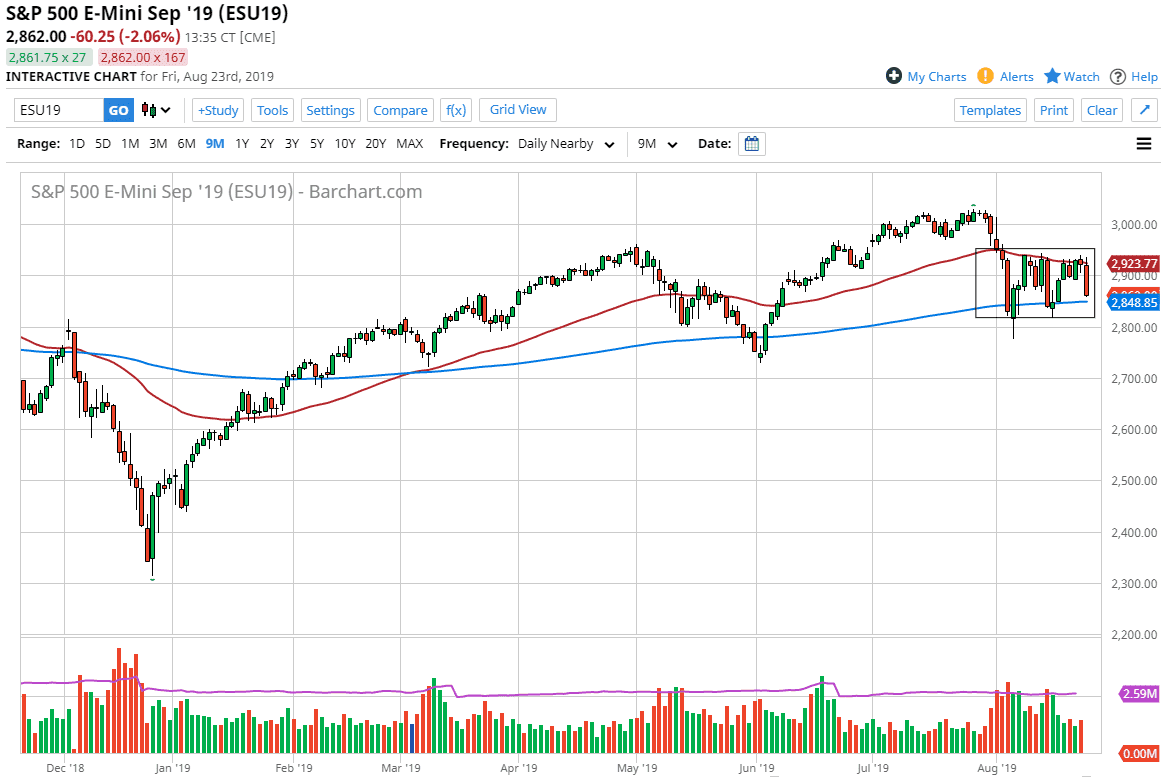

The S&P 500 broke down rather significantly during trading on Friday, as the Chinese have reacted to the US tariffs finally. They are adding 5% tariffs on soybean starting September 1, and 25% tariffs on US automobiles starting December 15 which would be basically a “tit-for-tat” tariff below. At this point, it looks as if the Americans and the Chinese are still a long way away from trying to sort things out, so I think this continues to be a major head wind when it comes to the stock market.

I think it’s obvious that the market is still concerned, and it probably will need to test the major support level just below. The first thing that we will test as the 200 day EMA, and then after that possibly the 2800 level. If the 2800 level gets broken through, this could be a massive negative sign. In that scenario, the S&P 500 will more than likely shed another 100 points rather quickly. I think that we still have the ability to recover and stay within the consolidation area, but when you look at this consolidation it doesn’t take a lot of imagination to see a bit of a symmetrical triangle. For me, this lines up perfectly with the calendar as we are heading into the last week of August and will start to see volume picked back up in the beginning of September.

The next week could be more of the same, but we have obvious levels that we need to pay attention to. To the upside, if we were to break above the 50 day EMA and close on the daily chart will above it, then it’s obviously very bullish. Ultimately, a break down below the 2800 level on a daily close below there would be a very negative sign. At this point it looks as if the negative is going to win the argument, but we have a weekend ahead that could produce just about any headline so you can’t just jump in and start shorting right away. Pay attention to your levels and keep your position size reasonable as we are obviously trading on a motion more than anything else right now. Even as bad as this candle looks, it is still well within the tolerance of consolidation, so at this point it’s not necessarily time to start panicking. Knowing the level that matters ahead of time is what counts.