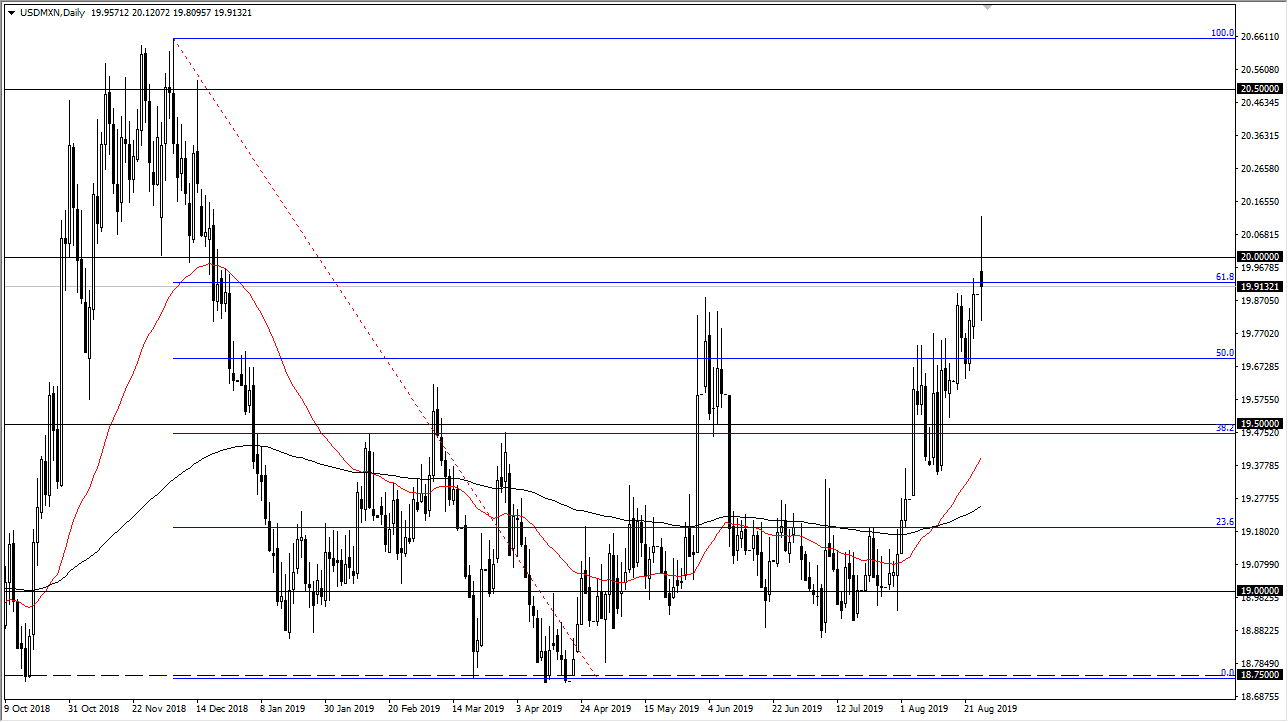

The US dollar shot higher during early trading on Monday, as we broke above the 20 MXN level. The Mexican peso, and all other emerging market currencies got absolutely hammered right out of the gate as a huge “risk off” move came into the marketplace. That being the case, we have broken above a large, round, psychologically significant figure, and that of course would attract a lot of attention. Beyond that, we are also at the 61.8% Fibonacci retracement level, so that of course will attract a certain amount of attention by itself.

Looking at the candlestick you can see that we are definitely all over the place and showing signs of exhaustion so it’s possible that we get a significant pullback from here. The 61.8% Fibonacci retracement level will often attract sellers on these types of pullbacks, but will we need to see risk appetite come back into the marketplace in order for emerging market currencies to pick up like the Mexican peso. This wasn’t so much a Mexican issue as it was just money trying to find safety.

The Americans added more tariffs against the Chinese after the markets closed, so this was the first opportunity traders had to react, and the US dollar picked up against most other currencies with perhaps the exception of the Japanese yen. However, it seems that risk enter the market relatively quick once the headlines cross that perhaps the Americans and the Chinese were going to continue speaking. With that, the 61.8% Fibonacci retracement level and perhaps most importantly the candlestick shape, I think that this market is very likely to pull back and go looking towards the 19.70 pesos level in the short term. I don’t know that I’m willing to put a lot of money in the opposite direction as we are little bit overbought. However, keep in mind that any “risk off” move will certainly push this market higher.