Gold markets gapped higher to kick off the trading session on Friday, dipped a bit to try to fill that gap, and then shot straight up in the air. There is a lot of concern out there and that should continue to favor gold, so therefore the fact that we ended up forming this candlestick isn’t much of a surprise. We tested the highs, but then pulled back at the end of the day. I think that people probably didn’t want to put a lot of risk into the market heading into the weekend.

Ultimately, this is a market that has been bullish for some time and it now looks as if it is really start to try to take off to the upside. Gold markets of course are reacting to a lot of fear around the world when it comes to Donald Trump and the Chinese, as well as global trade slowing down. With all of that being said, the fact that the central banks around the world are cutting interest rates also supports hard money such as gold and silver.

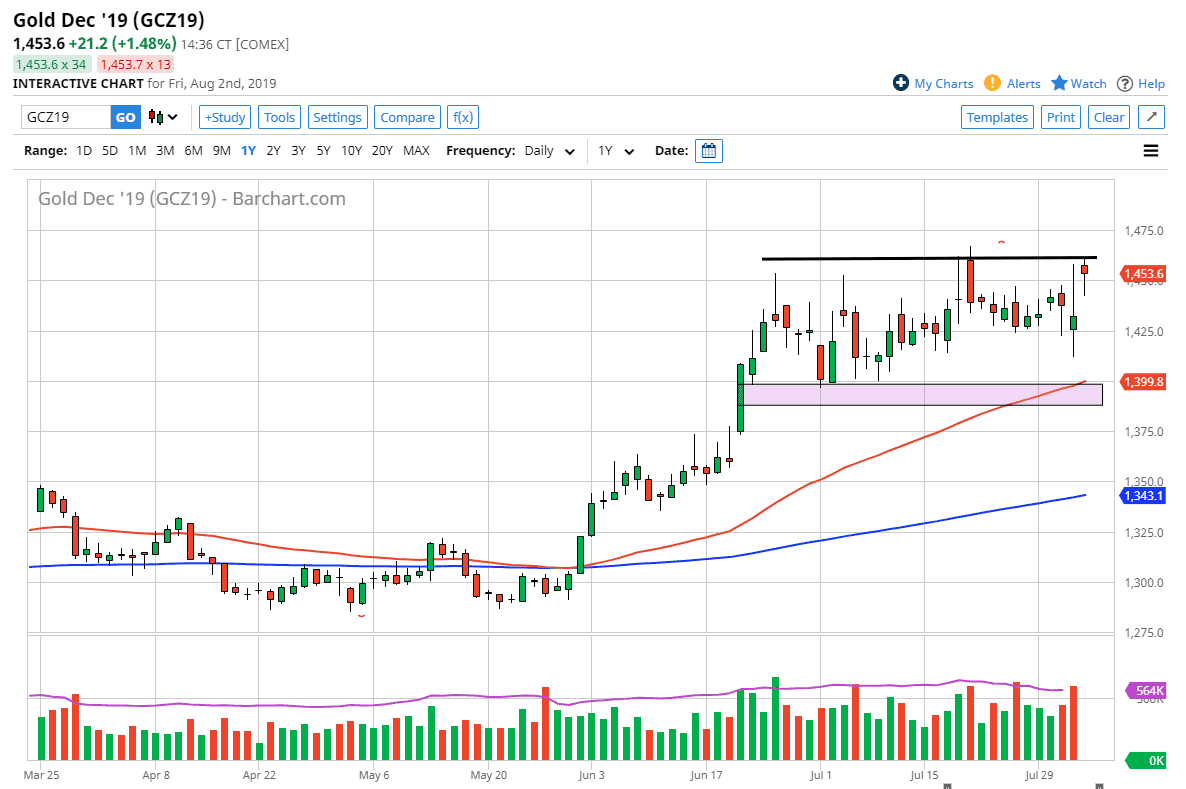

All things being equal I look for value in this market and have been looking for value for some time. I believe that this market as a bit of a hard “floor” in the region of $1400, which is the scene of significant support and of course the 50 day EMA. That being said, the 50 day EMA still continues to go higher, and at this point I think that we will continue to see that indicator offer a certain amount of support as it tends to. If we break down below the $1390 level, then the market probably could break down rather significantly towards the $1350 level. Having said that, I believe that the break down is the least likely of the scenarios, and I do think that more than likely there is more than enough fear out there to keep gold going higher.

Once we break above the recent highs, then I think the market goes looking towards the $1500 level, an area that will cause a certain amount of psychological importance. Ultimately, I think the sellers will push the market back down at that level but once we clear the $1500 level, it’s very likely that we go looking towards much higher levels and becomes more of a “buy-and-hold” scenario.