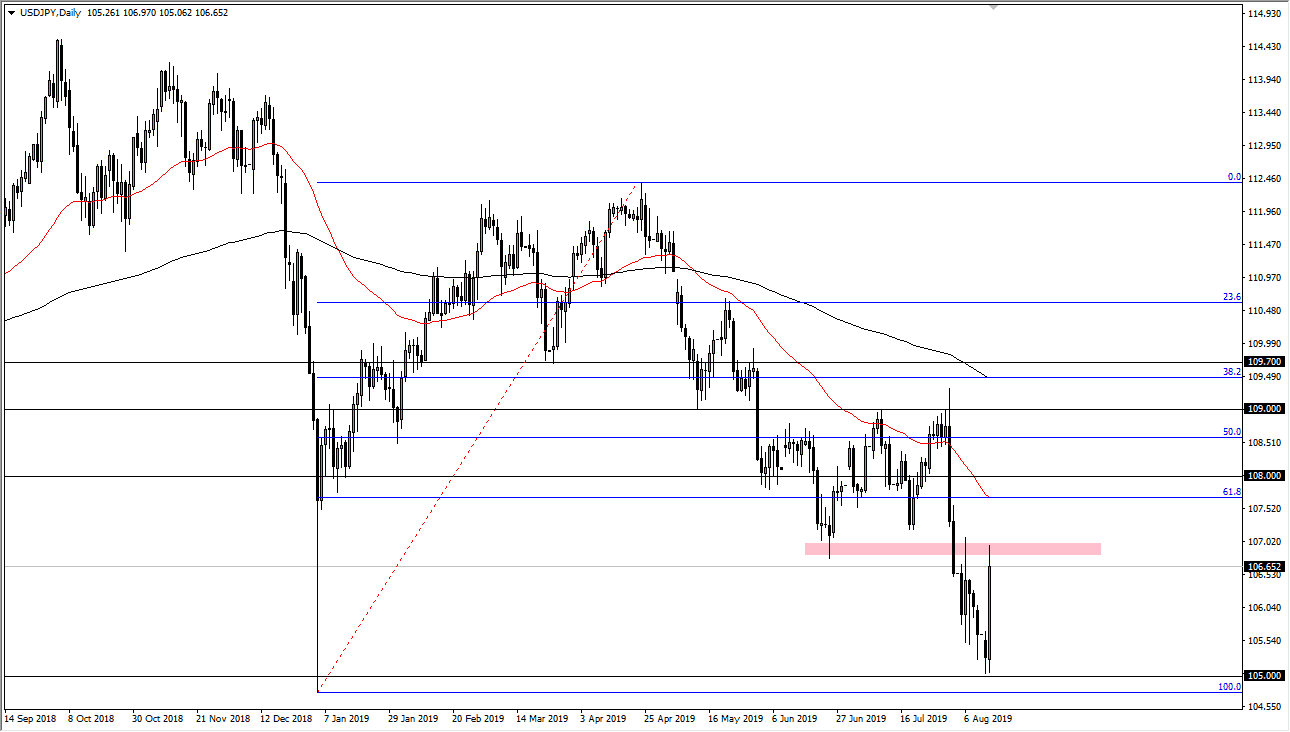

The US dollar has rallied rather significantly during the trading session on Tuesday, bouncing from the crucial ¥105 level. At this point, the market is starting to test a significant resistance area in the form of ¥107. That’s an area that has been resistance more than once, and therefore the fact that we have pulled back late in the day doesn’t overly surprise me. I look at this chart as one that is a bit overdone, mainly because it is based upon a quick announcement that doesn’t change much.

What I mean by that is that the United States is delaying tariffs against the Chinese, but it should also be noted that nothing is change longer term, as the United States dollar rallies against the Japanese yen in good times and falls against it in bad times. The stock market tends to lead this market as well, so I think it’s only a matter time before we roll right back over, because the S&P 500 did not take off to the upside and keep most of the gains.

We are only one tweet away from negativity, or perhaps a press release out of Beijing. With that in mind, I think we are going to have a selling opportunity rather soon. Beyond that we have a lot of negativity around the 50 day EMA which is painted in red on the chart. I think there is a lot of noise between ¥107 and ¥108, so at the first signs of exhaustion I’m more than comfortable to start selling. The ¥105 level underneath will be massive support and a target that people will continue to look towards. Even though we have had good news on the US/China trade front during the trading session on Tuesday, it still wasn’t any concrete plan. We’ve seen this before, and it failed as well.

If we were to break down below the ¥105 level, then the market probably goes down to the ¥102.50 level, or perhaps even the ¥100 level. I don’t really have a scenario where I’m willing to buy this pair, lease not at this point. All things being equal, I’m looking for signs of exhaustion to take advantage of “value” in the Japanese yen as we have a lot of potential negativity out there that could turn this whole thing right back around. Look for short-term exhaustion to take advantage of.