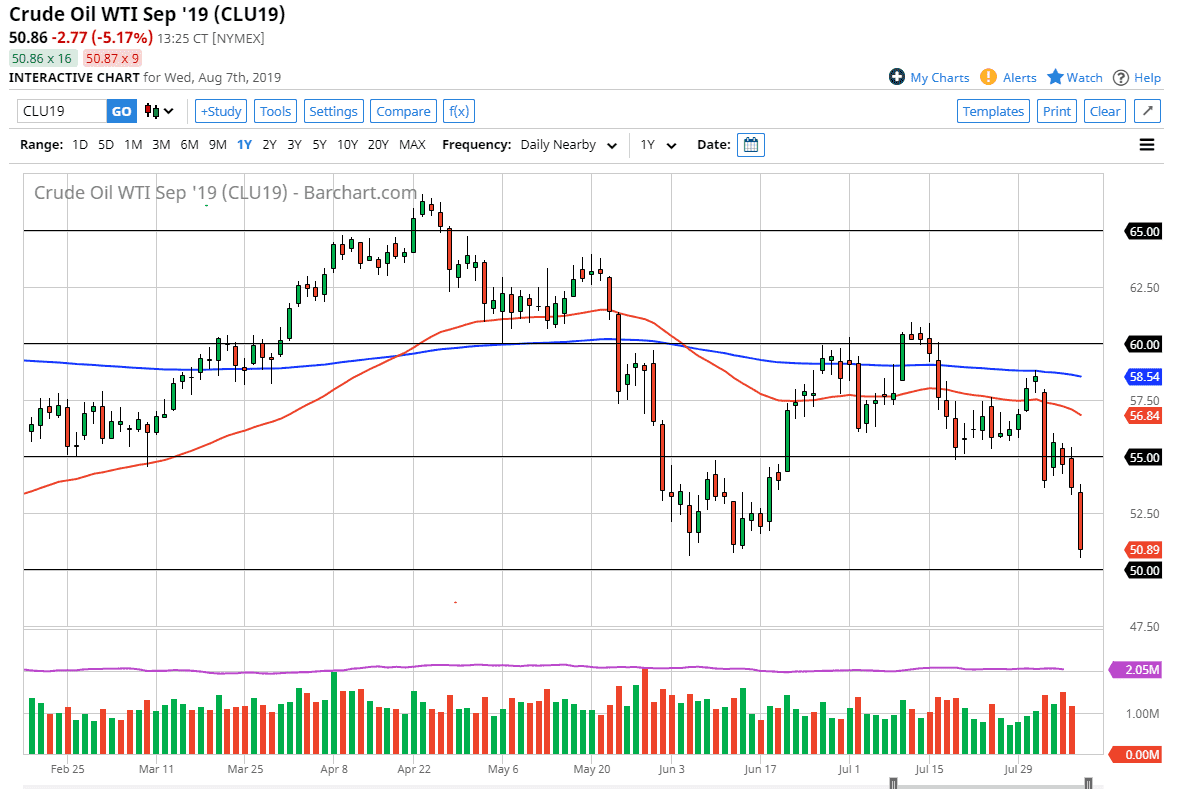

The West Texas Intermediate crude oil markets fell rather hard during the trading session on Wednesday, reaching down towards the $50 handle. As I have stated previously, the market seems to have a “zone of support” extending from the $51 level down to the $50 level. As we have reached that level and bounced a bit during the trading session on Wednesday, showing that this level should offer a bit of support. I believe that the crude oil markets are oversold, but at this point in time it is probably a short-term move at best.

As central banks around the world continue to cut interest rates, it suggests that people are worried about global growth. This will weigh upon the crude oil markets in general, driving demand lower in this market. I think that rallies at this point will continue to sell off, as we are most decidedly in a negative trend and have seen the 50 day EMA starting to drift a little bit lower, and I believe at this point will be paid great attention to as it should cause resistance.

Looking at the size of the candle, which shows that there is a lot of weakness in this market, so I do think that we get a bit of follow-through. I don’t think happens right away though, and the fact that we have bounced a bit during the trading session on Wednesday, we probably will get an opportunity to sell from higher levels. I believe that the $54 level above should be massive resistance, and I’d be looking for an hourly close that looks very weak near that area to start selling again. I believe that the consolidation at the $55 level should continue to offer massive resistance as well.

To the downside, if we closed below the $50 level that would be an extraordinarily negative sign, and therefore could lead to a bit of a panic in this market. All things being equal, I am bearish of this market but I also recognize that the market participants probably need to see a bit of a bounce to get negative. Overall though, I think that the crude oil market will continue to offer plenty of selling opportunities if you are patient enough to wait for those set ups to happen. Currently, I don’t have much in the way of an idea as selling is concerned.