The West Texas Intermediate crude oil market initially fell during the trading session on Tuesday, as we continued to see a lot of volatility when it comes to the energy markets. This makes quite a bit of sense considering that the global growth situation remains murky at best, and of course we have a lot of currency headwinds out there that continue to work against petroleum as well.

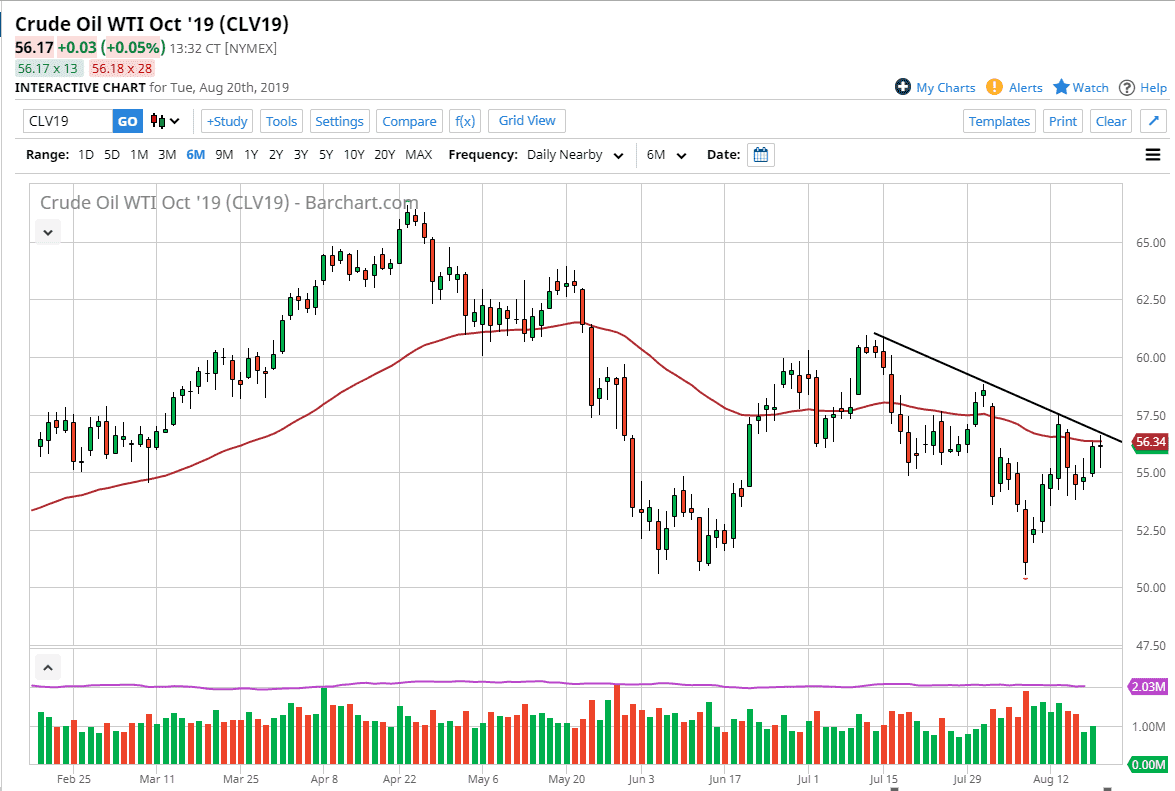

Looking at this chart, you can clearly see that there is a downtrend line that we are trying to press through, but still have not managed to do so. The 50-day EMA is slicing through the candlestick for the day, so at this point I think you have to look at this as essentially a “binary trade.” What I mean by this is that if we can break above the top of the candle stick, then you should be a buyer. If we can get a daily close above the top of the candle stick it would also clear the downtrend line, and I think at that point we may go looking towards the $60 level over the longer-term. That doesn’t mean that it will be easy, just that this would be the longer-term target.

On the other hand, if we were to rollover and break down through the bottom of the candlestick meaning that we clear the $55 level, that would turn this hammer-like candle stick into a “hanging man”, which of course is very negative. I think at this point you will see either one or the other happen rather soon, and the easiest thing will be to simply follow whatever comes next. Ultimately, this is a market the traders out there I speak to have had a lot of trouble with, just simply because it has been so noisy.

There are concerns about global growth, whether Saudi Arabia and Russia can cut production, and of course by extension the lack of global growth, the lack of global demand. We also have the US/China trade situation deteriorating, and that should continue to weigh upon the Chinese economy, as it is so heavily dependent on exports. That same economy is the largest consumer of crude oil in the world, so that of course works against the value here as well. Quite frankly, we have more than enough of crude oil out there to keep this market afloat.