Ahead of the release of important US consumer confidence figures, USD / JPY remains unable to avoid losses. The bearish price explosion earlier this week was anticipated in our latest technical analysis. The pair fell to 104.44 support, the 32-month low, before resuming fast to 106.41 resistance after Trump signaled the possibility of negotiation and postponement of tariffs, but with the return of markets and investors’ doubts in the Trump maneuver, the pair returned to move down to 105.60support at the time of writing. Both sides of the world trade war have often pointed to the possibility of negotiation and solution, and eventually tariffs are applied on each other's products.

The US dollar did not benefit from comments by Federal Reserve Governor Jerome Powell at the Jackson Hole, in which he affirmed the bank's adherence to monitoring economic developments and external risks to determine appropriate monetary policy, ignoring Trump's recent criticism and his demand for US interest rate cuts. Earlier, the minutes of the latest meeting of the US central bank showed a split among members of the bank's policy on the timing and amount of interest rate cuts, some of whom demanded no cut at the moment as the country's economic performance remains good.

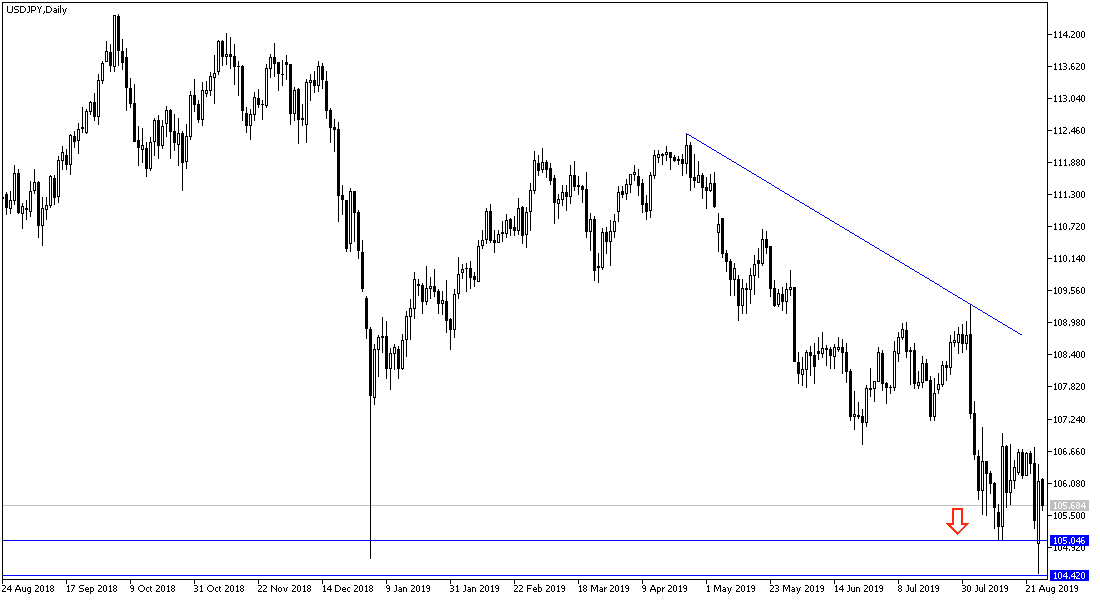

According to the technical analysis, the bearish trend for USD / JPY will strengthen if the pair moves around and below the 105.00 psychological support level, and then we will see new support levels, and currently the closest support levels for the pair are 105.35, 104.80 and 103.65 respectively. On the upside, the nearest resistance levels are 106.25, 107.00 and 107.85 respectively. Technical indicators have reached strong oversold areas, but global trade and geopolitical tensions continue to support investors buying the Japanese yen as a safe haven.

As for today's economic data, Japan's Producer Price Index (PPI) was released earlier in the day, showing stronger than expected drop, followed by the Bank of Japan's Consumer Price Index (CPI), which remained unchanged as expected. The pair will be awaiting the release of US consumer confidence and the Richmond Manufacturing Index.