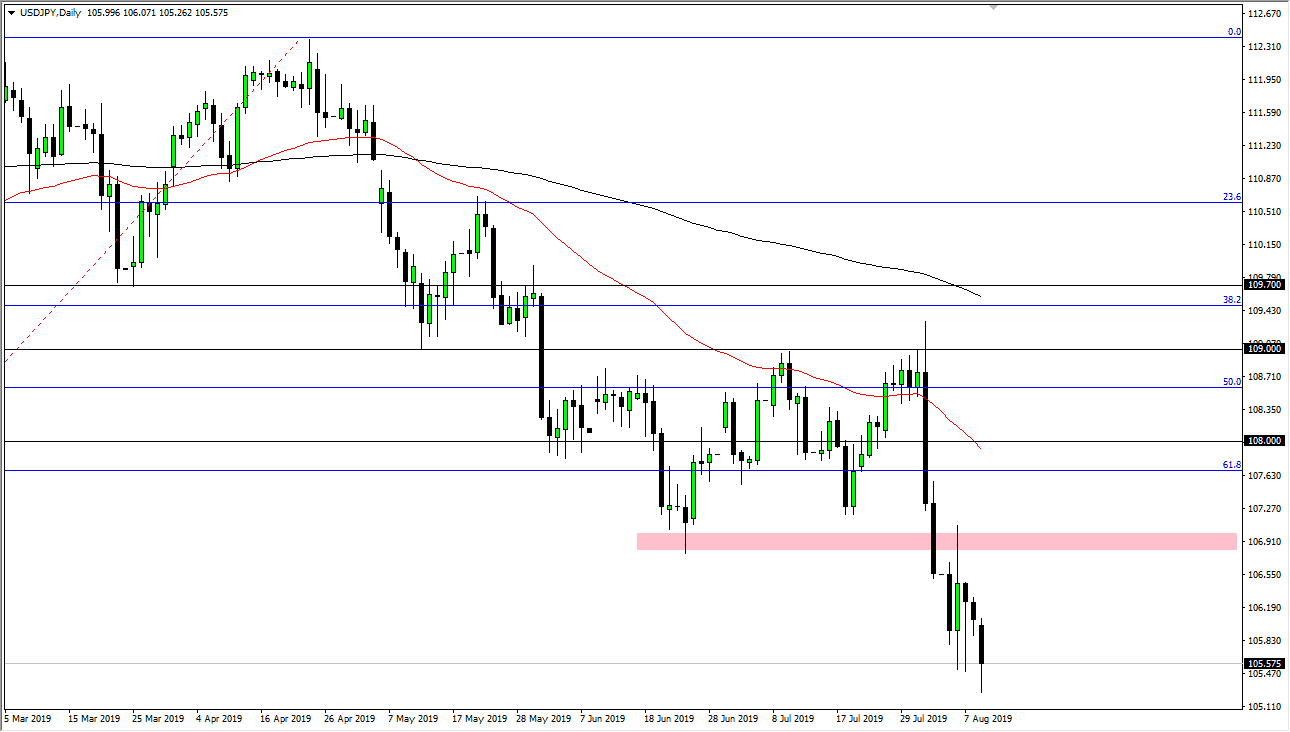

The US dollar fell a bit during the trading session on Friday, reaching down below the ¥105.50 level. We are still above the ¥105 level, so I think the bottom hasn’t been found quite yet. We did bounce a little bit during the latter part of Friday, but that was probably position squaring ahead of the weekend more than anything else.

Remember, this is a pair that is highly sensitive to risk appetite in general, as the Japanese yen is a safety currency. With that being the case it makes quite a bit of sense that it has gained in this environment. I believe that the market will continue to look to the Japanese yen for safety, and although the US dollar has been very strong against most currencies, the fact that it hasn’t been against the Japanese yen shows just how much concern there is out there. This means that the Japanese yen will probably be one of the stronger currencies in the FX world, followed by the Swiss franc in the US dollar.

The market rigging below the ¥105 level is a real possibility but we need to see some type of major “risk off event” going forward. If and when that happens, then we will probably go looking towards the ¥102.50 level, and then possibly even the ¥100 level. At that point, I believe that the Bank of Japan could get involved as they won’t hesitate to intervene when the Japanese yen gets a bit too strong. I am getting ahead of myself at this point though, as it’s more of a longer-term thing.

In the short term, I like fading rallies as the best trade in this pair. Ultimately, this is a pair that has a significant amount of resistance at the ¥107 level, so if we were to break above there then I think we would go looking towards the ¥108 region, or perhaps even the 50 day EMA which is painted in red on the chart. I’m looking to fade this market on signs of exhaustion, and not willing to buy as I think there continues to be a lot of uncertainty out there. If we were to break above the ¥180 level, then this market could pick up steam but that seems very unlikely at this point as we are well below the 61.8% Fibonacci retracement level.