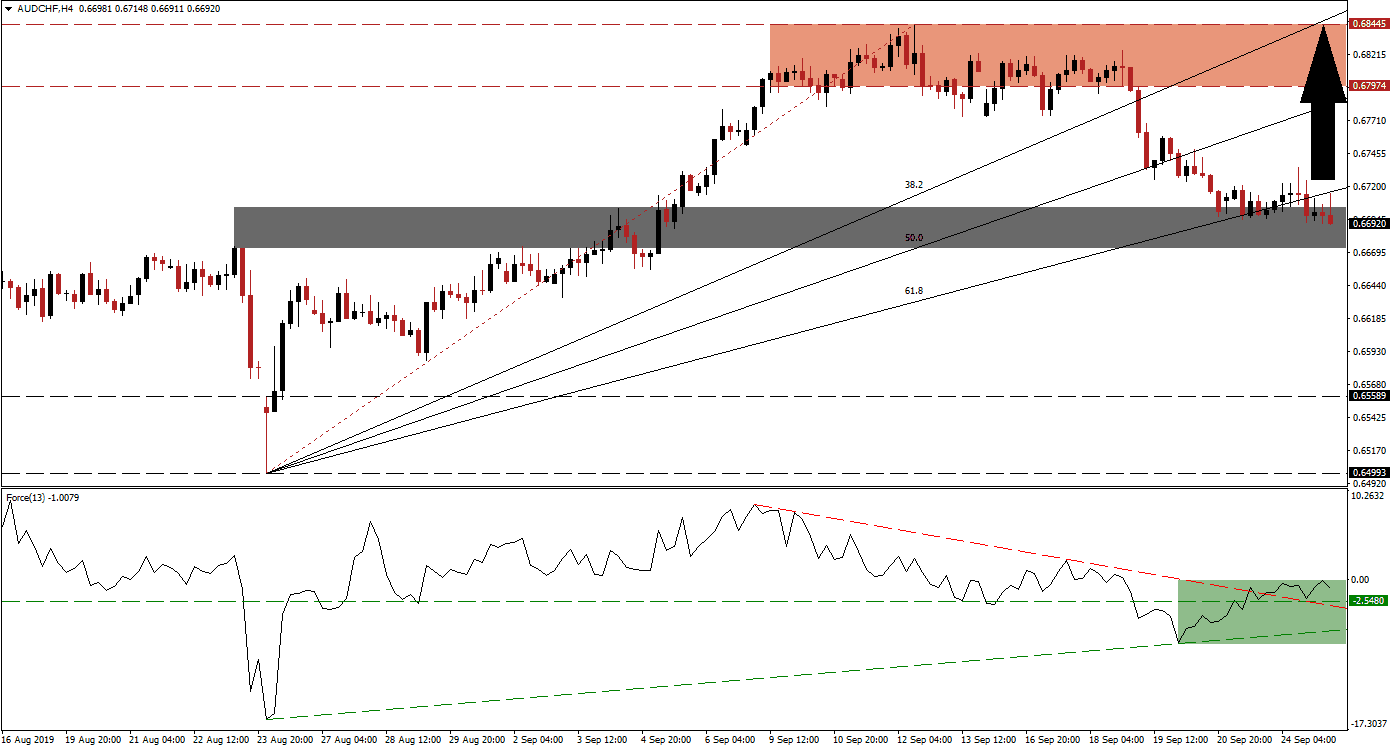

As global uncertainty roes from political issues to economies worries and trade fears, the Swiss Franc attracted safe haven demand as traders adjusted risk profiles. This led to a breakdown in the AUD/CHF over two weeks. A breakdown below its resistance zone initiated a bigger sell-off and price action completed a breakthrough through the entire Fibonacci Retracement Fan sequence which turned it from support to resistance. Selling pressure started to diminish as this currency pair reached its short-term support zone which is located just below its ascending 61.8 Fibonacci Retracement Fan Resistance Level.

The Force Index, a next generation technical indicator, confirmed the loss in bullish momentum and contracted together with the AUD/CHF. After price action pushed below its 50.0 Fibonacci Retracement Fan Support Level, turning it into resistance, this technical indicator started to advance from its lows while this currency pair drifted lower. A positive divergence formed as a result and The Force Index moved above its descending resistance level as well as above its horizontal resistance level, turning them into support which is marked by the green rectangle. This suggests that a breakout in the AUD/CHF may be imminent. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

While the Force Index started to recover, price action remains inside its short-term support zone. This zone is located between 0.66727 and 0.67035 as marked by the grey rectangle in the chart. As long as the Fore Index can maintain its position above the ascending support level, the AUD/CHF is expected to be under a rise in bullish momentum. Following a move above its 61.8 Fibonacci Retracement Fan Resistance Level, the intra-day high of 0.67349 should be monitored. This level marks the most recent high before descending into its support zone and a move higher could result in new net buy order which will push price action further to the upside.T

A breakout above the 0.67349 level, confirmed by the Force Index, can take the AUD/CHF back into its resistance zone for a full retracement of the sell-off. The resistance zone is located between 0.67974 and 0.68445 which is marked by the red rectangle. The 50.0 Fibonacci Retracement Fan Support Level is located just below the resistance zone while the 38.2 Fibonacci Retracement Fan Support Level has crossed above it. Trade developments between the US and China should be followed closely as the Australian Dollar remains the top Chinese Yuan proxy trade due to its deep ties to the Chinese economy and easy availability. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

AUD/CHF Technical Trading Set-Up - Breakout Scenario

Long Entry @ 0.66950

Take Profit @ 0.68250

Stop Loss @ 0.66450

Upside Potential: 130 pips

Downside Risk: 50 pips

Risk/Reward Ratio: 2.60

Should the Force Index reverse to the downside and move below its ascending support level, a breakdown below its short-term support zone is expected to take the AUD/CHF back down into its next long-term support zone. This one is located between 0.64993 and 0.65589. Further downside would require a fundamental catalyst. The current technical picture does favor a breakout from current levels.

AUD/CHF Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 0.66350

Take Profit @ 0.65550

Stop Loss @ 0.66750

Downside Potential: 85 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 2.13