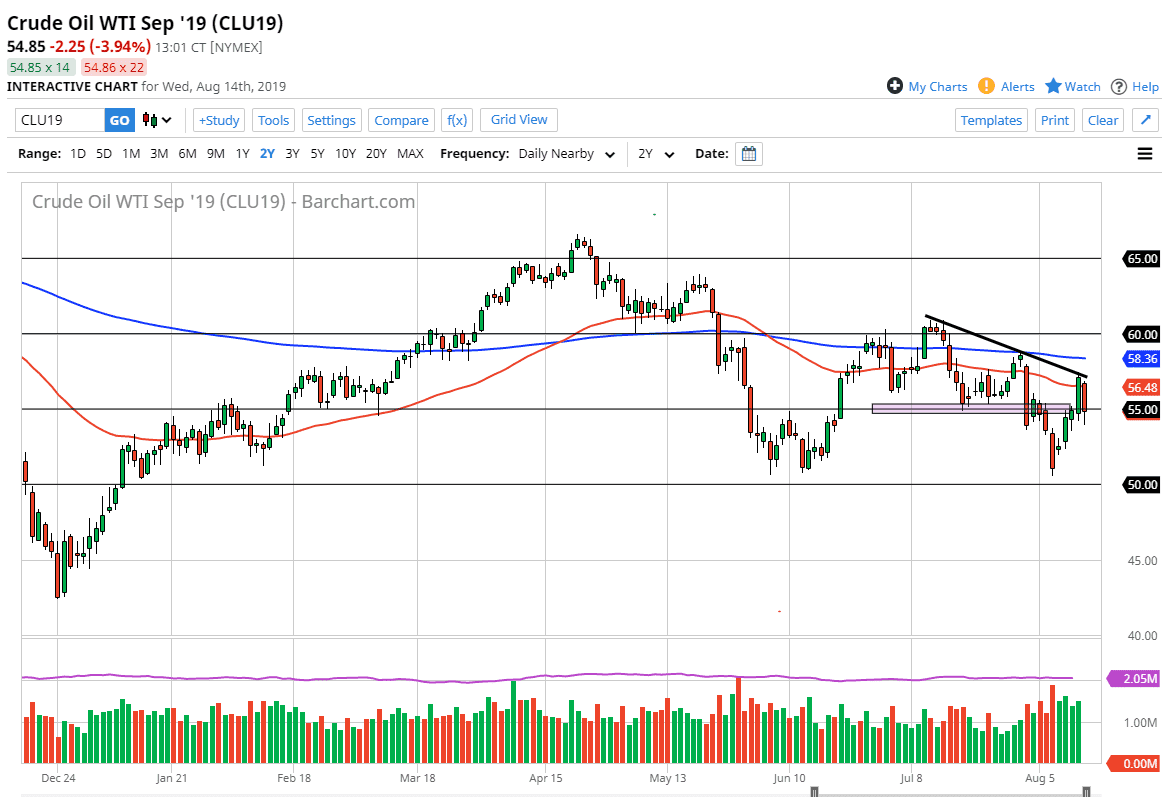

The WTI Crude Oil market broke down significantly during the trading session on Wednesday as we continue to see a lack of demand globally. Now that we have broken below the $55 level I would assume that we have wiped out a lot of stop losses. However, we have seen the market turn back around and show signs of resiliency. At this point though, the market should continue to find sellers due to the fact that the markets are starting to come to grips with the idea of slowing global growth. With this being the case, I think it makes quite a bit of sense that oil should also fall.

The US dollar has been strengthening in general, not only due to bond purchases, but the fact that so many other parts around the world are struggling. If that’s going to be the case, I suspect that the market probably continues to go lower because of that as well. I think at this point the market will probably go looking towards the $51 level underneath which is the beginning of significant support extending down to the $50 level. Overall, you can see that we had formed a downtrend line that kicked off during the trading session, just as the 50 day EMA has offered resistance.

Above the 50 day EMA and the downtrend line, we have the 200 day EMA pictured in blue as well. With both of these moving averages going sideways with a slightly lower tilt, it makes sense that we should continue to see the longer-term traders come in and push lower. I don’t know if we can break down below the $50 handle, but it is obvious to me that we have seen a lot of negative pressure lately, and it should be an opportunity to sell rallies going forward. If we did break above the 200 day EMA, it could be a very bullish sign, perhaps reaching towards the $60 level.

Looking at this chart, I think you are probably better off shorting this market on short-term charts. At this point, the market seems very unlikely to continue any type of move to the upside for any real length of time. I think you simply look for short-term exhaustion, and pounce upon it as it has worked more than once in the recent past. With recession looming relatively soon, it makes sense we continue to see selling.