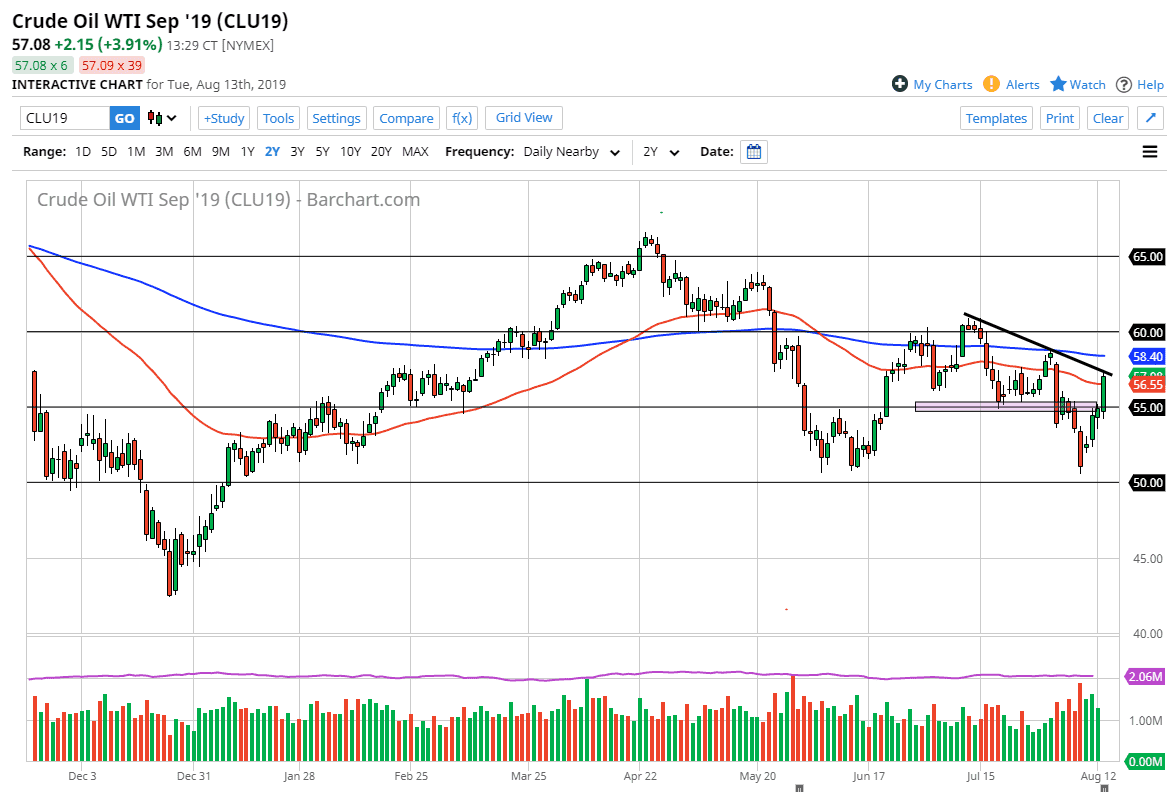

The WTI Crude Oil market has rallied a bit during the trading session on Tuesday to reach above the 50 day EMA. I have drawn a negative trend line at this point, and you can see that we have respected it so far. At this point, even though we have a strong candle stick for the trading session on Tuesday, the reality is we did not break out.

Keep in mind that a lot of what we have seen has been due to the idea of the US delaying tariffs against the Chinese, it had traders out there looking for a “risk on” position. That doesn’t necessarily mean anything is changed, and as a result I think this will actually end up being a nice selling opportunity. We obviously will have to wait to see how this plays out but one thing that I do know is that several hours have gone by since we tested the downtrend line, and the market has stabilized. It’s a strong indecent close, but there are still plenty of things that can go wrong.

If we do break above the downtrend line, then we will probably test the 200 day EMA above which is pictured on the chart in blue. That is at roughly $58.40, and a break above there opens up the door to the $60 handle. I think it makes sense that we pull back in the short term though, because people are already starting to discuss whether or not anything is change. Nothing has changed other than the idea of United States and China talking over the next couple of weeks. We have seen this happen before, which of course didn’t work out. At this point I suspect that more of a “risk off” attitude could creep in the market as once the dust settles people will begin to focus on the fact that we still are light years away from the trade deal.

If the US dollar rallies, that could also put downward pressure on this market, so I think there are far too many bad things out there just waiting to happen for crude oil to get bullish at this point. I will probably need to focus on short-term charts for signs of exhaustion to take advantage of. The short-term traders will continue to jump in and take advantage of these overextended moves.