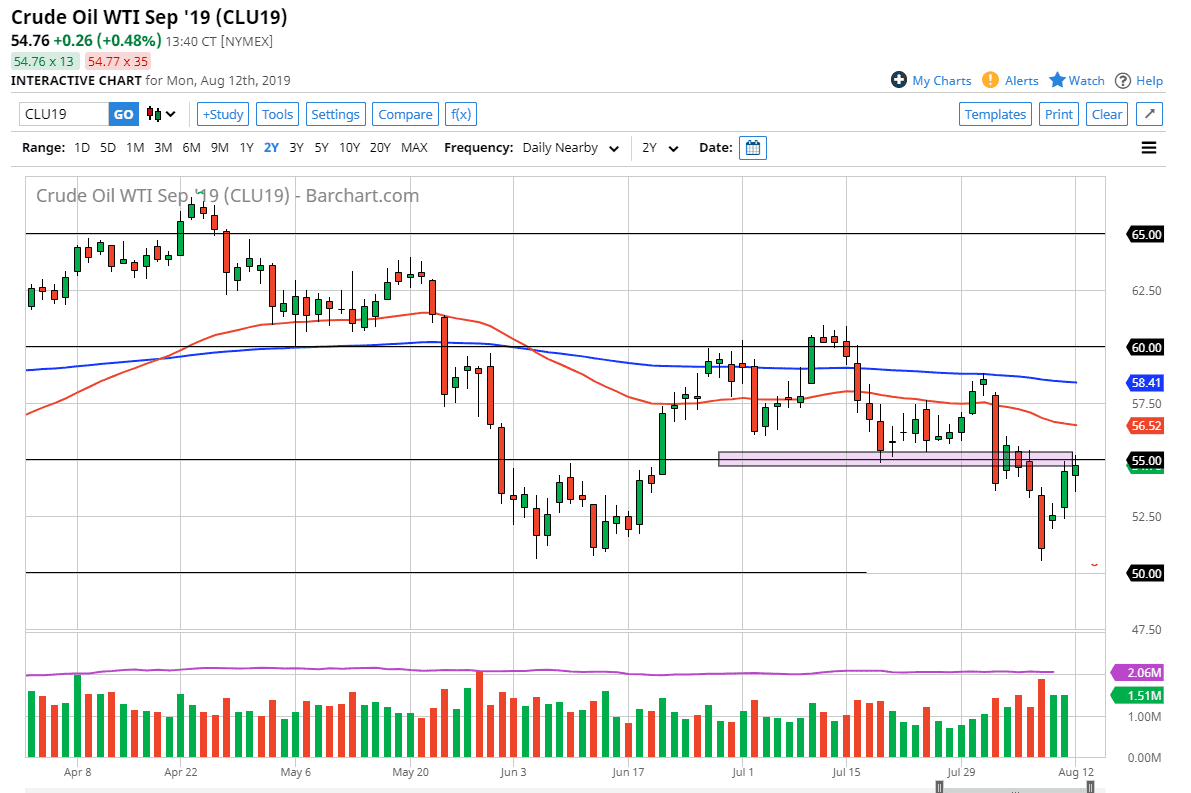

The West Texas Intermediate Crude Oil contract had a choppy session on Monday as traders came back from the weekend. We initially dropped, but then turned around to rally rather significantly, only to pull back from there and show a little bit of confusion. This makes quite a bit of sense considering that we had tested the large, round, psychologically significant figure of $55, which is not only a psychological figure, but it’s an area where we have seen both support and resistance.

If you look back to the early part of last week, you can make an argument for a bearish pennant forming at the $55 level, so it’s likely that there is a lot of order flow there. While the candle stick for the day wasn’t exactly negative, it does show that we are struggling a bit in this overall range, and therefore I think it’s likely that we are going to have to make a rather significant decision soon.

When I look at the crude oil market, I recognize that we have rallied from just above the $50 level, and that of course is something that could be thought of as bullish on the surface, but there are much bigger forces at play here. The first one of course is the fact that global demand for crude oil seems to be slowing as economies are slowing. While you can make an argument for the tensions between the Americans, British, and Iranians driving up price, the reality is that if the global economy is slowing down its going to be difficult to imagine oil picking up any major gains at this point.

Beyond all of that, the 50 day EMA is starting to roll lower, which should show quite a bit of interest and resistance if we were to reach towards that area. Overall, I would find it a bit surprising if we can break above the 50 day EMA, but if it does then the next target would be the 200 day EMA which is pictured in blue. Longer-term, I think we continue to see the crude oil markets soften, because there’s no real demand around the world. That being said, there is a bit of a rally underway, so keep in mind that you should be looking for short-term exhaustion to sell into. Once we get a failure near the $55 level, I’d be short again.