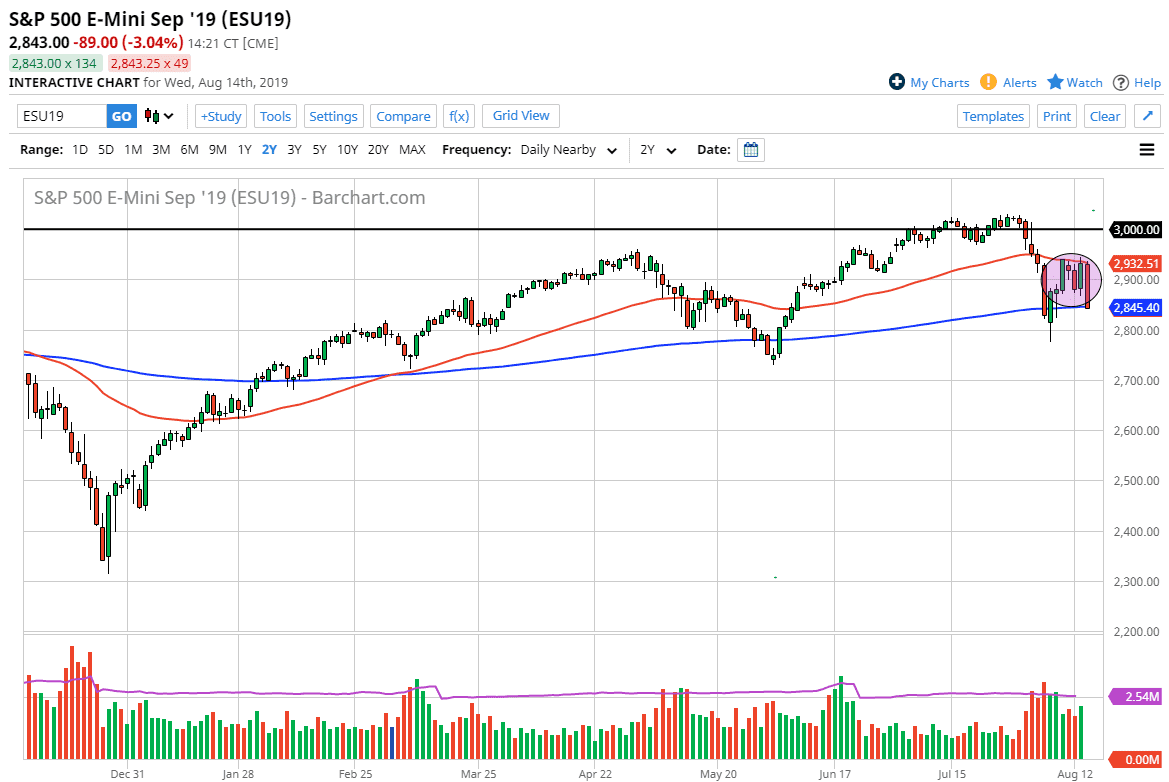

The S&P 500 has gotten hammered during the trading session on Wednesday, reaching down towards the 2850 handle. At this point, if we break down below the lows of the trading session on Wednesday, it’s likely that we could go down towards the 2800 level given enough time. I think at this point if we start to rally, it will be a selling opportunity as the market has proven itself to be in a lot of trouble during the trading session on Wednesday.

We have an inverted yield curve in the United States between the 10 and 2 year notes, which is a recessionary signal. At this point people are starting to become very concerned, and the S&P 500 has hit the 200 day EMA. This is a negative turn of events, and a break down below the bottom of the candle stick for the trading session on Wednesday, then it clears if the 200 day EMA, the daily low, and the 61.8% Fibonacci retracement level. Ultimately, I believe that the market will probably go down quite a bit and extend down to the 100% Fibonacci retracement level if we do continue lower. If that’s going to be the case, I think that you will see quite a huge “flush lower” as things definitely look a little on the concerning side.

In the short term, I believe that rallies will be sold, and that it should be a nice opportunity to short the market at the first signs of exhaustion. I like the idea of waiting for bounces to take advantage of, but if we break down below the lows of the trading session on Wednesday, it could show a bit of continuation. Ultimately, I think that this market will continue to be one that will be very sensitive to headlines as there seems to be a lot of fear out there.

At this point I don’t have any interest in buying, but I will take that on a day-to-day basis. After all, things can change but what’s particularly telling here is that we have completely wiped out the relief rally after Donald Trump suggested that certain parts of the tariffs were going to be delayed. The market initially celebrated that but we have wiped out everything gain from that session and more. As we are closing right at the 200 day EMA, a little bit of patience may go a long way.