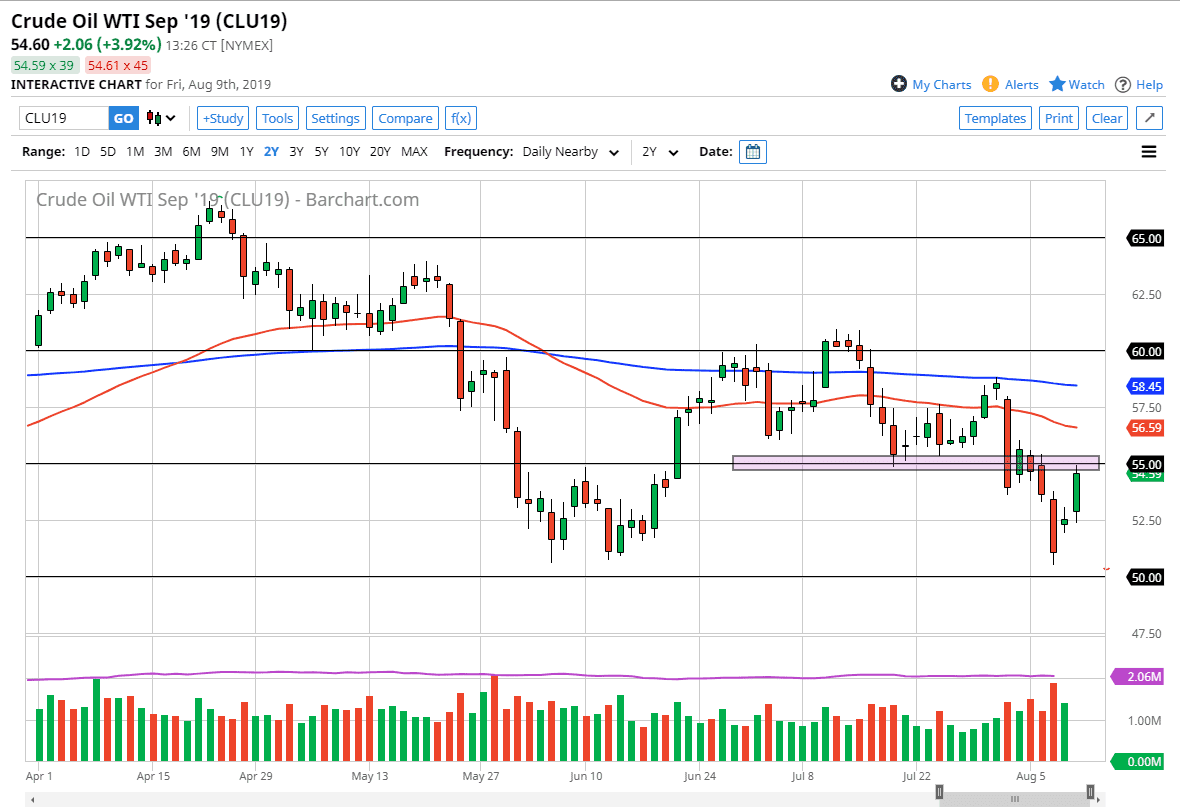

The West Texas Intermediate crude oil market has gapped higher to kick off the trading session on Friday, pulled back a bit, and then shot out from the $52.50 level to slam into the $55 level. I think that’s an area that will continue to cause a bit of trouble though, as it has been consolidation recently. Beyond that, we also have the 50 day EMA moving lower and driving towards that area.

With all of that being said we have to think about the global demand issue, and the issue is that we simply don’t have global demand. Crude oil markets are oversupplied because of the global slowdown and of course the Americans are starting to supply themselves at this point so it all comes down to other areas such as China which is in the midst of a crippling trade war. The likelihood of the Chinese picking up the slack and having enough demand to make up for the Americans is slim to none. Because of this, I’m looking for an opportunity to sell this market and that would be found right here at the $55 region.

I’m looking for some type of short-term exhaustion that I can take advantage of and send this market back down to the $52.50 level. If we break above the $56 level, then we have to think about perhaps shorting closer to the 50 day EMA. Crude oil market simply cannot seem to get out of their own way, and therefore I think that it’s only a matter time before you get an opportunity to start shorting again. I don’t necessarily think that we are going to break below the $50 handle, but certainly we are going to see a lot of noise between now and then.

If we did somehow break down below the $50 level, the market goes down to the $47.50 level. At this point, there’s just simply far too much out there that could cause issues for crude oil to rally. We have US dollar strength, nobody seems to care about the Iranian saber rattling, and of course the lack of economic activity simply doesn’t bode well for this market. As long as there are so many negative situations out there, I think that the crude oil markets will continue to suffer overall. At best, are looking at the $10 range between $50 and $60 above.