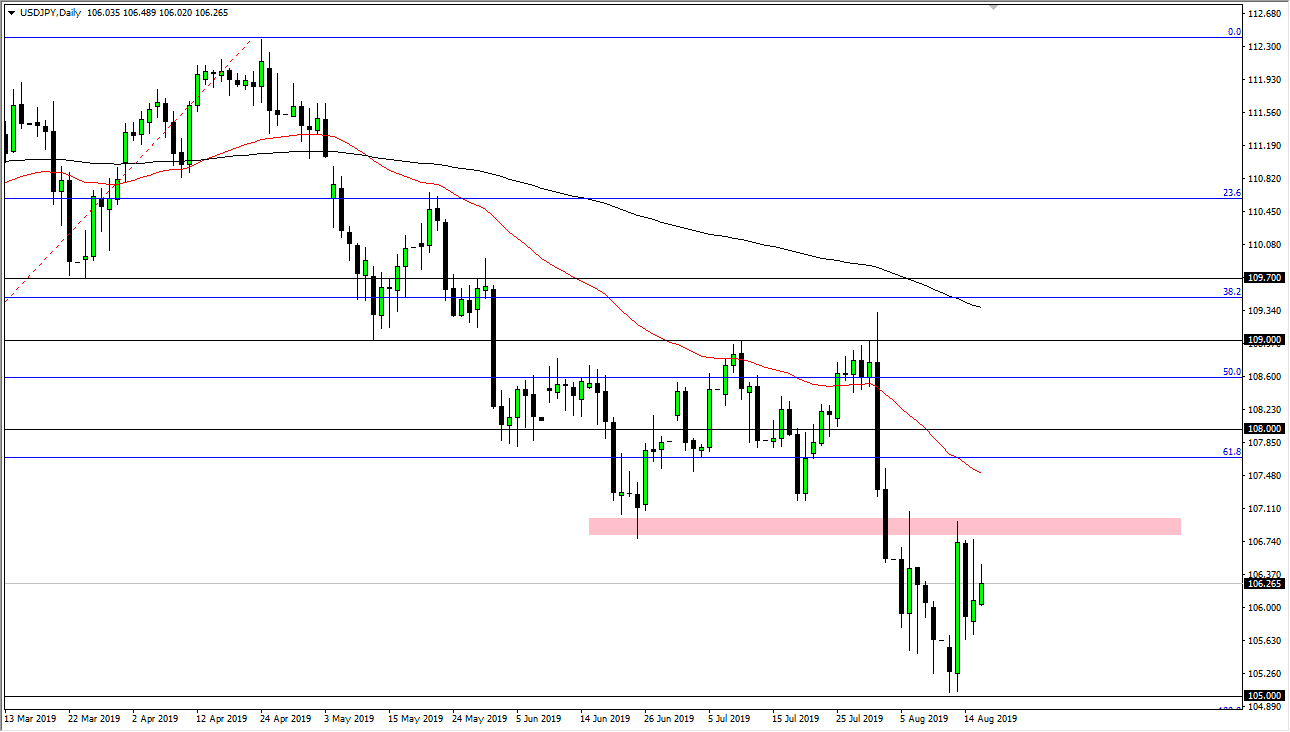

The US dollar tried to rally against the Japanese yen early in the day on Friday but has continued to find sellers on rallies. It’s very likely that the ¥107 level should continue to be resistance, as we have been consolidating between that ¥107 level and the ¥105 level. At this point, I think the market continues to stay in this range but as we are closer to the top and starting to form a bit of a long wick to the upside, it makes sense that we will roll over and reach towards the ¥105 level again. I think at this point, choppiness is something that you should continue to expect to be the main attraction, as trade concerns around the world should continue to be a driver of this market.

The US dollar of course is a safety currency, but when it comes to against the Japanese yen it’s a completely different scenario. This is because the Japanese yen is considered to be the “safest” of currencies, so a lot of money will flow back into Japan when there is a lot of fear, as there has been and will likely continue to me. With that, I think that the Japanese yen will continue to be favored as we have so much trouble with the US-Sino trade talks, and of course fears of global growth slowing down as we see so many poor negative economic figures and troubling data releases.

If we do break down below the ¥105 level, and I think we will eventually, we will probably break down towards the ¥102.50 level, and then possibly even further. I think once we get closer to the ¥100 level though, there will probably be a certain amount of interest by the Bank of Japan in this market and could have the Central Bank looking to either intervene or at the very least step in and verbally move the market. In the meantime though, there’s nothing out there that suggests we should see a ton of “risk on behavior”, so I think the ¥107 level will continue to be a significant barrier. If we did break above there then we have to tangle with the 50-day EMA which is just above, so I still continue to look for selling opportunities after these bounces. The candlestick from the Thursday session certainly does a lot to confirm this overall attitude as well.