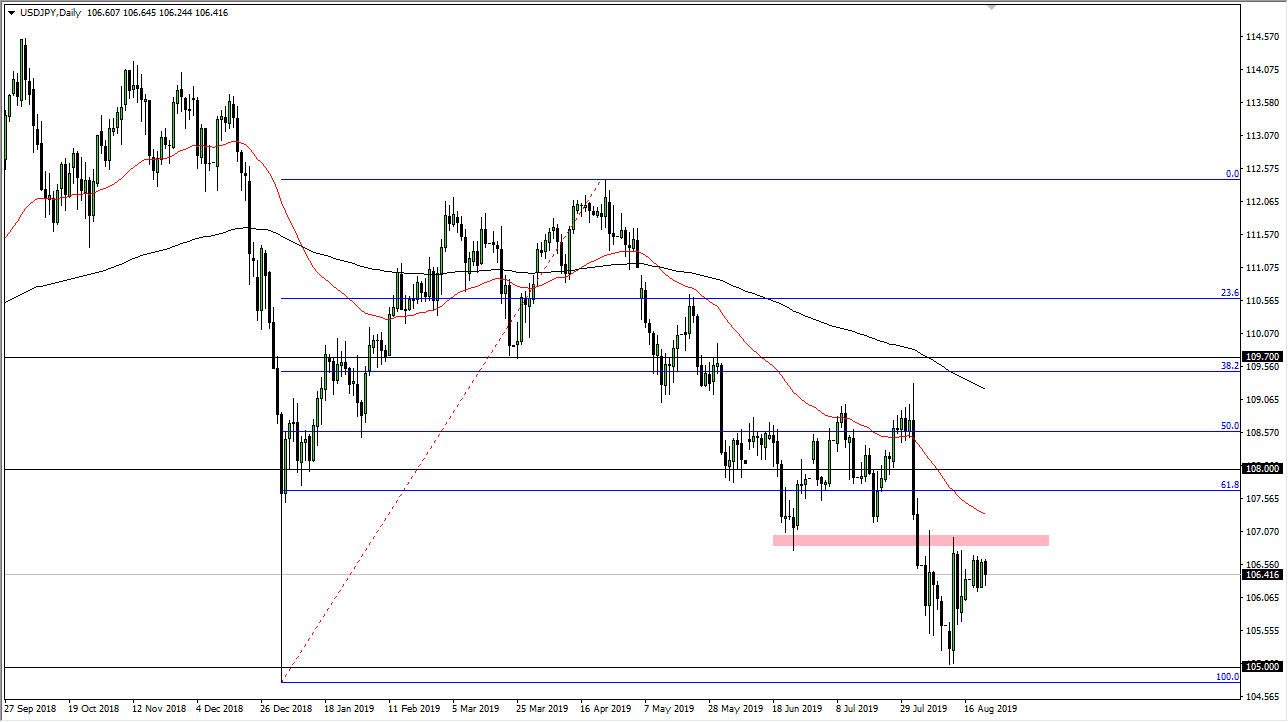

The US dollar fell a bit during the early New York trading session before bouncing on Thursday and we continued to see a lot of back and forth against the Japanese yen. At this point, the ¥107 level above continues offer a lot of resistance, and I do think that it will continue to find plenty of sellers going into the weekend. However, the 50 day EMA above there is even more resistive and as we have the Jackson Hole Symposium coming to a close, we will have a speech by Jerome Powell. It’ll be interesting to see how that plays out, and whether or not it becomes a “risk on” or a “risk off” type of situation.

I believe that the market will probably reach back down towards the ¥105 level, which is massive support, as we have seen recently. Even if we were to break above the 50 day EMA I think there’s far too much in the way of noise between here and the ¥109 level to keep this market viable for a long position unless of course we get some type of major shift in attitude when it comes to risk appetite.

Looking at the charts, it’s easy to see that the risk appetite can be seen at the S&P 500, NASDAQ 100, and other stock markets around the world. If they are rallying, it’s very likely that this pair will eventually rally as well, because although the US dollar is considered to be a “risk off” currency, it’s a bit different when we are looking at the Japanese yen which is even more of a “risk off” situation. Ultimately, I think that there is enough concern out there to keep this pair from rallying for any significant amount of time, and I believe we could probably then break down below the ¥105 level and go looking towards the ¥102.50 level, and then down to the 100 young level which will attract a lot of attention from market participants and of course the Bank of Japan, who could get involved at that point in time. That being said, it looks as if we are ready to roll over and I think it’s only a matter of time before that happens. I have no interest in buying this pair, because to be honest, if I wanted to buy the US dollar I would do it against other currencies that are much weaker.