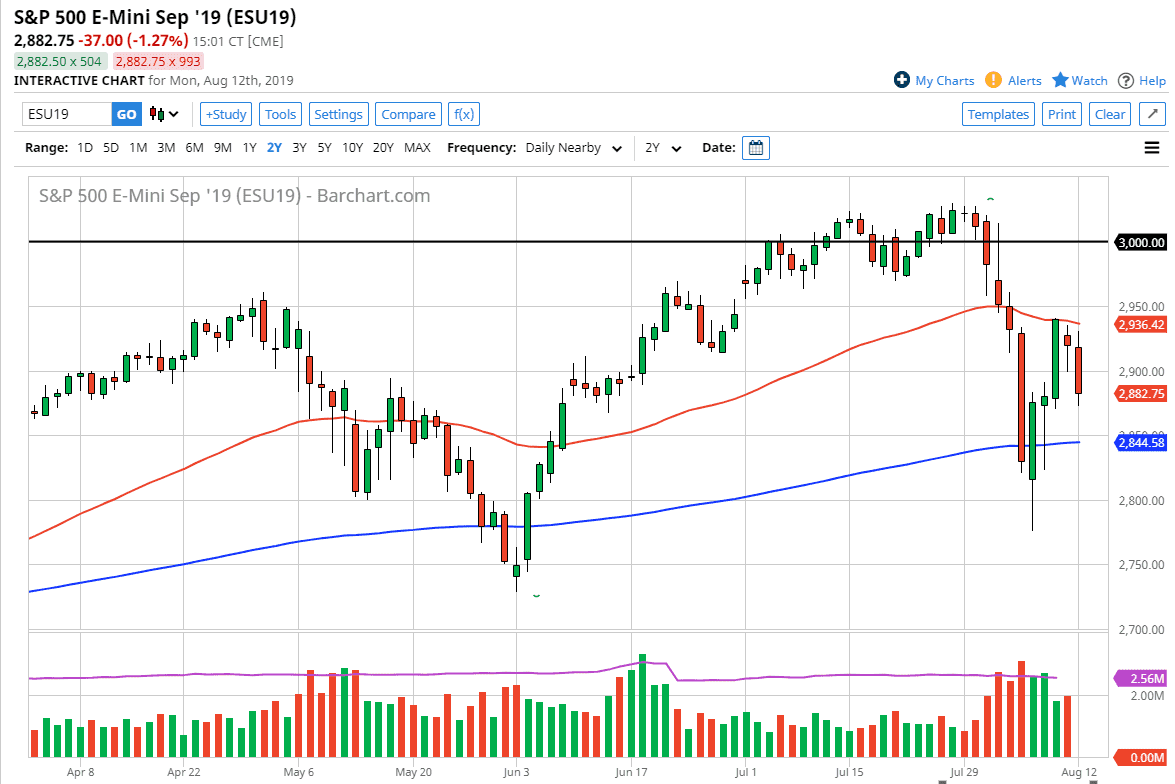

The S&P 500 initially tried to rally during the trading session on Monday, reaching towards the 50 day EMA before rolling over and falling rather significantly. The 2900 level being sliced through of course is a negative sign, and therefore I think we could continue to go towards the bottom of what I think is the bottom of the overall consolidation region.

That consolidation region is stuck between the 50 day EMA above, and the 200 day EMA below. I think at this point it’s likely that we bounce around in this area, so this is more of a short-term traders type of market. This makes complete sense though, because there are so many different moving pieces out there to drive fear into the market that it’s difficult to imagine a scenario where the market can shoot straight up in the air and hang onto the gains.

Ultimately, I think looking at shorter-term charts and smaller moves probably fits the situation a little better. We are at a very quiet time of the year, as a lot of large traders are away for holiday. In other words, most of the moves won’t necessarily be driven by serious longer-term money. This doesn’t mean you can’t trade the S&P 500, just that we are bouncing around in between a couple of major moving averages that longer-term traders will be paying attention to.

With global geopolitical uncertainty and of course trade wars going on, I think this market continues to be erratic and struggles to find true clarity as to which direction it wants to go. We are still technically in and uptrend though, you should keep that in mind so in theory we could break out to the upside but it would take a daily close above the 50 day EMA in order to show signs of hanging on to a longer-term move, just as a break down in a close below the 200 day EMA could send this market lower. I think we have a couple of rough weeks ahead of us, perhaps with a significant amount of opaque trading when it comes to expectations. Position size will be crucial, so therefore I would keep my position size somewhat small as the market continues to bang around with lack of serious direction. I suspect the next two weeks will be somewhat range bound.