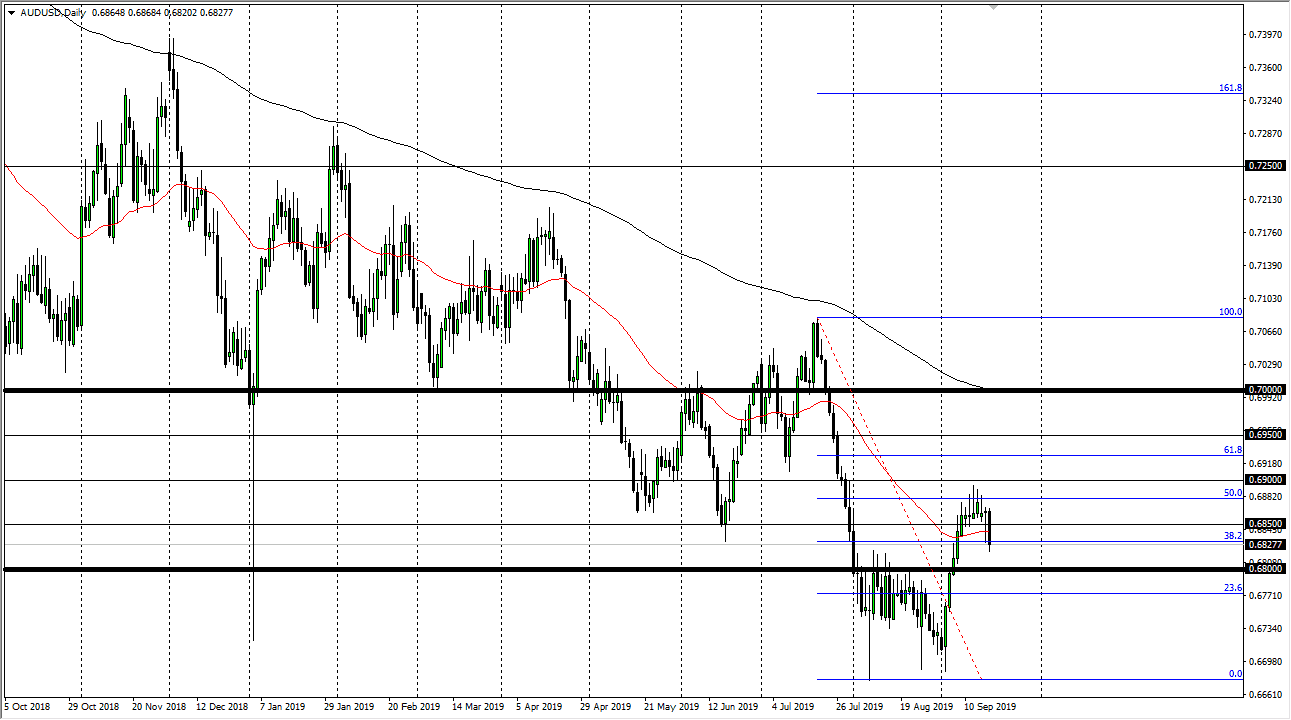

With the Australian dollar being a bit of a proxy for the Chinese economy, it makes quite a bit of sense that the Aussie will continue to find a lot of negativity. With that being the case, it’s likely that the pair will continue to drift lower over the longer-term. We have seen an initial push lower, but previously we have seen the lot of exhaustion near the 50% Fibonacci retracement level. With that being the case, it makes sense that as the Federal Reserve it didn’t cut rates in an aggressive manner or didn’t exactly give the market exactly what they wanted to hear longer-term, the US dollar should continue to strengthen against most currencies.

If we were to break down below the 0.68 handle, the market probably goes to the lows, closer to the 0.67 level. If we were to break down through there, then the market would find itself going towards the psychologically important 0.65 handle. The alternate scenario of course is that we break above the 0.69 level, which could send this market back towards the 0.70 level given enough time as well. All things being equal though, this is a very negative look to the chart, and the fact that we have broken through the hammer from the previous session also is a bit of an ugly look to the chart as well. As long as the US/China situation continues to be the same, it’s very unlikely that we will see the Australian dollar strengthen. Now that the Federal Reserve has sounded less than certain about a long series of interest rate cuts, it makes sense that the US dollar should continue to strengthen for quite some time against many of the other currencies around the world that are facing massive headwinds on multiple levels. The candle stick looks very ugly, and therefore I think we are about to see continued momentum.