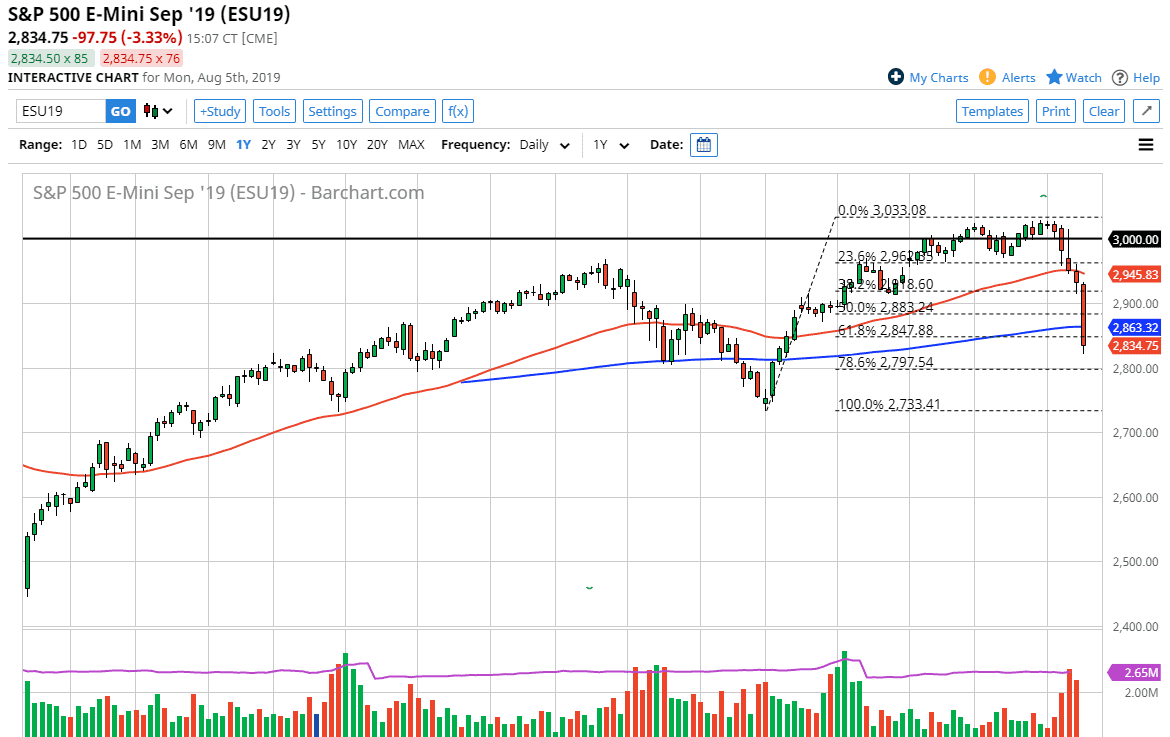

The S&P 500 broke down pretty significantly during the trading session on Monday, slicing through the 200 day EMA. At this point, we need to see the market bounce in order to save the semblance of an uptrend, or we could see a major problem. I have a couple of different ways we will be trading this marketplace, as the last couple of candlesticks have been very telling.

If we were to break down below the bottom of the candle stick for the trading session on Monday, I believe that the 61.8% Fibonacci retracement level will be in the rearview mirror, and typically that means that we are going to go lower, reaching down towards the 100% Fibonacci retracement level. It is just above the 2700 level, somewhere closer to the 2725 level. However, if we were to turn around and bounce back above the 200 day EMA, we could make a significant attempt to bounce from here and reach towards the 50 day EMA, closer to the 2945 handle.

All things being equal though, I think at this point the market looks very skittish, it makes quite a bit of sense considering that the US/China trade situation is getting worse, not better. With the Chinese yuan being depreciated during the evening, this shows a major escalation in the trade war between the Americans and the Chinese. If that’s going to be the case, people are going to be concerned about owning equities, and throw money at treasuries and the like.

In other words, I believe the stock markets are going to continue to see a lot of noise and trouble, and it’s likely that we will continue to see a lot of noise. However, if we can close above the 200 day EMA, we could see the market trying to protect itself going forward and perhaps saved that uptrend. At this point though, things don’t look good as we are closing towards the bottom of the candle stick and therefore I do believe that rallies will probably lose a lot of momentum and of course the grip on the market. At this point, there’s not much that looks good on this chart, even though we may be just a bit oversold in the short term, and therefore I think that the bounce coming could be something that’s worth paying attention to over the next several days.