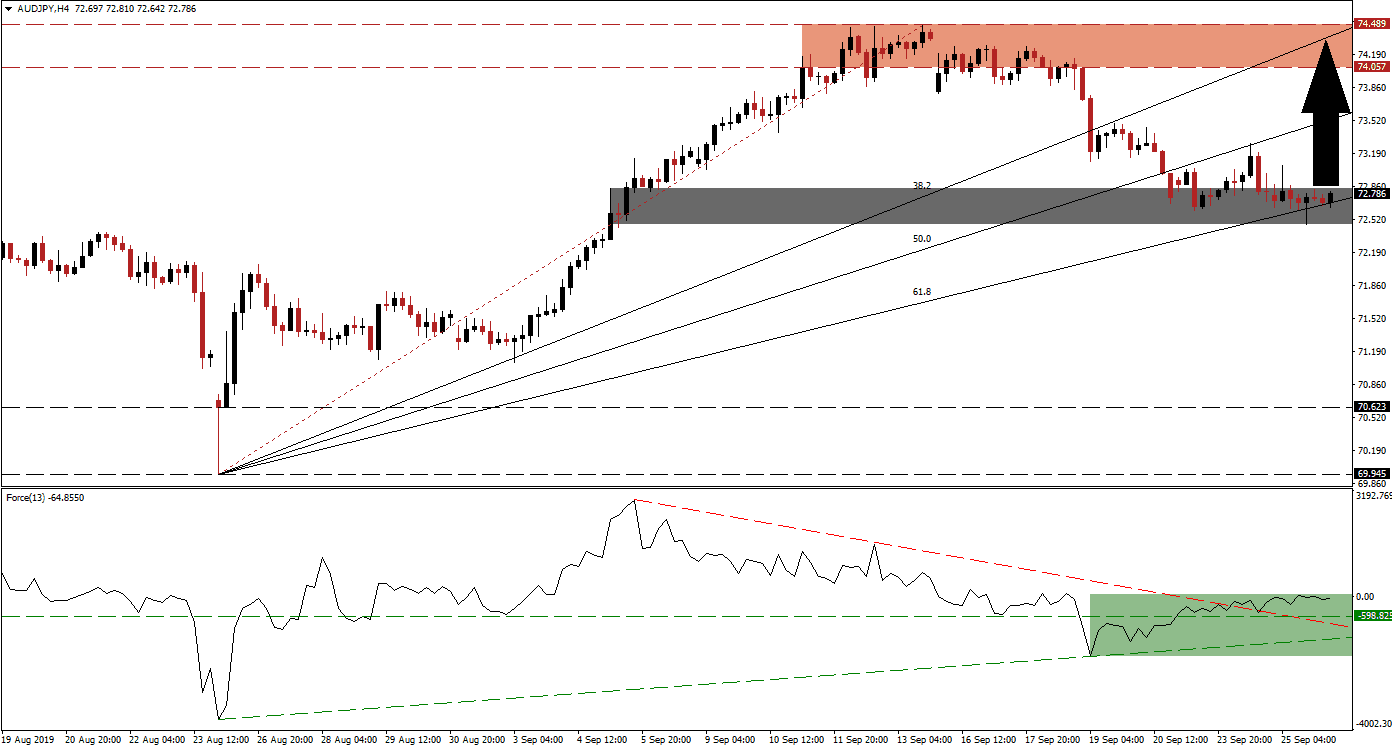

US President Trump suggested that a trade deal with China could be reached sooner than most people expect. While he has been known to make big promises which fail to come to fruition, market sentiment turned more bullish. This lifted the Australian Dollar which is closely tied to Chinese economic performance; the Australian currency is also the preferred proxy currency for forex traders who seek exposure to the Chinese Yuan. Trump’s commentary coincided with the AUD/JPY descending into its 61.8 Fibonacci Retracement Fan Support Level from where selling pressure receded.

The Force Index, a next generation technical indicator, signalled that the sell-off in the AUD/JPY could be coming to an end with the formation of a positive divergence. This technical indicator reached its bottom after price action pushed below its 38.2 Fibonacci Retracement Fan Support Level, turning it into resistance, and started to ascend. At the same time this currency pair extended its contraction. An ascending support level formed and bullish momentum pushed the Force Index above its horizontal resistance level, which turned it into support, as well as above its descending resistance level. This is marked by the green rectangle. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

Lending additional strength to the 61.8 Fibonacci Retracement Fan Support Level is the short-term support zone which is located between 72.471 and 72.834 as marked by the grey rectangle in the chart. The 61.8 Fibonacci Retracement Fan Support Level is currently passing through this zone. The directional momentum in the Force Index should allow the AUD/JPY to recover to the upside. The intra-day high of 73.292 should be monitored, it represents the previous high of a push into its 50.0 Fibonacci Retracement Fan Resistance Level. A move above it is expected to attract new net buy orders and extend the recovery.

As long as the Force Index maintains its position above its ascending support level, bullish momentum is likely to drive the AUD/JPY into a series of breakouts. A recovery into its resistance zone, which is located between 74.057 and 74.489 as marked by the red rectangle, should be considered. In addition, the 38.2 Fibonacci Retracement Fan Resistance Level is passing through the resistance zone. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

AUD/JPY Technical Trading Set-Up - Price Action Recovery Scenario

Long Entry @ 72.750

Take Profit @ 74.450

Stop Loss @ 72.200

Upside Potential: 170 pips

Downside Risk: 55 pips

Risk/Reward Ratio: 3.09

Should the Force Index push below its ascending support level, followed by a breakdown in the AUD/JPY below its 61.8 Fibonacci Retracement Fan Support Level as well as below its short-term support zone, a bigger sell-off may emerge. The next support zone is located between 69.945 and 70.623. The intra-day low of 72.471, the bottom range of its short-term support zone, should be monitored together with the Force Index.

AUD/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 72.100

Take Profit @ 70.650

Stop Loss @ 72.600

Downside Potential: 145 pips

Upside Risk: 50 pips

Risk/Reward Ratio: 2.90