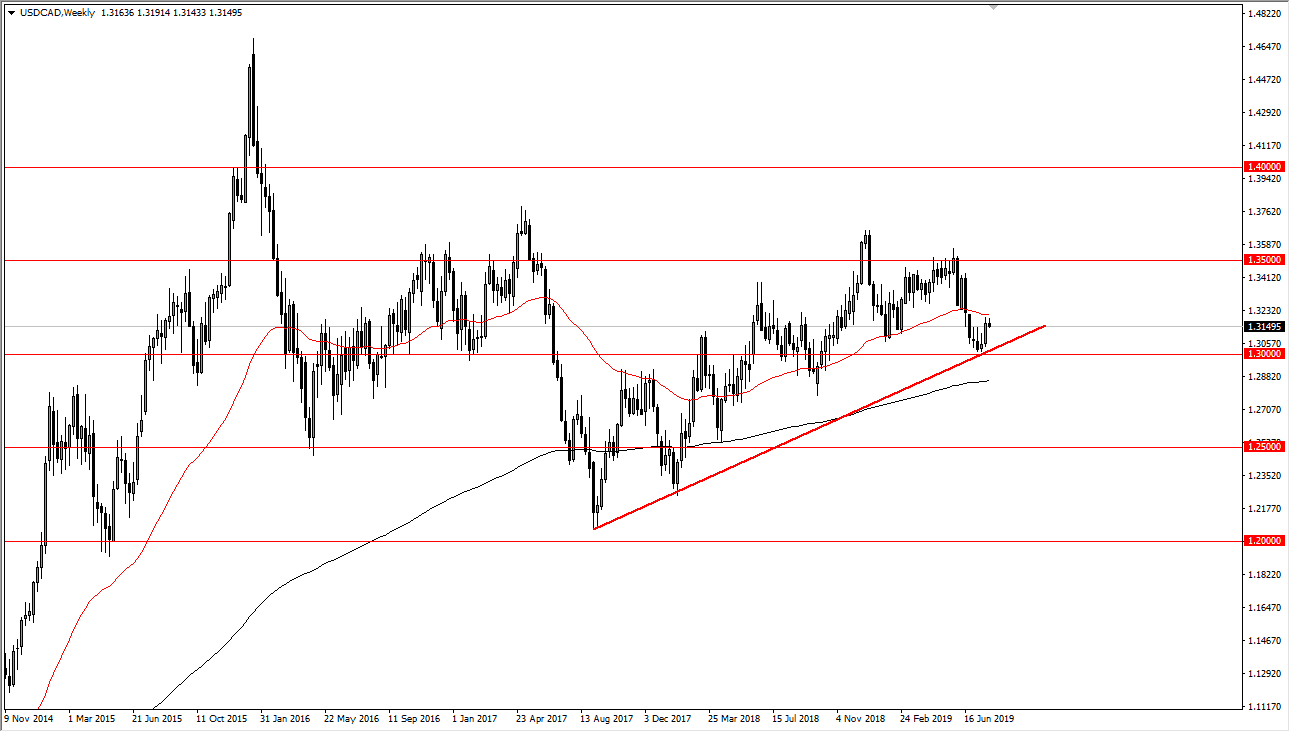

The US dollar has rallied against the Canadian dollar late during the month of August, and furthermore has broken the back of several inverted hammers on the weekly chart. Beyond that that even, we have bounced from the uptrend line that has been so prevalent, so therefore it’s likely that we are going to try to make a move to the upside.

All of that being said, obviously the Canadian dollar will be highly influenced by crude oil which looks choppy and range bound to say the least. I look at this pair is one that is a nice opportunity to buy on short-term pullbacks, as long as we can stay above the trend line that I have clearly marked on the chart. The fact that we broke through the inverted hammers from several weeks before tells me that there is a certain amount of buying pressure.

This might be one of the few places that the US dollar strengthens, mainly because of the oil market and the week Canadian economic situation. However, if we can break above the 50 week EMA which is pictured in red on this chart, roughly the 1.3250 level, then we could go looking towards the 1.34 handle, maybe even the 1.35 level after that.

Otherwise, if we were to break down below the trendline and of course the 1.30 level, then the market could unwind and go much lower, perhaps down to the 1.25 handle. I suspect that’s not very likely but it’ll be interesting to see how we behave after that interest rate cut and of course the statement. If the statement is extraordinarily dovish, that could set up that trend line break but heading into it it certainly looks as if the buyers are trying to make some type of stand. All things being equal, we should have a relatively strong move sooner or later, simply above the 50 week EMA, or below the 1.30 level. This is in fact a longer-term inflection point.