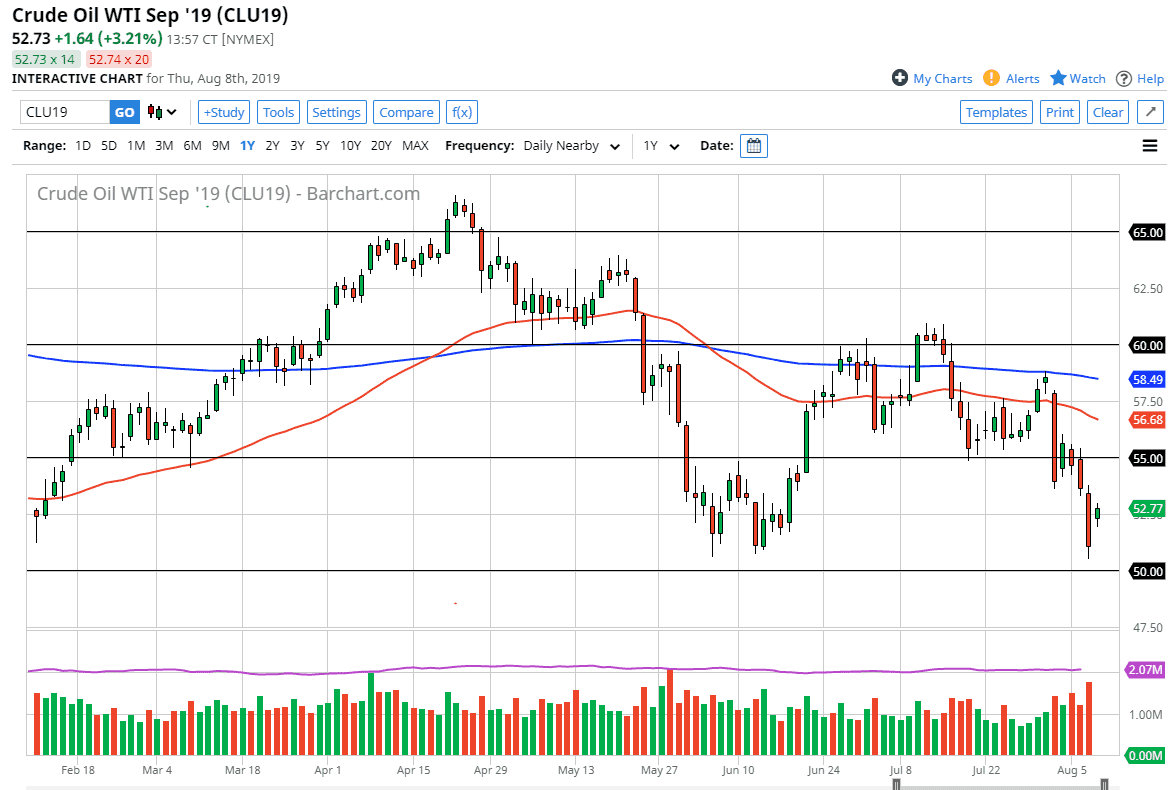

The West Texas Intermediate crude market gapped a bit higher to kick off the trading session on Thursday, breaking above the $52.50 level. This is obviously very bullish sign, but you should also keep in mind that gaps do tend to get filled in the futures markets. So what does this mean going forward? I believe that we are looking at a potential move towards the $54 level above as a target for sellers to jump in.

Looking at this chart, I believe that there is a major resistance barrier above that starts at the $54 level. It extends to the $55 level, so I’m looking for any opportunity to sell in that area. Signs of exhaustion will be jumped on, as I believe that crude oil continues to suffer in general. That being said, short-term rally does make sense because we are a little bit overdone. Beyond that, we have also formed a bit of a “harami” on the charts, which is a bullish sign. But it’s not a trend changing type of situation at this point.

Somewhere in the range mentioned previously, we should get some type of long tail that we can fade. The shooting star, something along the lines of that perhaps even on an hourly chart. That being the case, it should give us an opportunity to reach down towards the $51 level below, which extends down to the $50 level. Ultimately, that is an area that should be massive support, so if we were to break down below the $50 level, then we could break down significantly and go looking towards the $45 level. All things being equal, there just is not enough demand out there to drive the value of crude oil. If you don’t believe me, simply think about all of the things that should be driving oil higher. The very least of which is the situation in Venezuela, it of course the tensions between the Iranians and just about everybody else on the planet. All of these things should be driving crude oil higher if there was significant demand, but we don’t have enough demand to overcome the selling pressure. In this type of situation, it’s difficult to imagine that it should be worth buying. All things being equal be looking for signs of exhaustion to take advantage of in a market that has clearly shown itself to be soft.