Investors continue to buy safe havens amid increasing global trade and geopolitical tensions, which will favor continued downward pressure on USD / JPY. The pair is stable around 106.20 support at time of writing and attempted to rebound yesterday to reach 107.08 resistance from 105.51 support level, the lowest in seven months. The Japanese yen has recently been catalyzed by China's devaluation of the Yuan to below $ 7 for the first time in 10 years. China's move was followed by the U.S accusing China of manipulating the currency and that they seek to drag the U.S into a currency war in retaliation for the continued imposition of US tariffs on imports from China, with near imposing of tariffs on all U.S imports from there. A weaker Yuan means weak US competitiveness in world markets in the face of cheaper Chinese exports. The US dollar is currently at its highest levels against other major currencies.

The US Federal Reserve may face direct criticism from Trump after China's move. The Fed usually ignores Trump's criticism, as after they cut US interest rates for the first time in 10 years last week, they did not confirm this as a monetary policy shift towards more rate cuts and insisted that what happened was only an update to the policy cycle. The shift in monetary policy will depend on future economic developments.

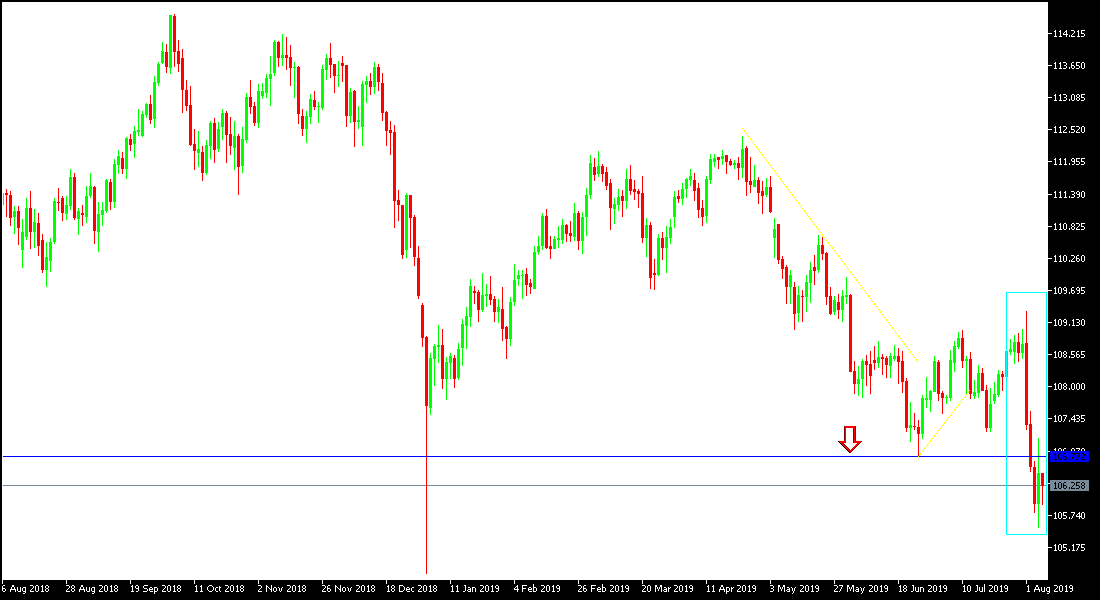

Technically: USD / JPY price performance, with weak bullish correction, will remain strongly bearish, especially with the return of stability below 106 support, which may support the move towards the support levels at 105.50, 104.80 and 104.00 respectively. At the same time, these levels of support attract the attention of investors to think about the return to buy the pair, as all technical indicators have reached oversold areas. In case of a bullish correction, the nearest resistance levels are 106.75, 107.30 and 108.00, respectively. As we have confirmed in recent technical analysis, the opportunity for a correction upward will not be strong without the pair moving towards the 110 psychological top, otherwise the downside will remain stronger.

On economic data today: The economic calendar has no important data today, whether from the United States or Japan.