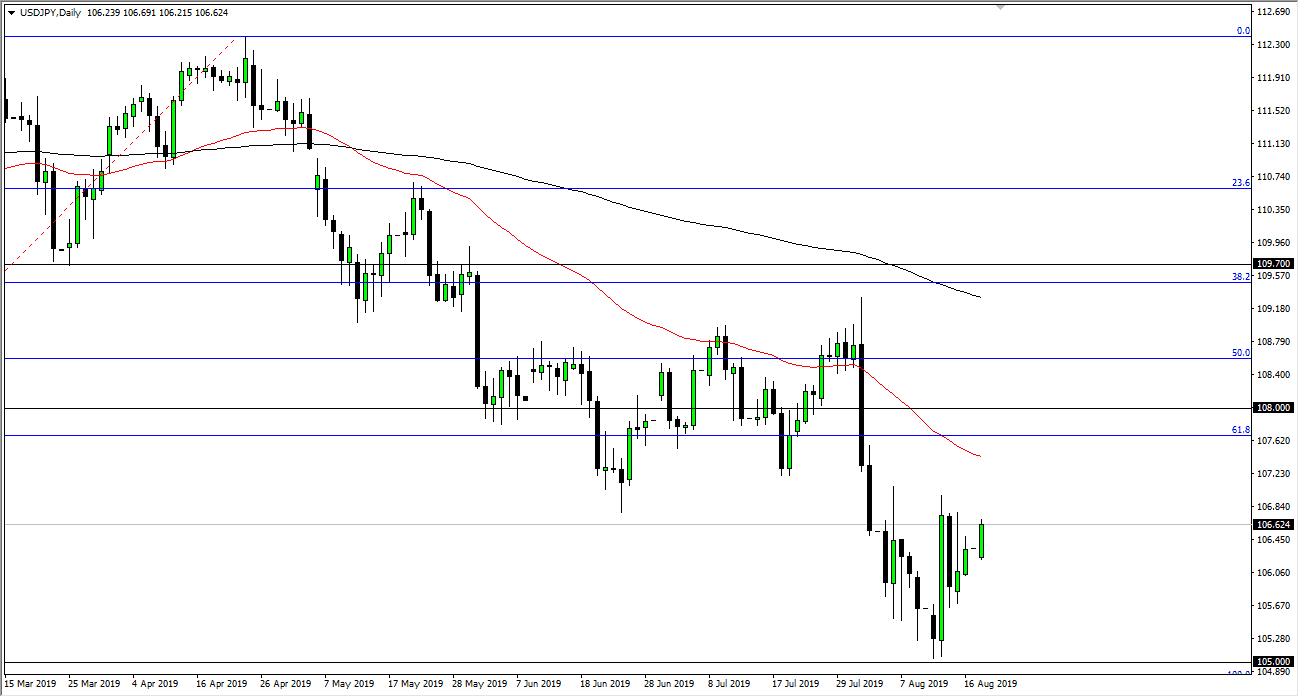

The US dollar rallied significantly during the trading session on Monday, reaching towards the ¥107 level – it but continues to see sellers just above. At this point, the 50-day EMA is coming into the picture, and I do think that the ¥107 level is going to be crucial going forward. It does look like we are trying to rally from here but realistically speaking, this is a market that is highly sensitive to the risk appetite of traders around the world, and probably the easiest way to measure risk appetite is going to be via the S&P 500.

The correlation between the USD/JPY pair and the S&P 500 over the longer-term is relatively strong, so it makes quite a bit of sense that you should be watching both markets. If the S&P 500 can continue to get a bit of a bid, then it’s likely that the Japanese yen will sell off. This is probably not so much a question of whether or not the US dollar is strengthening. Rather, the real question is going to be whether the Japanese yen is selling off. Ultimately, I anticipate that the market will continue to sell off at the first signs of trouble, and therefore I think it’s not going to take much to get this market to rollover. If it does rollover, then I believe the ¥105 level would be the next target. That’s a major support level that will be crucial, and if we are to break down below that level this market could go much lower. One has to wonder whether or not the Bank of Japan is going to continue to sit there and watch this, or are they going to get involved? They have a history of suddenly jumping into the market.

Looking at this chart, I think it’s only a matter time before the sellers jump in, and I think if we get some type of selloff in risk appetite around the world, then it’s likely that we are going to see this market show signs of exhaustion. I believe the 50-day EMA is going to continue to be attractive for sellers as well, so pay attention to that. All things being equal I think it is much easier to simply fade rallies until something drastically changes in the mindset of traders around the world. Ultimately, this is a market that is going to move right along with headlines.