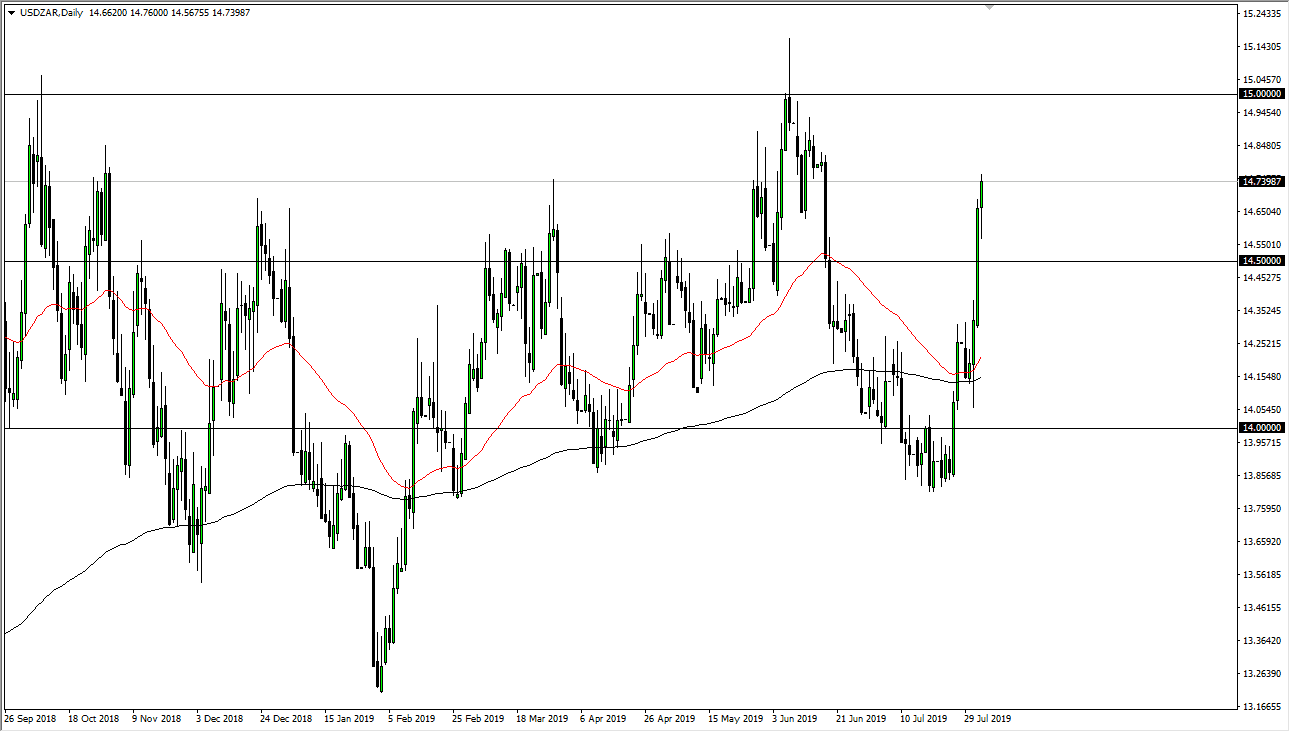

The US dollar has rallied again during the trading session on Friday, after initially pulling back. By doing so, it looks as if we are ready to take on a major resistance barrier above. The 15 Rand level will of course attract a lot of attention as it was not only the most recent high, but it is also a large, round, psychologically significant figure. Looking at this chart, it’s obvious that the market has gone a bit parabolic, so a pullback wouldn’t be a huge surprise, but keep in mind that this pair moves on a lot of different fundamentals.

Without a doubt, one of the most important things that you need to pay attention to when trading this pair is whether or not the market is in a “risk on” or “risk off” type of attitude. As we have seen massive damage done to stock markets around the world it makes sense that the US dollar will rally against such exotic currencies of the South African Rand.

As money starts looking for safety, it will look towards US treasuries. At this point, the market looks as if it is favoring the greenback, and the treasury market. Money runs away from places such as South Africa because obviously it’s a little bit more risk year. Beyond that, the South African economy is heavily dependent on commodities, so it would make sense that we see this market rally as commodities have taken quite a bit of a hit. All things being equal, this is a market that struggles in times as which we have seen recently.

The massive candle stick from the Thursday session was very impressive, and it looks like we are simply going to look for some type of continuation. However, if we pull back from here I think that the 14.50 Rand level will probably be the first support level underneath. The 15 Rand level above will be major resistance but if we can break above there then we could really start to take off to the upside. This would probably coincide with some type of financial meltdown, which at this time it looks like we could have that happen but the little bit help. To the downside, I believe that the 14 Rand level will be the “floor” of this market. I’m a buyer on dips, looking for value.