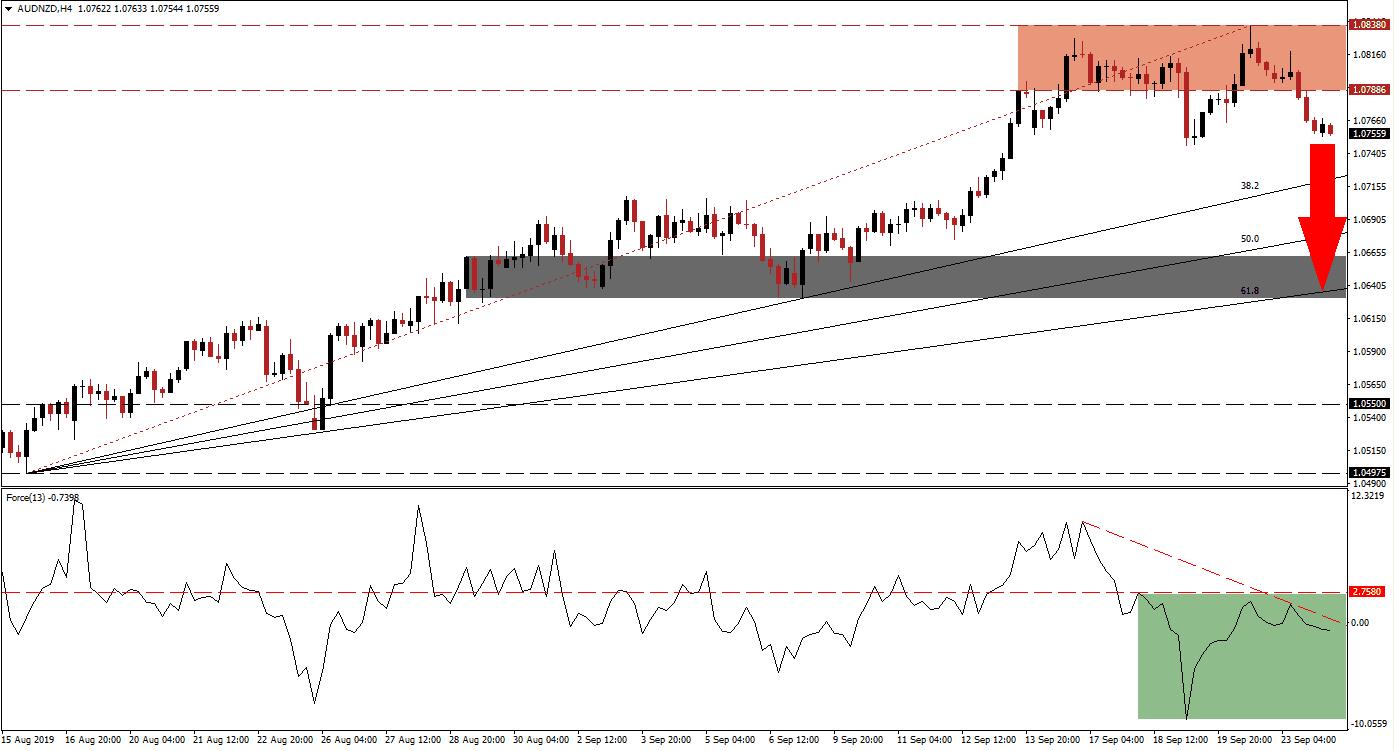

The Australian Dollar has been under pressure from two fundamental factors which led to a breakdown in the AUD/NZD below its resistance zone and a rise in bearish momentum. The Reserve Bank of Australia, according its latest minutes released last week, is open to more monetary easing with chances of a 25% interest rate cut next month at 80%. Adding to the rise in bearish momentum is an increase in trade worries after the Chinese delegation cancelled planned farm visits in the US and returned home. The 38.2 Fibonacci Retracement Fan Support Level is now the next level to watch following the breakdown in price action.

The Force Index, a next generation technical indicator, confirmed the bearish trend and entered downtrend as well as a breakdown below its center line of its own. This is marled by the green rectangle. The AUD/NZD initially complete a breakdown below its resistance zone following an intra-day high of 1.08285 which was reversed to the upside and resulted in an intra-day high of 1.08380. At the same time the Force Index contracted throughout the process and a negative divergence formed. This gave the first bearish trading signal from a technical perspective. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

A move into its 38.2 Fibonacci Retracement Fan Support Level is expected and the Force Index should be monitored in order to assess if another breakdown will follow. As long as this technical indicator maintains its downtrend and its position in negative territory, more downside is possible.The next breakdown will clear the path for the AUD/NZD to descend into its next short-term support level which is located between 1.06305 and 1.06624 as marked by the grey rectangle. The 61.8 Fibonacci Retracement Fan Support Level is currently passing though this zone as well.

Another key level to watch out for is the intra-day low of 1.07470 which represents the low recorded during its first breakdown below its resistance zone from where a quick recovery led to a higher high. A move below this level could further attract new net sell orders while profit taking is likely to increase selling pressure as well. This combination will provide enough bearish momentum for a breakdown in the AUD/NZD. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

AUD/NZD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.07450

Take Profit @ 1.06400

Stop Loss @ 1.07850

Downside Potential: 105 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 2.63

Should the Force Index recover and push above its descending resistance level as well as manage a breakout above its horizontal resistance level, the AUD/NZD could retrace the breakdown back into its resistance zone. This zone is located between 1.07886 and 1.08380 which is marked by the red rectangle. A fundamental catalyst would be required in order to push price action above this zone.

AUD/NZD Technical Trading Set-Up - Reversal Scenario

Long Entry @ 1.07950

Take Profit @ 1.08350

Stop Loss @ 1.07750

Upside Potential: 40 pips

Downside Risk: 20 pips

Risk/Reward Ratio: 2.00