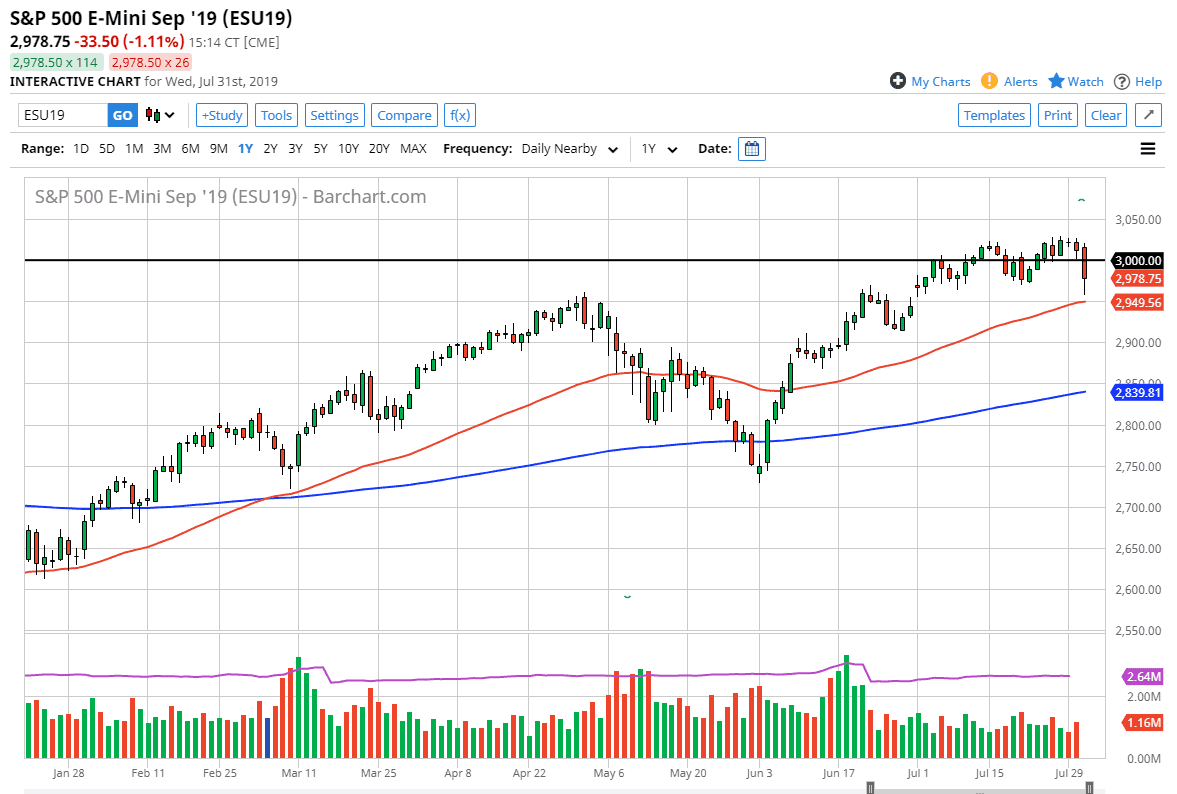

The S&P 500 got hammered during the trading session on Wednesday after the Federal Reserve interest rate cut, and more importantly the statement. The statement probably wasn’t soft enough for a lot of Wall Street insiders, but at the end of the day we did see the gap get filled underneath, and that is something that has somewhat concerned me over the last couple of weeks. The 2950 level was massive support, and now we have the 50 day EMA touching that level as well. We reached down to that area before bouncing and that of course is a good sign. That’s exactly what I would have expected to happen, although I didn’t necessarily expect that to happen in such a short amount of time.

Now that we have made that move, it’s likely that we will continue to go to the upside and I do think that we will recapture the 3000 level given enough time. All things being equal, I am a buyer of short-term dips understanding that the Federal Reserve is still dovish, and even though they didn’t go all out with their rate cuts, they are very likely to continue to be loose with their monetary policy going forward and that of course is good for stocks as it is basically the only thing that anybody cares about.

There always is the alternate scenario, in this case it would be breaking down below the 2950 level on a daily close. If we get that daily close underneath there it’s likely that we could go to the 2900 level after that. That’s an area that is a large, round, psychologically significant figure, so it would make sense for a short-term selling target. A breakdown below that level could get things going towards the blue 200 day EMA. Ultimately, this is a market that I think will continue to find value underneath, so as long as we don’t melt down, I think that value hunters will continue to jump into this market and perhaps reach to higher levels, including the 3050 handle, and perhaps even the 3100 level. While I recognize that there are a lot of dangers out there to global growth, stocks will continue to go higher. Even as rough as things looked at one point during the day, we still only lost a little over 1%, hardly anything worth mentioning.