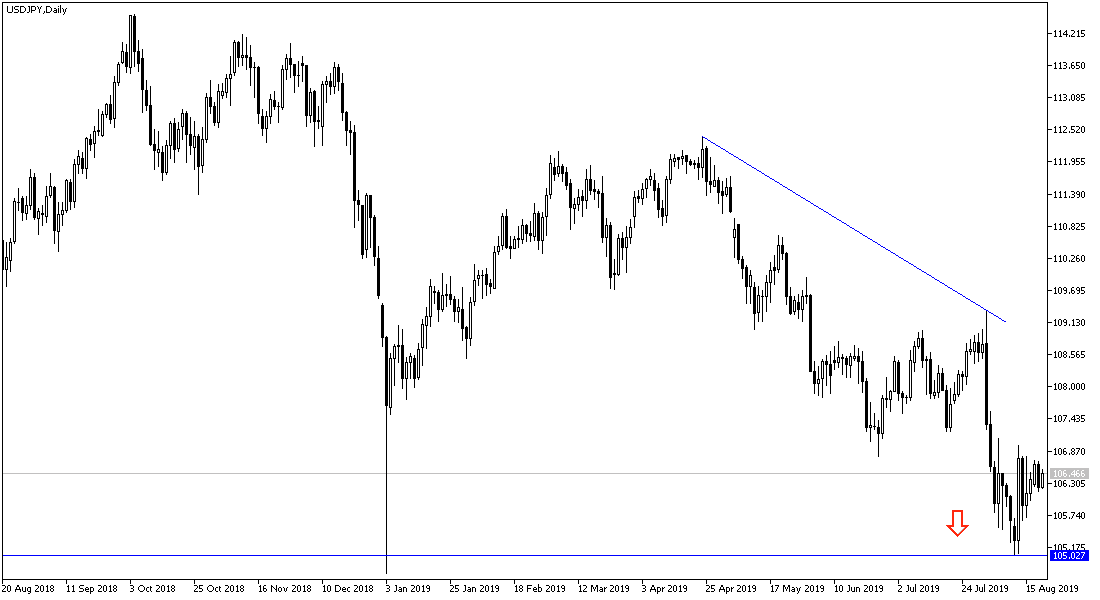

On the daily chart, it appears that the USD/JPY is stabilizing in tight ranges for several sessions between the 105.70 support level and the 106.68 resistance level before settling around 106.40 at the time of writing, and before the release of the last Fed minutes of the meeting. At the meeting, the bank cut the US interest rate by a quarter-point in the first move to cut the rate in 10 years. This week trump's trade wars toward world economies, particularly with China, have negatively affected global economic growth and may force global central banks to ease monetary policy by cutting interest rates.

The global outlook has increased recently that the US economy is on its way to recession, especially if the global trade war continues, which was rejected by the White House and President Trump as he pointed to the record of American jobs numbers and the American citizens saving more money after the huge tax cuts approved by Trump to revive the American economy. Federal Reserve Governor Jerome Powell will make important remarks at the Jackson Hole symposium, which is organized by the Fed and attended by officials from other global central banks. Investors and financial markets are willing to concentrate on Powell's comments to predict the future of the bank's monetary policy as Trump and other global central bankers continue to attack monetary easing.

According to the technical analysis: So far, no reversal of the general trend of USD/JPY has been confirmed. As the price is moving within a bearish channel, it will be stronger in case the pair returned to move around and below the 105.00 psychological support. The 100 SMA remains below the 200 SMA in the long term to confirm that the trend is down strongly. The RSI is bullish and has a bullish run before reaching overbought territory, so bulls can stay in control of the pair's performance for a bit longer. The nearest resistance levels are currently at 107.10, 108.00 and 108.85 and the trend will not strengthen without the pair moving towards the 110.00 psychological resistance level. The global economic situation supports investors' appetite for safe havens and the Japanese yen is the most important one.

On the economic front today, there is no significant economic data out of Japan. US data will focus on existing home sales and the contents of the minutes of the last Fed meeting.