The US stock markets got hit during the trading session on Friday, after the jobs number came out as expected. It appears that traders are still concerned about the Federal Reserve not being able to cut rates going forward, giving Wall Street that “monetary methadone” that they all crave. Remember, stock markets have nothing to do with the underlying companies, rather they have a lot to do with whether or not money is cheap, and that companies will come in to do a lot of buybacks.

The stock market has been distorted since the great recession, and unfortunately there are still plenty of people out there that will talk about earnings and valuation when it comes to stocks. The reality is most trading anymore is done either by algorithms or via ETF markets. This means that everybody runs for the exits at the same time. This is basically what we’ve seen over the last couple of days, as people will sell these ETF products or futures markets instead of a particular company. This is what you have seen the last three days as we worry about expanded tariffs against the Chinese.

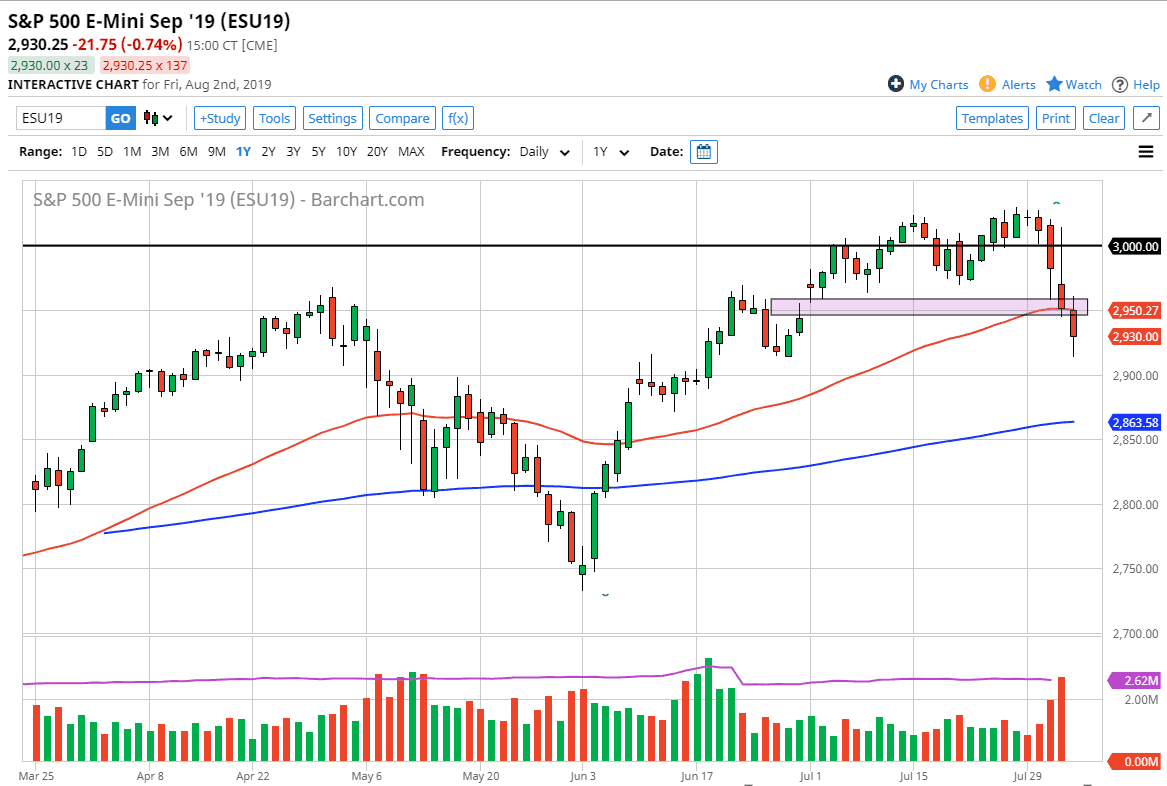

At this point, the markets have been rattled and it looks like they are very careful going forward. If we break down below the candle stick on the trading session on Friday, then I think the market goes looking towards the 2900 level next, and then eventually the 200 day EMA which is pictured in blue. The alternate scenario of course is that we break above the top of the candle stick for the trading session on Friday, which could open up the door to the 3000 level again. However, I think that is going to take something good coming out of the Federal Reserve or the trade talks to get things going.

We are through most of her earnings season and it’s been okay, but again it has nothing to do with the stock market anymore. The technical analysis is starting to look very weak, but there are plenty of levels underneath that should pick this market up so I think it’s only a matter of time before the out of those come in and try to pick up this market. 2900 is an excellent candidate for that, so we will have to see whether or not we can bounce from that area. Part of the recovery was probably due to the fact that it was late in the day and more importantly, late in the week.