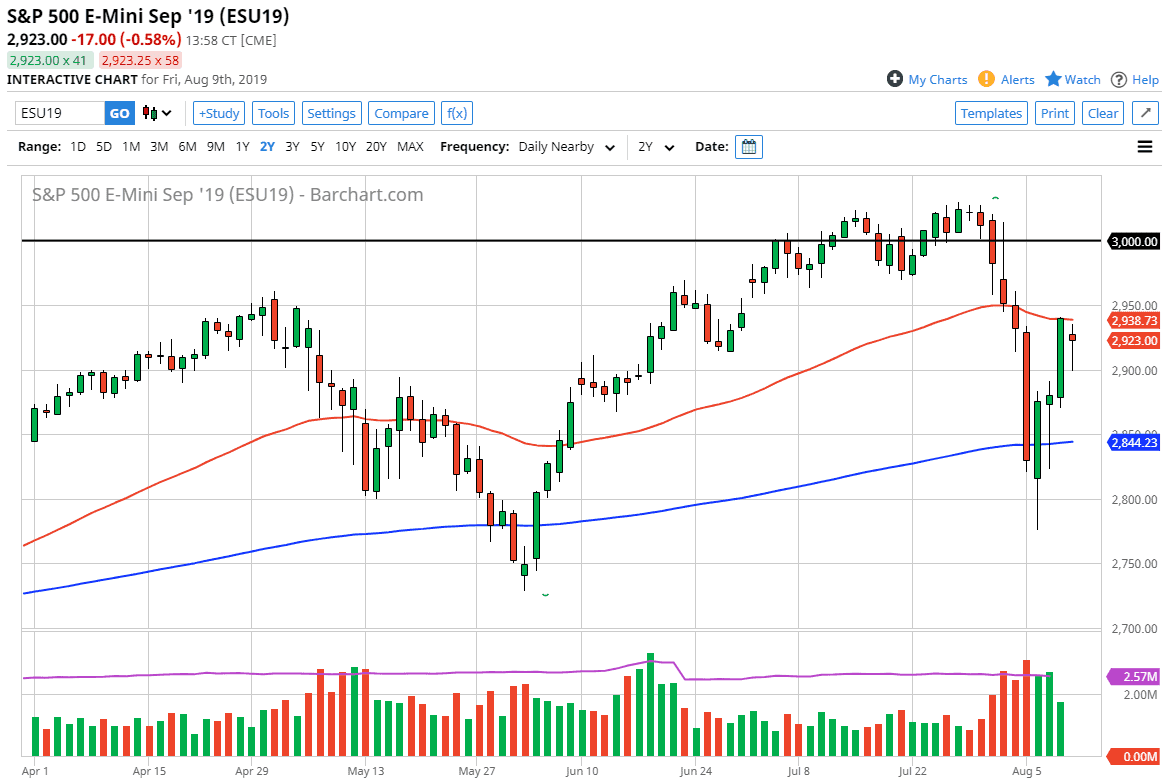

The S&P 500 has been all over the place during the week, and what has been a massive amount of volatility driven by the US/China situation, central banks in Asia doing surprise interest rate cuts, and then of course the Federal Reserve outlook. Ultimately, this has been a lot of algorithmic trading, because it has been so violent. That’s normally the first sign, and I think ultimately we are setting up for a bit of a “binary trade.”

A break above the Friday candlestick during the trading session on Monday, and perhaps maybe more specifically the 2950 handle offers a buying opportunity and perhaps another 50 points to the upside. Overall though, if we were to break down below the 2900 level, it probably sends this market looking towards the 200 day EMA. Both the NASDAQ 100 and the S&P 500 are trading between the 50 and the 200 day EMA indicators, so at this point we could see a lot of choppiness and volatility as short-term traders are negative and longer-term traders are positive. I think the biggest problem we have here is that the market doesn’t know what to do about the US/China trade relations, as we are simply one tweet away from cratering. Having said that, we are probably only one tweet away from rallying as well.

All things being equal though, we have a hammer on the weekly chart, so it does suggest that perhaps there is a certain amount of buying pressure but it isn’t going to be very easy to do that. If we do break to the upside, once we get a fresh, new high, we are looking at a move towards the 3050 handle, the 3100 handle, and much higher. One thing is for sure, this has been extraordinarily resilient market so therefore you can’t rule the outside.

Looking at the chart, I think the only thing you can count on is a lot of volatility and I am allocating very little money towards these markets right now. Keep in mind that we are also at the end of August, meaning that it’s a very thin time of year anyway as a lot of the large traders out there are away at holiday. That will only make the situation worse, not better at this point. Protect yourself.