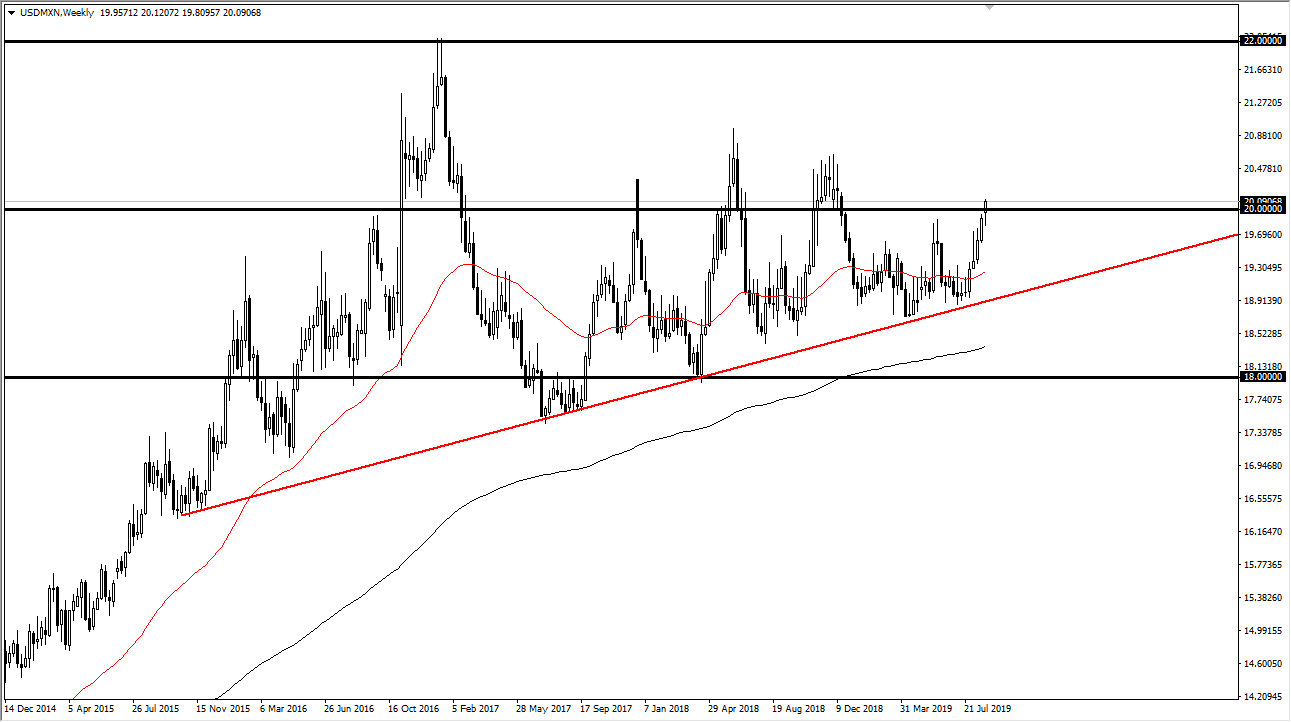

The US dollar has rallied quite significantly against the Mexican peso for some time and looking at the weekly chart you can see that we have been grinding higher for a couple of years. This shows just how dire the situation is starting to get in the emerging markets, and it’s likely that the carnage will continue. That being said, we are approaching a rather significant level in the USD/MXN pair, just above the 20 MXN handle.

All things being equal, as long as we can continue to see this trendline hold and the moving averages till higher, I think that the pair should continue to show strength. Remember, the Mexican peso is an emerging market currency, and of course the gateway to Latin America. Under the current regime of trade tensions, it makes sense that emerging markets continue to suffer. I think that the US dollar will continue to attract a lot of inflow, if no other reason than for the Treasury market.

The month of September could present a couple of opportunities, but you should look at this as a “buy on the dips” type of scenario. Trade tensions are likely to get worse, not better and of course the global growth continues to slow down. That slowing global growth will continue to work against the value of not only the Mexican peso, but other exotic currencies that I follow here at Daily Forex such as the South African Rand.

Longer-term, I anticipate that by the end of the year we could see the Mexican peso trading at the 22 handle, but obviously it’s going to take some work. If we did see a sudden burst higher in risk appetite, that could send this market lower, but I don’t think we will get that opportunity in September. If we break down below the 19 MXN level though, it’s likely that we will go looking towards the 18 MXN level. I currently assess that possibility at about 10% this month. I do think that there is a very high likelihood of that pullback, and I suspect somewhere near the 19.50 MXN level will cause enough support to form the next bounce. Alternately, we simply slice through the 20.50 MXN level and go reaching towards 22 MXN. Expect volatility but that’s nothing new in this pair. Simply look to the longer-term charts for the directionality that you need. We are a little overdone over the last month or so, but that will be rectified and the trend should continue.